Inflation has very likely bottomed for 2023.

The inflation data published in the U.S. is based on year over year comparisons. When the Consumer Price Index (CPI) comes out at 5%, what it’s really stating is that a basket of goods and services costs ~5% more currently than it did a year ago.

This is called the base effect: a comparison between two data points in which the current one is expressed as a ratio of the older one. And it can result in some pretty strange circumstances if you’re not careful.

Situations like the one we’re in today.

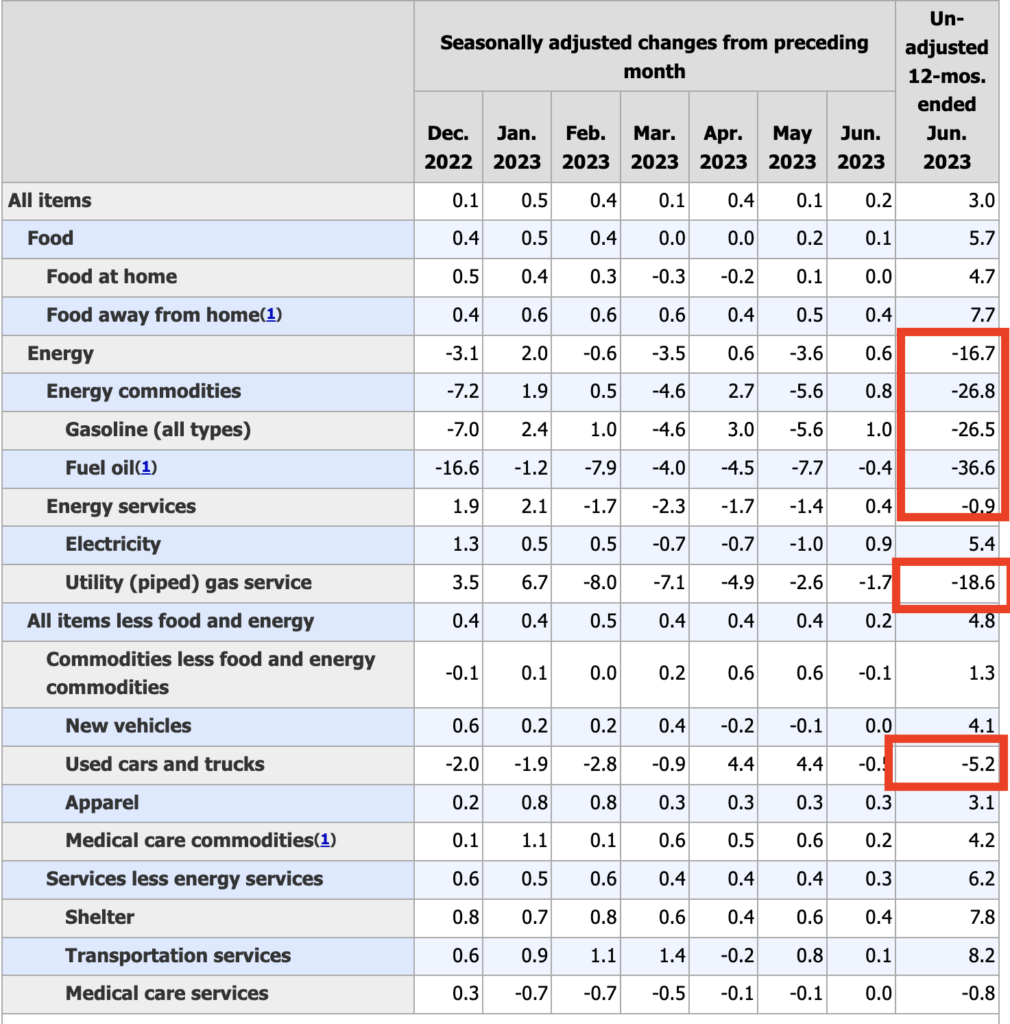

For most of the first half of 2023, inflation, as measured by the year over year comparison for the CPI has been trending down. However, as I’ve noted repeatedly, the only part of the inflationary data that is declining is energy prices (well that and used car prices).

See for yourself.

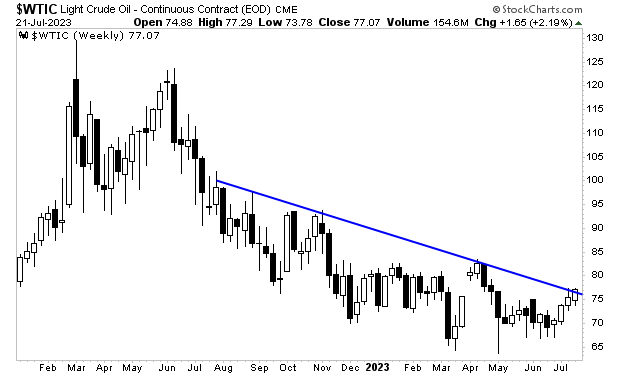

I mention this, because it is increasingly looking as though oil prices have bottomed.

Oil has spent much of the last 18 months in a downtrend. But that downtrend is about to be broke.

If oil prices rip higher from here, then the inflationary data will begin to turn back upwards. Remember, energy prices are the ONLY part of the CPI that are DOWN. The price of everything else continues to RISE, albeit a slower rate.

Many investors will be caught offsides here. Don’t be one of them!

92 views