I’m about to share the single most important thing about investing in Artificial Intelligence (AI) today…

If you keep this in mind, you’ll avoid the basic mistake that 99% of investors are making when they put capital to work in AI.

Are you ready? Here it comes…

Over 99% of commentators have no idea what they’re talking about.

I’m not trying to be rude, nor facetious. There are plenty of brilliant, insightful people commenting about AI today. But investors often act as if strategists and analysts are psychic.

They’re not.

Human innovation is too messy, chaotic, and ever-changing for lots of people to accurately predict. This is especially true when it comes to technological revolutions with far-reaching implications.

If you don’t believe me, let’s consider what happened with search engines, one of the recent technological revolutions that produced incredible profits for investors who played it correctly.

Today, Alphabet (GOOGL) is THE search engine of the world, accounting for over 90% of global searches. At a market cap of $1.7 TRILLION company, it is one of the 10 largest companies in the world. It routinely produces tens of billions of dollars in profits. In fact, its 2023 profits were greater than the market capitalizations of Ford (F) and U.S. Steel (X) combined.

However, back in the 1990s when search engine technology first came to market, Alphabet (then Google) wasn’t a market leader. Rather, the company was competing for market share with numerous other firms including Yahoo!, Hot Bot, Excite, Ask Jeeves, AltaVista, AOL Search, MSN Search and others.

Indeed, at that time, Yahoo! was the largest search engine company with a market capitalization of $125 billion. In fact, Yahoo! had a chance to buy the Alphabet for just $1 billion in 2002! Fast forward to 2017, and Yahoo! was sold to Verizon for less than $5 billion… by which point Alphabet was a $730 billion company.

Who saw that coming?

My point here is that, the internet, specifically search engines, represented an incredible revolution that changed the world. However, few if any people were able to accurately predict how it would play out.

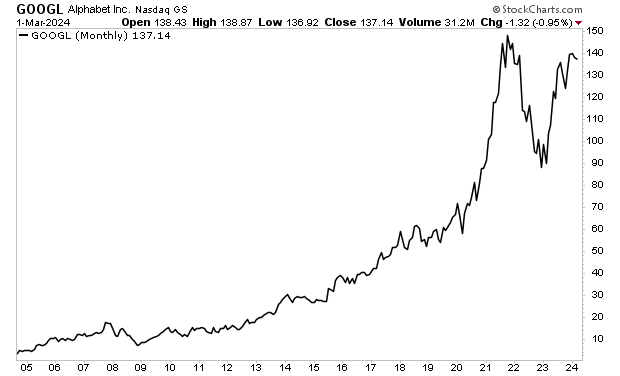

And this didn’t just concern picking winners vs. losers… it also concerned the technology as a whole: many investors thought that the Tech Crash of the early ’00s meant that the opportunity for profiting from search engines was over. They couldn’t have been more wrong as the below chart illustrates.

The great news is that those who were able to navigate the markets to profit from search engines made truly STAGGERING amounts of money. And if you could pick the future market leaders in advance… while riding the booms and busts with proper risk management… well, the above chart of Alphabet shows you the kind of returns you could generate.