There are two primary reasons why inflation has remained so persistent despite the Fed raising rates from 0.25% to 5.25% in the span of 14 months.

1) The Fed is using the wrong tools to end inflation.

2) The Federal Government continues COVID-19 emergency levels of spending.

Today we’re going to dissect #1.

The Fed is repeating the same mistake it initially made during the last major inflationary bout in the U.S. in the 1970s: focusing on rate hikes as opposed to draining excess reserves/ liquidity from the financial system.

During the first round of inflation from 1972-1975, the official inflation measure, the Consumer Price Index or CPI, rose from 3.3% to 11.1%. During this period, the Fed, chaired by Arthur Burns, attempted to rein in inflation using rate hikes. This succeeded in triggering a recession, but failed to end inflation: CPI only fell to 5.7% in 1976 before rebounding and eventually peaking at 13% in 1980.

Burns was replaced William Miller as Fed Chair in 1978, but Miller only lasted a year, as his efforts to end inflation proved similarly futile: the Fed raised rates from 6.75% to 10.5% during Miller’s tenure, but inflation continued to rise from 7.6% to 11.3%

It was only when Paul Volcker took the reins as Fed Chair in 1979 that things changed. Volcker shifted the Fed’s focus from rate hikes to draining excess reserves/ liquidity from the financial system. The goal was to remove the froth from the financial system, while letting rates move in a wider range in order to tighten policy to the point that inflation finally disappeared.

The effect was a severe recession (July 1981-November 1972), but CPI also came down, eventually falling to ~3% in 1983.

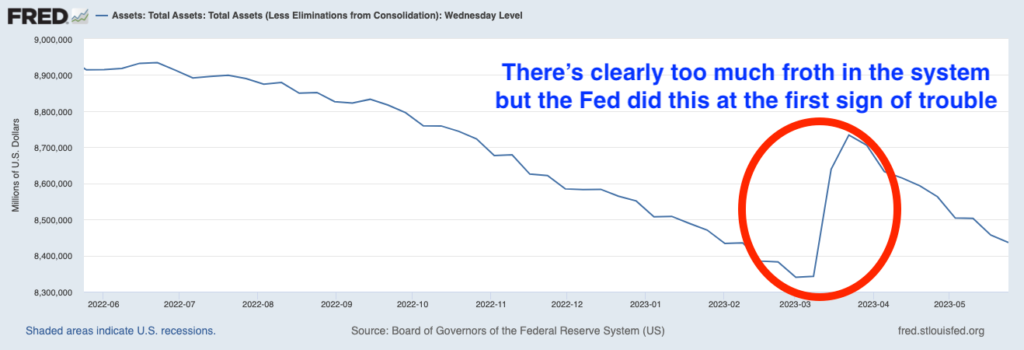

Fast forward to today, and the Fed repeating the same mistakes it made from 1972-1979. Thus far in its quest to end inflation, the Fed has raised rates from 0.25% to 5.25% in 14 months. It has also attempted to drain ~$500 billion liquidity from the financial system via its Quantitative Tightening (QT) program. CPI has dropped from 8.9% to ~5% where it stands today.

Meanwhile, the evidence is clear that there is still far too much liquidity/ froth in the financial system.

Banks continue to park over $2 TRILLION at the Fed every night via the overnight Reverse Repo Agreements. This is a very technical arrangement that isn’t worth delving into right now, but the primary point is that there is a LOT of excess money in the system.

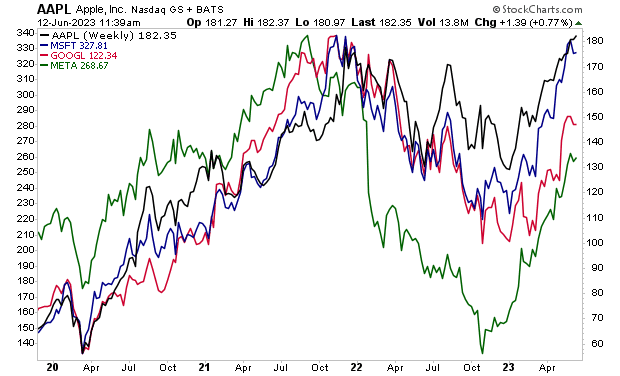

Other signs of excess froth concern the fact that several of the large tech companies are back at their all-time highs, despite the fact their underlying businesses have either gone ex-growth or growing at much slower rates.

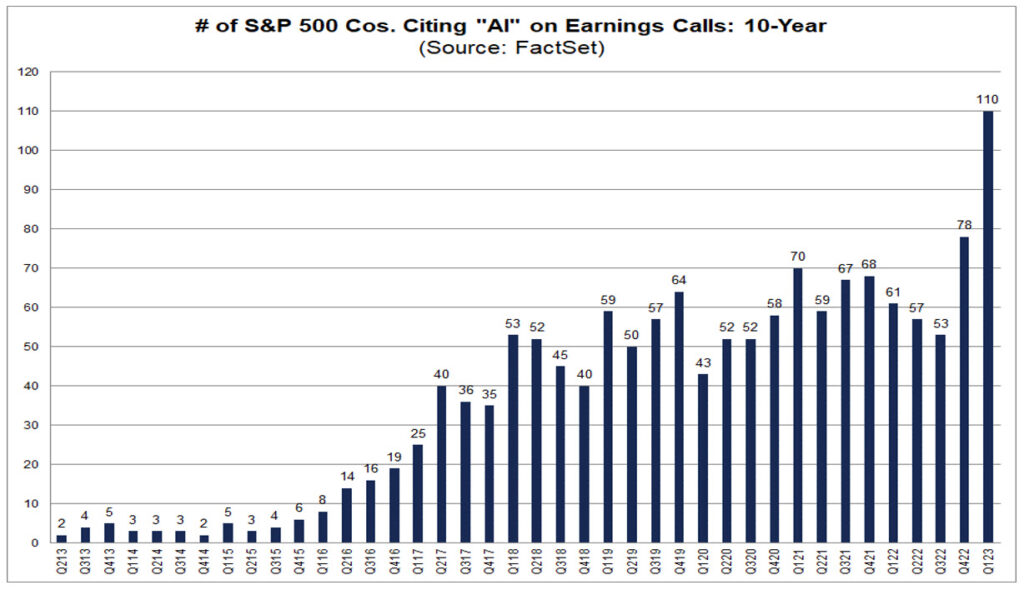

And of course, there is the Artificial Intelligence (AI) bubble.

Nvidia (NVDA), which is seen by the market as the primary beneficiary of A.I., has seen its market cap go from sub-$300 billion to over $1 trillion in six months… on annual revenues of $44 billion (annualized based on the company’s increase 2Q23 outlook). By way of comparison, Cisco (CSCO) which operates in a similar business as NVDA, already has annual revenues of $50+ billion, but trades at a market cap of $200 billion.

Companies are doing everything they can to align themselves with this mania, to the point of mentioning the term “AI” on earnings conference calls even if their businesses has little if any real exposure to the technology.

To summate the above examples, there are clear signs that there is much too much froth/ excess liquidity in the financial system today. And the Fed seems unaware of how to fix this. Case in point, during the regional banking issues of March 2023, the Fed pumped $400 billion into the financial system in the span of three weeks, thereby reversing roughly two thirds of its entire nine-month Quantitative Tightening (QT) efforts!

All of the above items indicate to me that the Fed is unlikely to succeed in its attempt to end inflation unless it dramatically increases QT and implements other measures to drain excess reserves/ liquidity.

To summate, the Fed is making the very same mistake it made in the 1970s: focusing on fighting inflation with rate hikes when there is clear evidence that the REAL issue is that there is too much money/ reserves in the financial system.

For more inflationary insights as well as a Special Investment Report that details how to profit from sticky inflation swing by: