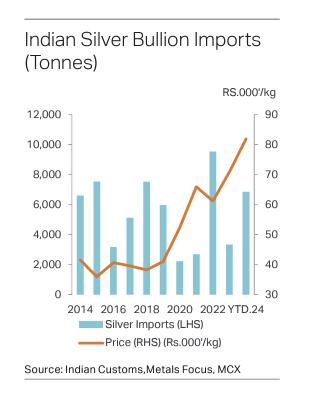

India’s appetite for silver has reached record-breaking levels, shaking up the global market. In the first four months of 2024 alone, India imported an unprecedented 4,172 metric tons of silver—surpassing the total for all of 2023 and marking a massive leap from the 455 tons brought in a year prior. This surge has had ripple effects, pushing global silver prices to near three-year highs.

In February 2024, India’s silver imports spiked by an astonishing 260%, reaching 2,295 tons from January’s 637 tons. Analysts now predict India could import upwards of 6,000 tons this year, a projection that underscores the country’s booming demand.

Several factors are driving India’s silver rush. The surge aligns with a strong demand for silver in solar panel production, where silver is a key component due to its high conductivity. Investor interest has also spiked, fueled by silver’s reputation as a hedge against inflation. Additionally, a recent import duty cut by the Indian government, strategically timed before the festive wedding season, has made silver more accessible, boosting its demand among both urban and rural consumers.

Improving rural consumption following a good monsoon season and increased crop yields has further intensified silver demand. This elevated buying activity has had a clear effect on the global silver market. With high demand and decreased mine output, the Silver Institute projects a growing deficit in silver supply, likely to keep prices high and potentially alter market dynamics.

Sources:

Silver dips continue to get bought up, and the metal is already hitting new weekly highs by Tuesday.

Exciting times for precious metals investors in my opinion. pic.twitter.com/j0zbmT0kWA

— Otavio (Tavi) Costa (@TaviCosta) October 29, 2024