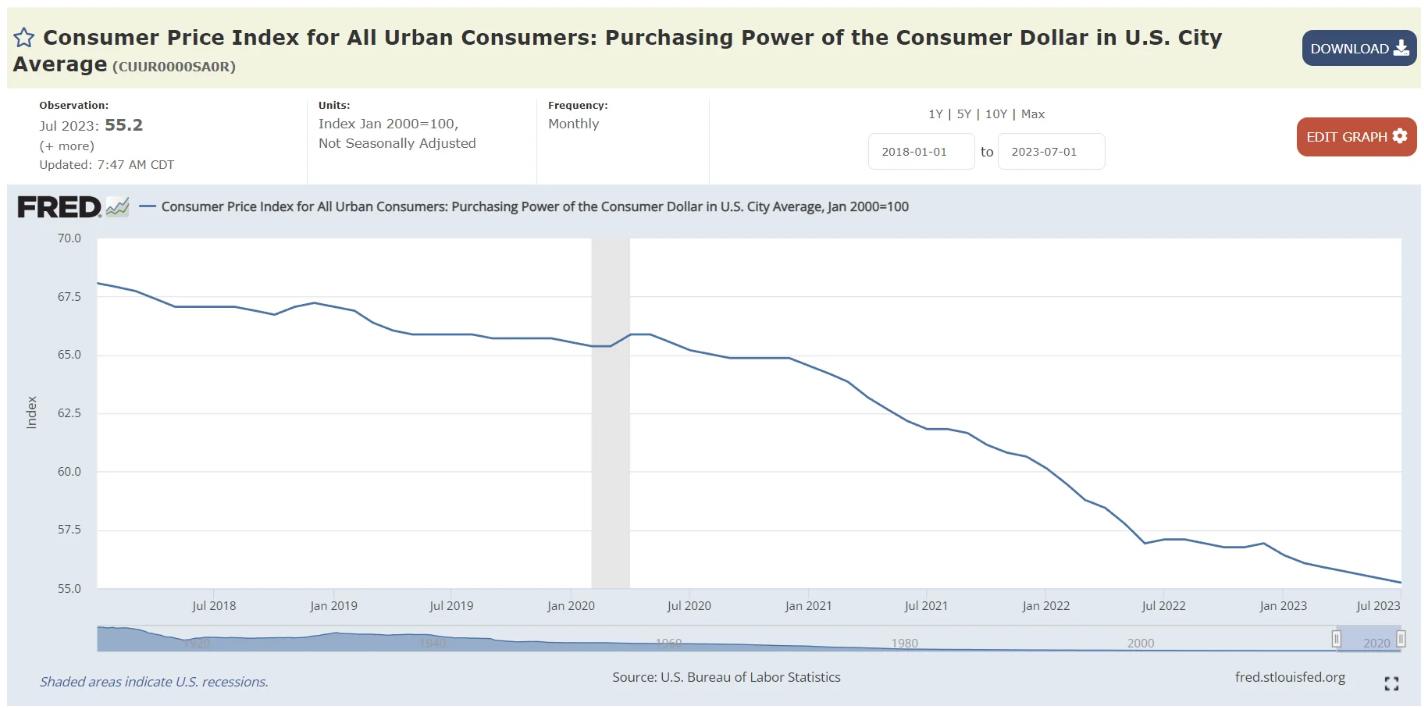

Source: https://fred.stlouisfed.org/series/CUUR0000SA0R#0

Zooming in:

CPI tracks the loss of the purchasing power of your dollars, and thereby the purchasing power of your hard earned labor:

- July 2022 purchasing power of $100 in January 2000: 57.1 (down -3.33% in purchasing power in the last year!)

- July 2021 purchasing power of $100 in January 2000: 61.8 (down -10.68%% in purchasing power in two years!)

- July 2020 purchasing power of $100 in January 2000: 65.2 (down -15.34% in purchasing power in three years!)

For those looking for proof CPI is understated:

When the loss of purchasing power is growing faster than the rate of inflation, it means that the real value or purchasing ability of money is decreasing at a pace that’s greater than what the official inflation rate suggests.

- In July purchasing power declined -.3% for the month and -3.3% for the year

- The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in July on a seasonally adjusted basis, the same increase as in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment.

What does this mean for household’s well being?

- Purchasing Power declined by -0.3% for the month and -3.3% over the last 12 months.

- The decline in purchasing power means consumers would be able to buy 3.3% less with the same amount of money compared to the previous year.

- The monthly decline of -0.3% indicates this trend is ongoing.

- Inflation: Rose by 0.2% for the month and 3.2% over the last 12 months.

- Goods and services, on average, have become 3.2% more expensive over the year.

- The 0.2% monthly increase shows inflation is STILL growing.

- Wages: Increased by 0.4% for the month and 4.4% over the last 12 months.

- Over the past year, the combined effect of reduced purchasing power (-3.3%) and increased inflation (3.2%) suggests that folks are 6.5% worse off in terms of the value their money can provide.

- With the wages rising by 4.4% over the year, it compensates for some of the loss in value from reduced purchasing power and inflation.

- Essentially, while the money’s value in terms of what it can buy has decreased by 6.5%, folks are earning 4.4% more of it.

- So to bring this all together, on net, folks are 2.1% worse off in terms of real value over the past year (6.5% – 4.4% = 2.1%).

- .1% worse off in the last month.

TLDRS:

- The Consumer Price Index (CPI) is a measure that helps us understand how the average price of a basket of goods and services has changed over time.

- July 2022 purchasing power of $100 in January 2000: 56.9 (down -3.33% in purchasing power in the last year!)

- July 2021 purchasing power of $100 in January 2000: 62.2 (down -10.68%% in purchasing power in two years!)

- July 2020 purchasing power of $100 in January 2000: 65.5 (down -15.34% in purchasing power in three years!)

- In other words, it’s an indicator of inflation, or the increase in prices over time.

- When I say that the purchasing power of your dollars has decreased, I’m talking about how much less you can buy with the same amount of money due to rising prices.

- The purchasing power of your hard-earned labor is eroded by inflation!

- Folks are 2.1% worse off in terms of real value over the past year

- Oh yeah, the FDIC noticed that some banks aren’t correctly reporting the amount of deposits they have that aren’t covered by federal insurance. Some banks mistakenly think that if a deposit is backed by assets (like collateral), it doesn’t need to be reported as uninsured.

- This isn’t right! The deposit’s status doesn’t change just because it has collateral.

- When banks incorrectly report uninsured deposits, it could create a perception in the market that these banks are more stable than they actually are.

- Banks that incorrectly report uninsured deposits might face liquidity challenges in extreme circumstances, where depositors simultaneously demand their funds.

- Reminder, while banks have the liquidity fairy, ‘we’ get the promise of 2 more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates–causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.