via Mike Shedlock:

Median new home prices are plunging. What will homebuilders do for an encore to entice buyers?

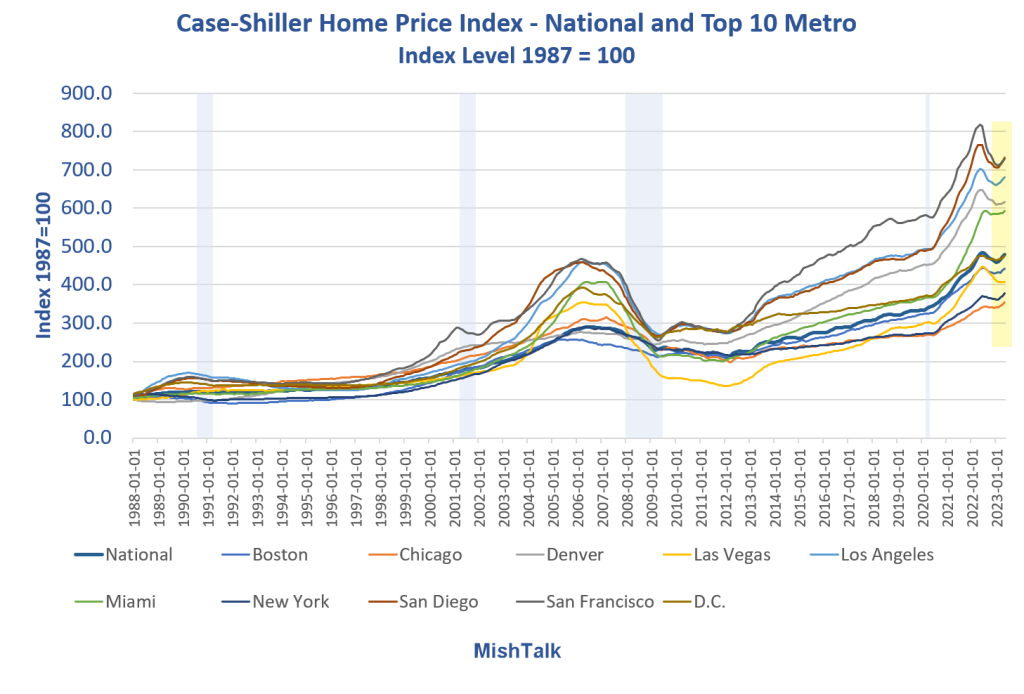

Existing homes sales prices remain stubbornly high as measured by Case-Shiller repeat sales of the same home.

In contrast, homebuilders have passed on lumber price discounts, offer interest rate buydowns, and now build smaller homes.

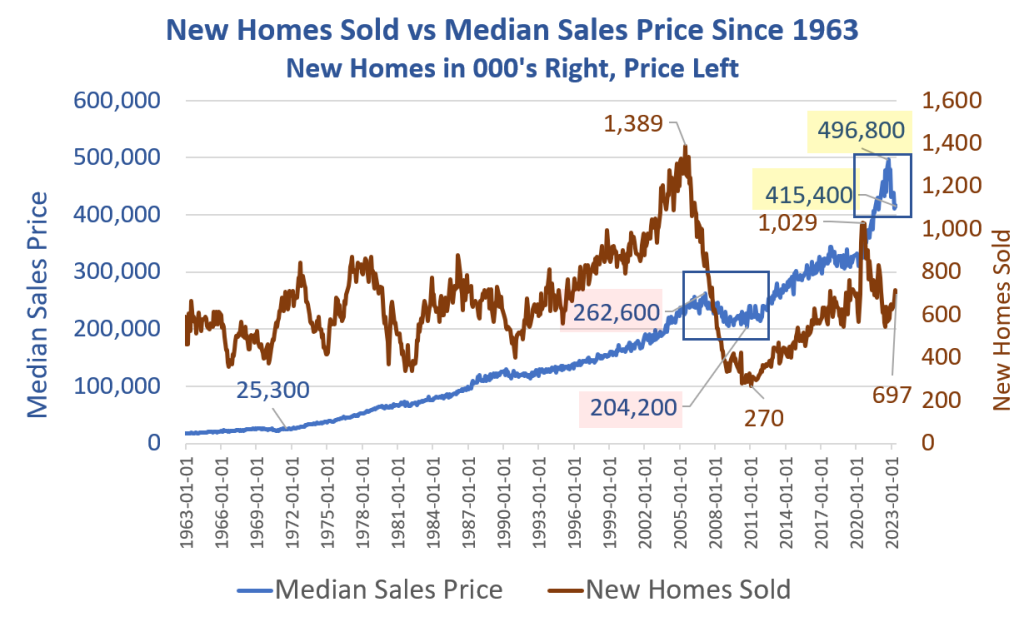

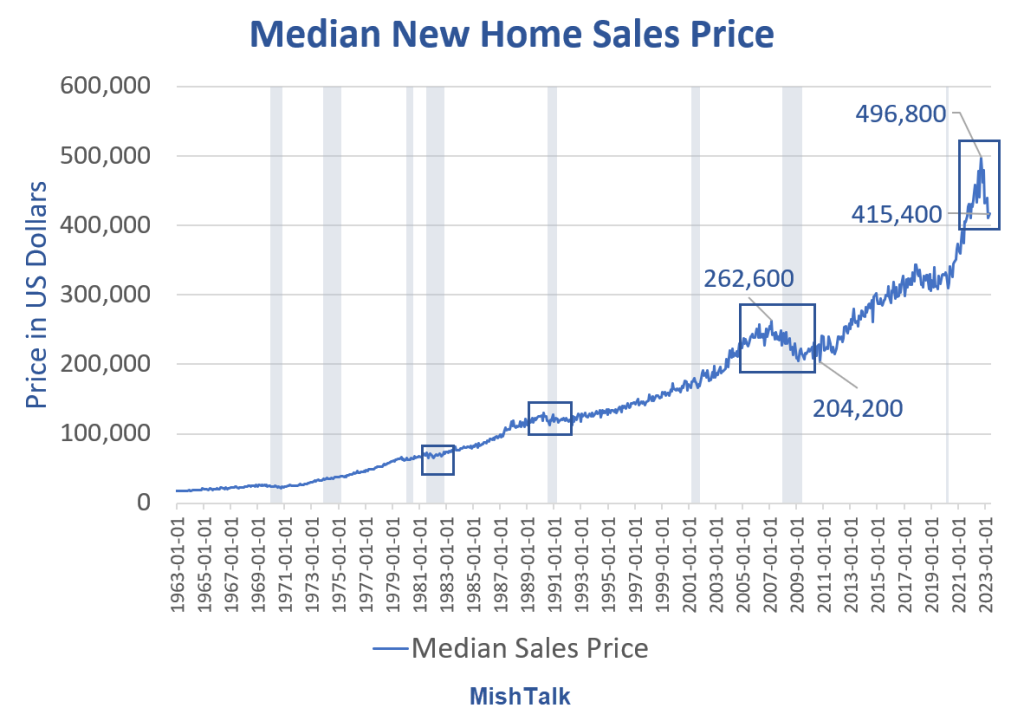

Median New Home Sales Price vs Recessions

Peak-to-Trough Declines

- Great Recession: $262,600 to $204,200: 22.2 Percent Decline

- Current: $496,800 to $415,400: 16.4 Percent Decline

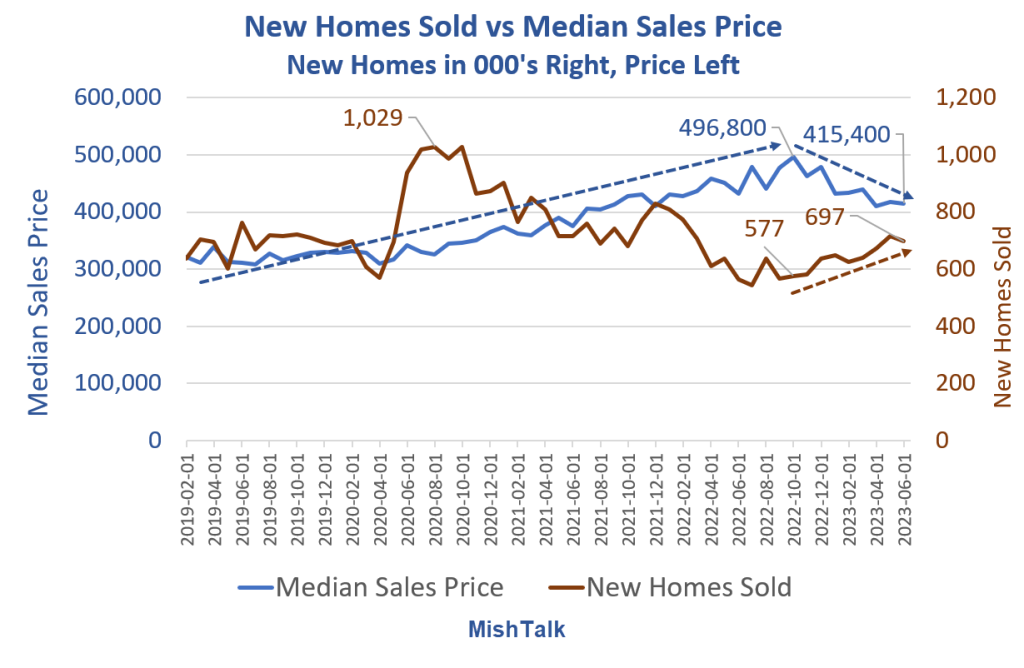

New Home Sales vs Median Sales Price Detail

Buyers hit a brick wall on price with a peak of $496,800 in October of 2022. Median price has fallen 16.4 percent since then.

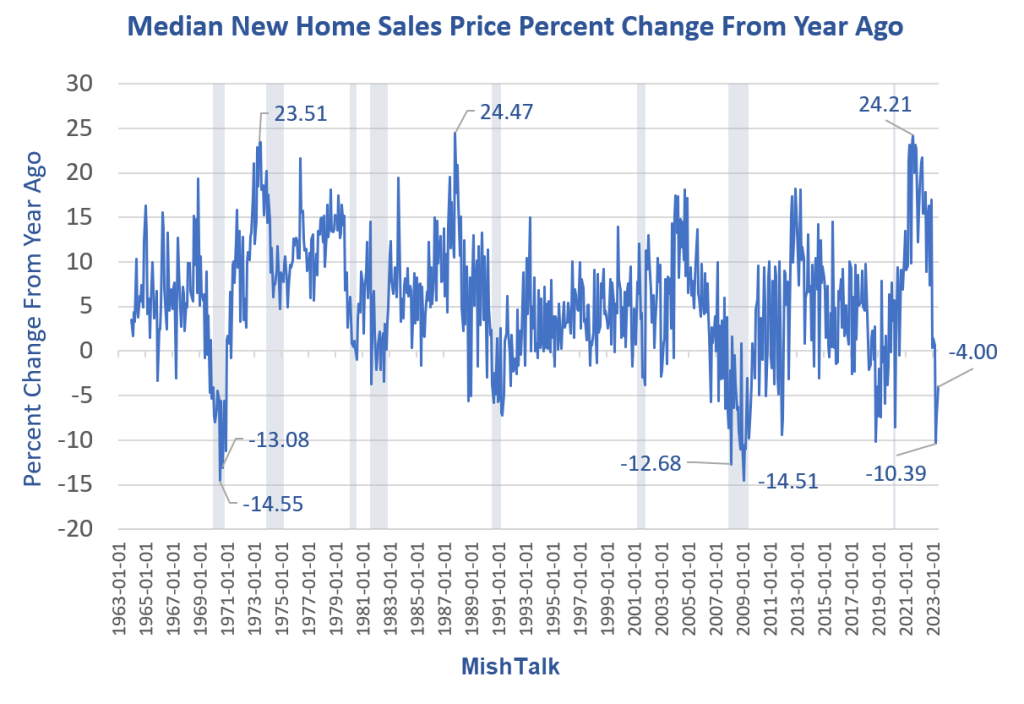

Price declines of 10 percent or more are usually associated with recessions. We now have a recovery of sorts from -10.39 percent to -4.0 percent, but that’s primarily due to easier comparisons, not rising prices.

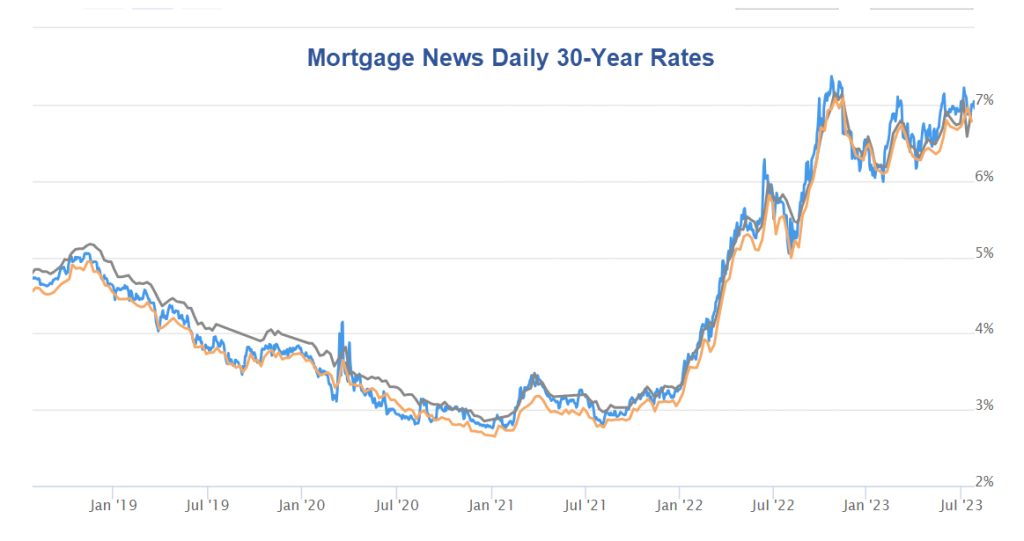

Mortgage News Daily Rates

Buyers hit the brick wall in price when mortgage rates approached 7.0 percent. Transactions started declining much quicker.

The transaction stall point is more apparent in existing home sales.

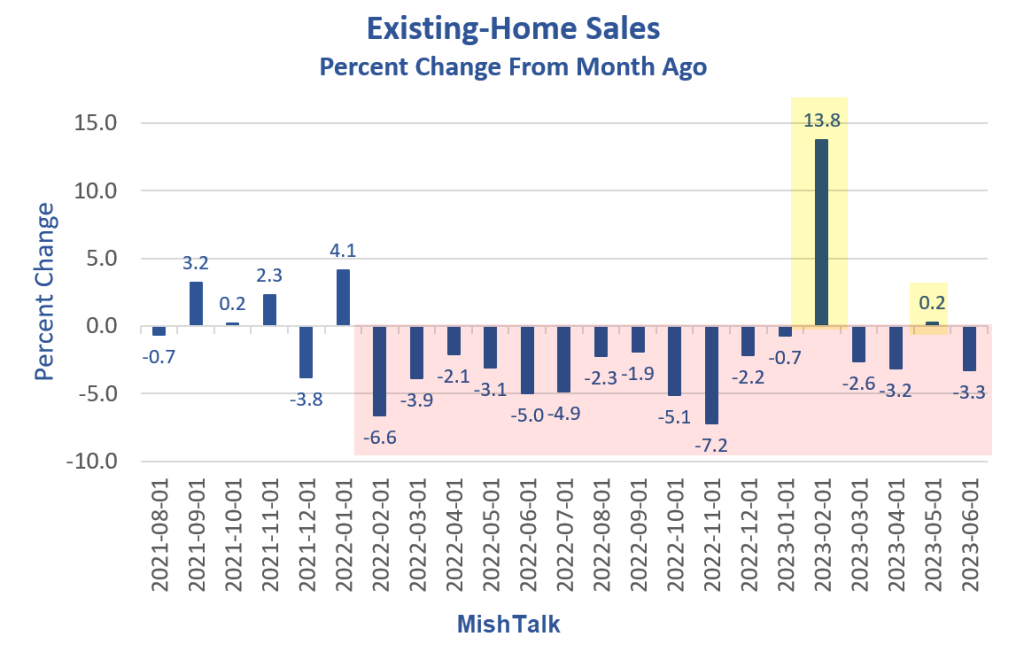

Existing Home Sales Percent Change

Existing-home sales data from the NAR via St. Louis Fed download.

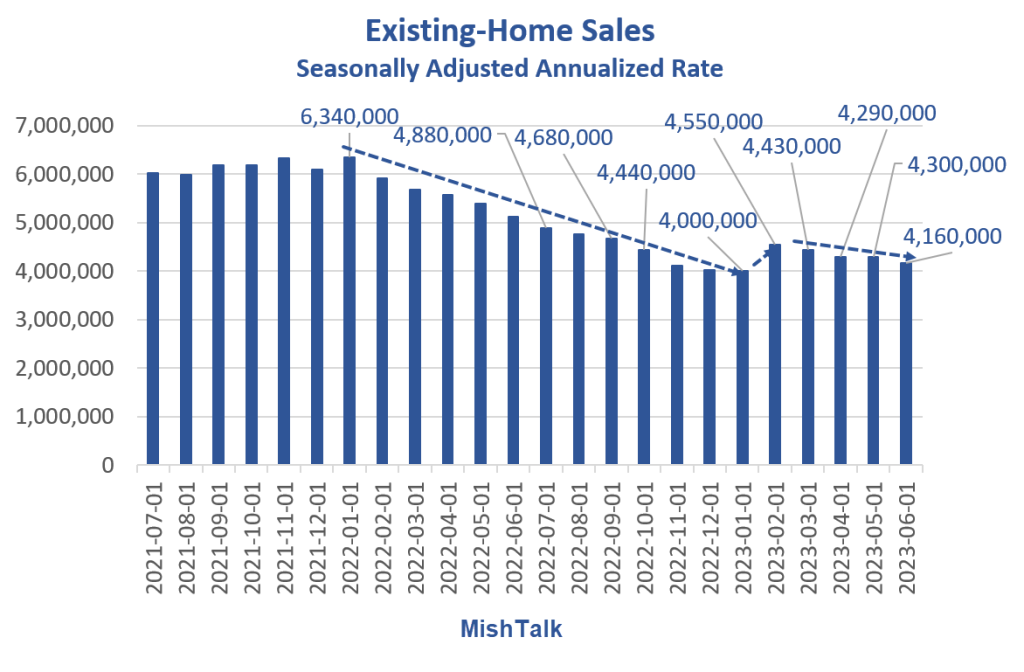

Existing Home Sales Seasonally Adjusted

Existing home sales went into a massive set of declines starting in February of 2022. Mortgage rates had barely started ticking up.

For discussion, please see Existing Home Sales Resume Slide, Down 15 of the Last 17 Months

The Housing Bubble, as Measured by Case-Shiller, Is Expanding Again

Killer Combination

The killer combination for existing home sales transactions was a sharp increase in mortgage rates coupled with a sharp increase in asking price.

As long as we have high mortgage rates and high asking prices, sales will remain in the gutter.

People do not want to trade a 3.0 percent mortgage for a 7.0 percent mortgage.

For discussion, please see The Housing Bubble, as Measured by Case-Shiller, Is Expanding Again

What Will it Take?

This brings us back to the lead question: How Much More Will Homebuilders Have to Reduce Prices to Increase Sales?

To boost sales, builders have passed along drops in lumber prices, reduced home sizes, reduced lot sizes, and bought down mortgage rates. But the easy fruit is off the vine.

For existing home sales, current transactions reflect a combination of mortgage rates, price, and willingness of consumers to speculate on rising home prices.

For new home sales, factor in ability and willingness of homebuilders to make homes more affordable with incentives or by building smaller homes. More incentives reduces profit.

Noose Tightens on Consumer Credit, Auto Loan Rejections Hit Record High

Please note, the Noose Tightens on Consumer Credit, Auto Loan Rejections Hit Record High

Yet, the consensus opinion has changed from recession to soft landing. Does anyone hear a bell?