We have long lived in a Fed-funded Wonderland where financial markets hope for bad news in order to rise because Fed rescues with helicopter cash have come to mean more than good business.

On May 3rd, I wrote the following about how a recent tiny rise in unemployment that the Fed has been looking for before it starts lowering interest rates to rescue the economy from a slump could very well just be another head fake:

Today delivered a “new jobs” report that came in (at 175,000 new jobs), well below expectations of 240,000. By that report, the unemployment rate ticked higher from 3.8% to 3.9%.

As I commented yesterday, we may be nearing the point where all the layoffs this year and last year are bringing jobs down enough to where they will finally start to come in line with available workers. Once that threshold is met, unemployment can rise when and if layoffs are higher than normal. We’ll have to see if this minute rise becomes a trend, though, since the numbers pulled a head fake to his level in February, too, then dipped back down in March to the familiar 3.8 level they had hovered along in August, September and October of last year.

As could be expected, markets took off on the day I wrote that because that bitty rise in unemployment gave a wisp of hope for a Fed rate cut, taking back the financial tightening markets had put in place when they were falling days before:

As usual, the slightest hint of a softening labor market caused stock and bond investors to back markets [back] from the recent financial tightening investors had brought back to the marketplace. Brains smoked in the fumes of hopium and fueled with pure testosterone bid stocks and bonds and rate cuts hopes all back up again today in response to this slight hint that the Fed’s jobless gauge may finally allow it to cut rates. Same pipe dream from the same glass-pipe smokers.

It turns out that renewed financial loosening in markets is also likely based on nothing but a head fake. Today, we found the slight increase that showed up a week ago in the relentlessly and suspiciously repeated number of 212,000 weekly new jobless claims, which bumped those claims up to 223,000, just turned out be a mere feint and went back down. Today we read:

Jobless claims for the week ending May 11 fell by 10,000 to 222,000, down from 232,000 the week before, the Labor Department reported Thursday

So, no new trend of rising unemployment so far. Just chop. That is 10,000 short of the BLS’ magically repetitive line of consecutive 212,000 new jobless claims each week that I wrote about. However, having finally been called out by CNBC on numbers that were so exactly repeated as to defy belief, the Bureau of Lying Statistics likely figured reporting a sixth month right at 212K since last October might tip off a few more slow-to-catch-up minds that the numbers have been rigged, now that even CNBC finally called the rigging right.

What’s so magic about 3.9% unemployment?

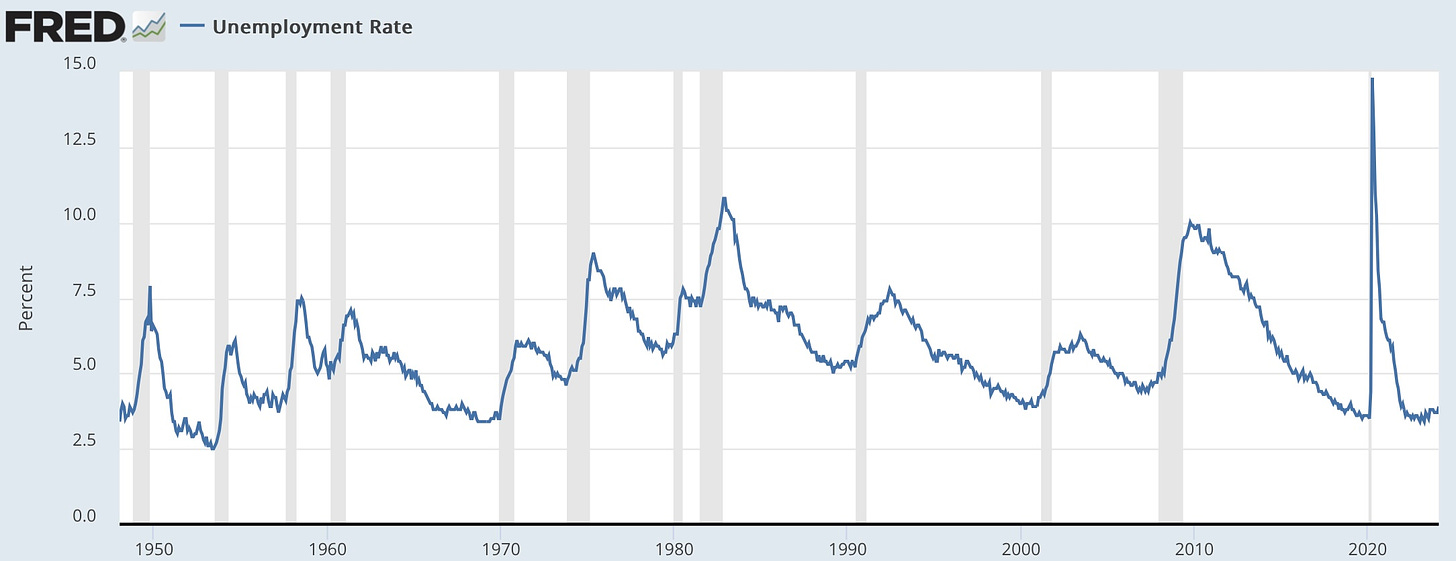

In a March Deeper Dive, I wrote about the importance of the rise to 3.9% that had just happened in February in terms of how strongly it pushes the Fed to cut rates. I used this graph to show how, as soon as unemployment wiggles up, a recession begins, unemployment soars, and the Fed starts cutting rates: (Gray bars are recessions.)

It happens as precisely as clockwork: Unemployment turns up a mere few notches then leaps, and recession begins that very same moment the leap is made. The two are dancing partners on the glockenspiel of the Fed’s cuckoo clock of recession cycles. Looking at the very end of that graph, we see a hint from this last week’s unemployment report that the initial faint upturn MAY have begun. I say “may” largely because the current badly broken labor market has given more than one head-fake in this direction already then gone back down. Here’s a view closer up:

3.9% is the critical level because that is just the right step above this cycle’s extreme low to make the next move the leap onto the soaring unemployment path if the move is up. If you analyze the graph, you’ll see that after every tiny uptick this size, recession begins and then unemployment spikes.

However, with the upturn in new jobless claims having just demonstrated it was a head fake, the rise in unemployment to 3.9% that came right after the jobless report will likely prove to be the same thing, putting us right back to where there is nothing to drive rate cuts or hikes either way. (I pointed out in the Deeper Dive how we had just tagged that 3.9% in February, as mentioned above, only to lose it in March.)

To all this, two more Fed heads chirped in today, saying they are in no hurry to raise rates and think the Fed should take its time. So, stock and bond markets are insane in their fantasy that the Fed will quickly be lowering rates in a helicopter rescue operation.