by Dismal-Jellyfish

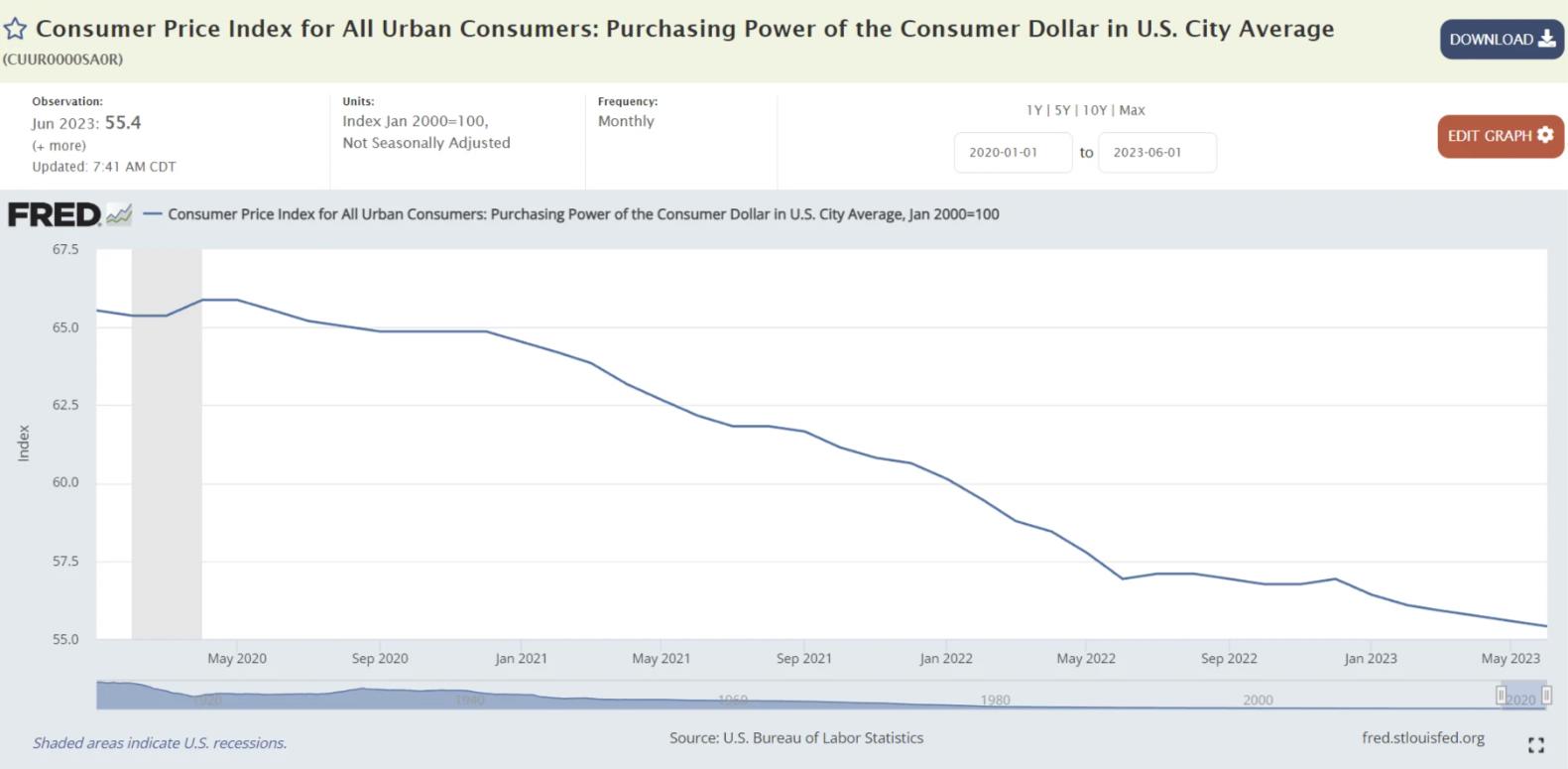

Remember, CPI tracks the loss of the purchasing power of your dollars, & thereby the purchasing power of your hard earned labor.

Source: https://fred.stlouisfed.org/series/CUUR0000SA0R#0

Let’s zoom in on this since 2020:

CPI tracks the loss of the purchasing power of your dollars, and thereby the purchasing power of your hard earned labor:

- June 2022 purchasing power of $100 in January 2000: 56.9 (down -2.64% in purchasing power in the last year!)

- June 2021 purchasing power of $100 in January 2000: 62.2 (down -10.86%% in purchasing power in two years!)

- June 2020 purchasing power of $100 in January 2000: 65.5 (down -15.40% in purchasing power in three years!)

TLDRS:

- The Consumer Price Index (CPI) is a measure that helps us understand how the average price of a basket of goods and services has changed over time.

- June 2022 purchasing power of $100 in January 2000: 56.9 (down -2.64% in purchasing power in the last year!)

- June 2021 purchasing power of $100 in January 2000: 62.2 (down -10.86%% in purchasing power in two years!)

- June 2020 purchasing power of $100 in January 2000: 65.5 (down -15.40% in purchasing power in three years!)

- In other words, it’s an indicator of inflation, or the increase in prices over time.

- When I say that the purchasing power of your dollars has decreased, I’m talking about how much less you can buy with the same amount of money due to rising prices.

- The purchasing power of your hard-earned labor is eroded by inflation!

- For example, imagine you have $100 today, and you decide to save this money in cash instead of investing it.

- Fast forward a year, and the CPI indicates that there’s been a 6.9%% increase in the average price of goods and services.

- This means that the things you could buy with your $100 last year would now cost $106.9.

- The value of your dollars has decreased, and your purchasing power has dropped.

- Reminder, while banks have the liquidity fairy, ‘we’ get the promise of 2 more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates–causing further stress businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.