After Treasurer Janet Yellen’s soft reassurance yesterday that we are out of the woods, Powell’s plane has landed and recession never came near us and never will, the World Bank warns today that the global economy is headed for its worst half-decade in thirty years, and a number of economists warn the US is not immune but will be falling into recession this year after all. No wonder Yellen was so busy calming us. As I commented to one reader earlier today, whenever I hear Janet Yellen saying the banks are strong and the economy is resilient, I get a strong urge to start stuffing my bank account into a mattress.

This news, of course, has the World Bank and the UN concerned because nations are already well behind in meeting the UN’s 2020 agenda. Which is to say, there is an upside to the world economy’s downside. It seems lack of national funding slows globalists. Aside from that glint of gold, the bank suggest we don’t pop the cork on the champagne just yet when it comes to the good news Yellen was toasting about inflation. The bank sees US GDP dropping to 1.6% growth while inflation globally continues through the year at 3.7%.

Before you say, “That doesn’t sound too terrible” or “it could be worse,” a number of economists say the US will do substantially worse than that:

Currently, there’s growing talk about the prospect of a “soft landing” in 2024. Nevertheless, economists remain cautious, with many expecting a bumpy ride ahead due to the lingering effects of tight monetary policy over the past two years.

Although the economy has shown resilience in the face of numerous challenges, many analysts predict a significant slowdown in the coming months, with some even anticipating a recession….

“There is a high risk that we will experience an economic recession before the 2024 election,” Desmond Lachman, senior fellow at the American Enterprise Institute, told The Epoch Times.

The U.S. economy is yet to see “the full effects of the Federal Reserve’s monetary policy tightening, and there are major problems in the commercial real estate space that could trigger another regional banking sector crisis.”

The Conference Board, a nonprofit business think tank, predicts that the recession will arrive in the first half of the year.

“We forecast two quarters of negative growth that will be broadly felt across the economy,” Erik Lundh, principal economist at the Conference Board, said in a recent report.

It’s all about that lag time I keep harping about.

That, of course, would be the recession that I said yesterday we are already in this quarter (and likely were in last quarter), whether real GDP agrees or not. Real GDI certainly agrees. So do many other measures of the economy. Some think GDP is about to catch down to GDI, as I’ve said it always does when such disparity exists:

Mr. Lundh said he still expects it to be officially designated as a recession.

The wounds of inflation …

For the average person, inflation cuts deeper than a flesh wound. One of the things that makes inflation so tough on normal people is that, even though the rate of inflation has come down, prices are still rising, just slower. Americans realize they are paying roughly 20% more for everything than they were a couple of years ago. At one time, the might have had hope that this was a temporary adjustment that they could power through with the use of credit.

Now they realized it is a 20% bite out of their budget that they may need to sustain for the rest of their lives. Once people recognize that falling inflation does not make for falling prices, they realize they cannot keep making up for inflation with their credit card. Given that most homes lived month-to-month with no surplus prior to all this inflation, that hit means a serious permanent reduction in lifestyle. No wonder Americans are not happy with the economy, even though economists are saying it’s strong and can’t figure out why Americans feel so sour about (likewise, everyone else in every other country). Living the rest of your life with 20% less doesn’t feel strong.

“Pundits, politicians, and investors focus on the rate of change, but that does not match the experience of American consumers, who are still paying 18 percent to 20 percent more for just about everything,” Nancy Tengler, CEO of Laffer Tengler Investments, said in a recent note to clients.

She offers this little promise:

“As inflation slows, though, real prices will decline….”

How does that math work? Slower up does not equal down. Unless inflation turns negative, prices don’t go down. She may be assuming wage gains when she says “real prices,” but the Fed is doing its best to stomp those down to size, and wage gains historically have, at best, kept even with ongoing inflation, not taken “real prices” down.

It takes a pretty staunch recession to turn inflation into actual deflation. So, for those prices to go down, Janet Yellen needs to turn out to be dead wrong. Some of us might almost welcome a recession just to see that happen. (We get lots of opportunities to see Janet proven wrong, so I don’t mean that. I mean we might welcome a hard reset with a recession.)

However, given all the fantasy that runs the financial systems and markets, it will take an enormous recession to bust through all of that and get a real reset of prices downward. But, then, Janet being enormously wrong would not surprise me either. I am sure she will before this Fed mess is over. The problem with that reset hope is that she and her colleagues will do their unlevel best to prop it up and bail it out to make sure it never happens … as if they are doing the little guy a favor … because they hate nothing more than deflation.

Maybe that is why …

Despite these predictions, roughly 63 percent of Americans don’t anticipate an improvement in their financial situation this year, according to a recent Bankrate survey.

… are the steps to higher living for the rich

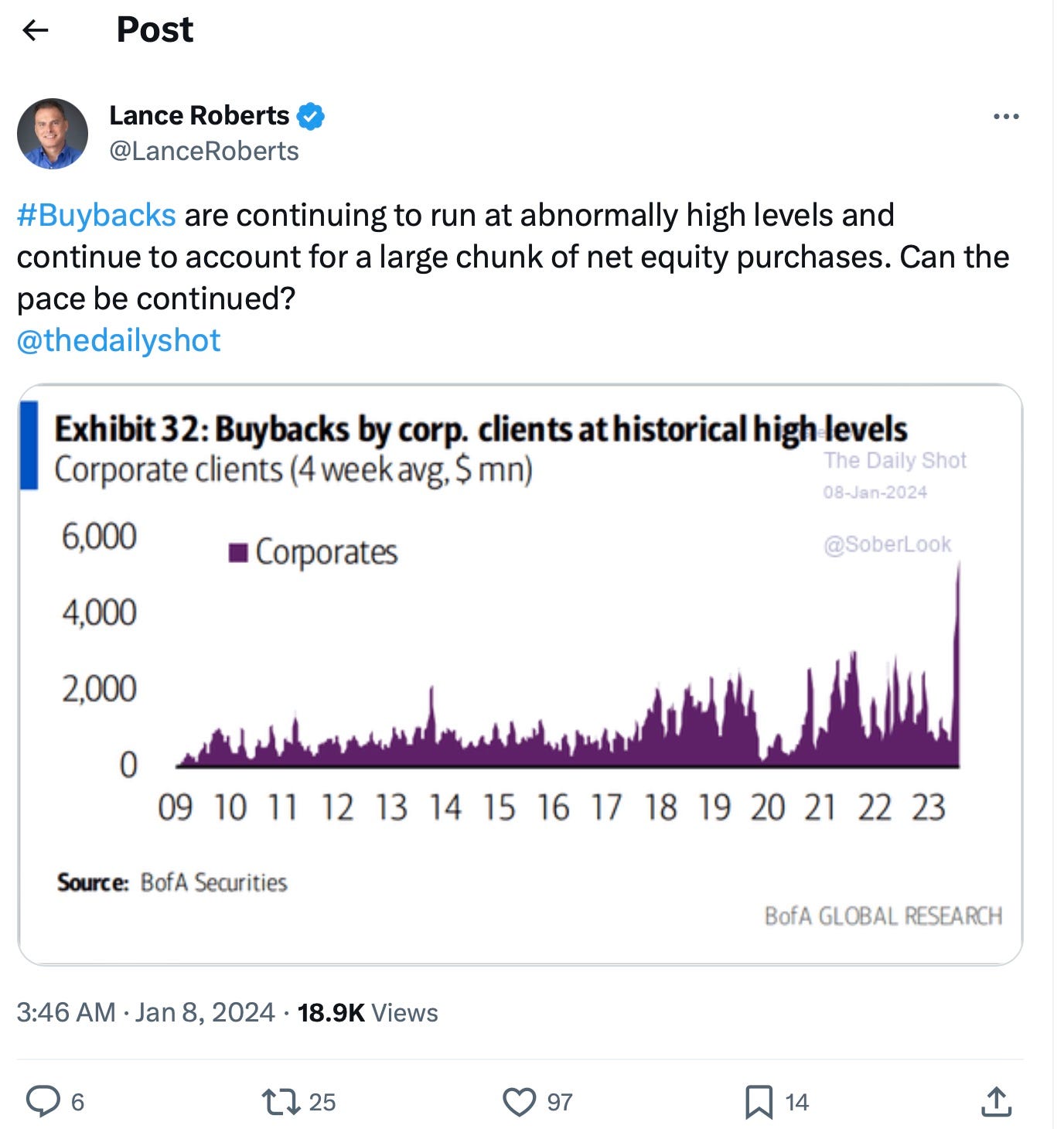

For the rich corporate bosses, it has been a much different story. They are apparently profiting handsomely off of inflation as a place to hide their higher profit margins. According to today’s headlines, 38% of US companies are anticipating lay offs (sounds like recession to me) this year to help cut expenses so that they push their absolute record right now in stock buybacks even higher:

Look at that rocket ride to moon! We used to think all those spikes back in the teen years and the early 20s were phenomenal levels of stock buybacks. It turns out, though, that thanks to excruciating levels of inflation and shrinkflation and skimpflation and stinkflation the rest of us have felt, the corporate bosses have managed to make greater personal profits than ever before!

That is just how essential the inflation in their prices was to their profiteering. (No price gouging there!) Inflation has obviously enabled the corporate owners to fatten themselves up with greater buybacks than ever before. That, of course, explains why they need to lay off so many of the workers who help make them rich in order to substantially cut costs. How else will they get that buyback rocket ride to escape earth’s orbit so they can fly into the sun and melt their golden wings?

Want to get a handle on inflation? Maybe we should go back to the good ol’ days when corporate buybacks were treated as an illegal from of insider trading and market rigging. There is a not-so-novel idea that worked nicely for many decades. You could cover the rest of inflation and provide nice wage gains at the same time by just doing that.

Yet, with all of that ongoing pumping of corporate profits into one-percenters pockets, stocks fell today as bond yields rose because stock values are—aside from the buyback rockets that are running hot—based on Fed fantasies that appear to be failing already.