Ummm. Houston we have a problem.

4.85% on the 10 year.

Damn things are getting out of control

Stock futures starting to dive. pic.twitter.com/5nUb1QoGLA

— QE Infinity (@StealthQE4) October 4, 2023

The real fun starts when investors refuse to buy U.S. debt that’s going to be inflated away by the Fed.

Last year, the main consensus was a #recession. Now, the consensus is #SoftLanding.

Just a reminder:

"When all experts agree, something else tends to happen." – Bob Farrell

h/t @ISABELNET_SA pic.twitter.com/5FiKdKztMJ— Lance Roberts (@LanceRoberts) September 27, 2023

"Soft landing" was always a bullsh*t narrative.

"Transitory" inflation was always a bullsh*t narrative.Are you recognizing a pattern?

Below is an Establishment/MSM headline this morning (versus what we've been warning for many months).

Question the narrative people. pic.twitter.com/ymIrawAHaU

— Hedgeye (@Hedgeye) October 4, 2023

H/T LCDNEWS pic.twitter.com/G9v6sxwYd6

— Win Smart, CFA (@WinfieldSmart) October 4, 2023

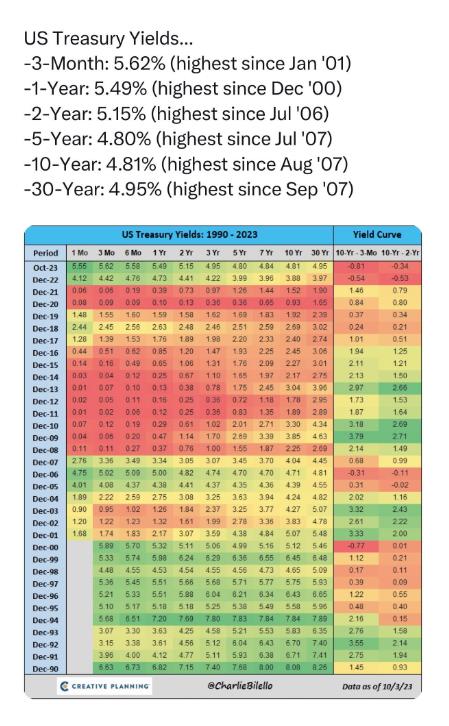

The three-month yield rose to 5.62% the other day.

At 5.62% the yield was 29 basis points above the Effective Federal Funds Rate (5.33%), and is therefore now fully pricing in another 25-basis point rate hike by year-end 🚨🚨🚨

How many rate hikes until something breaks in… pic.twitter.com/8Qxv2yDjro

— Wall Street Silver (@WallStreetSilv) October 4, 2023

Billionaire Investor Gundlach Said Tuesday That a Severe Economic Downturn Is Becoming More Likely

Jeff Gundlach of DoubleLine Capital warns that rising bond yields indicate an imminent U.S. recession. He emphasized the rapidly de-inverting U.S. Treasury yield curve and stated that even a slight increase in the unemployment rate will trigger a recession alert. Historically, an inverted yield curve has foreshadowed every U.S. recession since 1969. Other Wall Street experts also foresee potential economic turmoil due to the bond-market shifts.

h/t Simian_Stacker