The Fed didn’t raise rates yesterday. What it did do was update its projected dot plot for where Fed officials expect rates to be in 2024 and 2025.

The Fed now only expects to cut rates twice in 2024, as opposed to four times. In very simple terms, the Fed sent a message that rates will need to be higher for longer to end inflation.

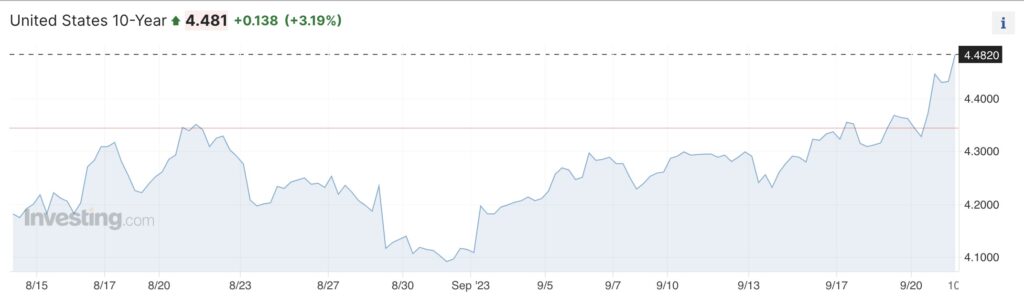

The markets took the news hard with bonds, stocks, and even oil all selling off simultaneously. The yield on the all-important 10-Year U.S. Treasury spiked to new highs.

This is a HUGE deal. As I mentioned in yesterday’s article, this is the bond yield against which all risk assets, especially Tech stocks, are priced. If this yield keeps rising, it means stocks will need to be repriced lower.

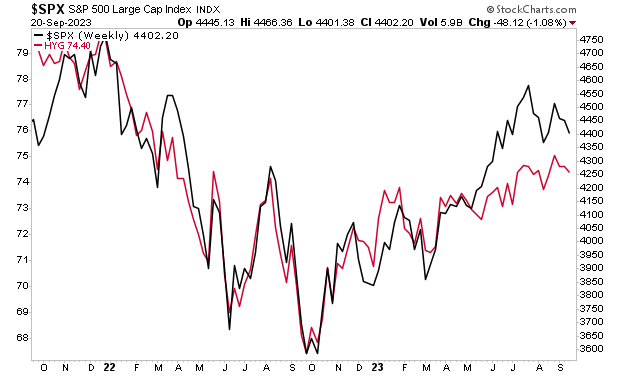

High yield credit has already figured this out. Stocks are next.

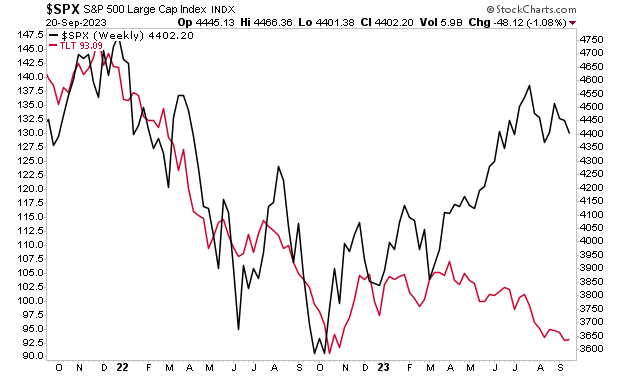

And God help us if the S&P 500 FINALLY realizes what the long end of the treasury market has been saying for the last few months.

As I keep warning. The Great Debt Crisis of our lifetimes is fast approaching.

159 views