by FATPEPPAPIGGAMER420

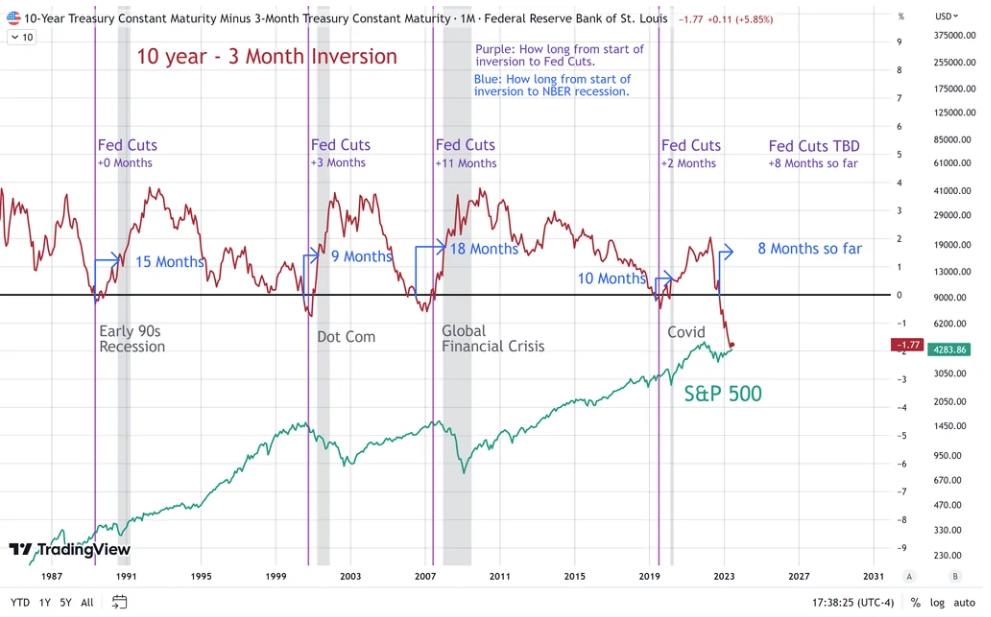

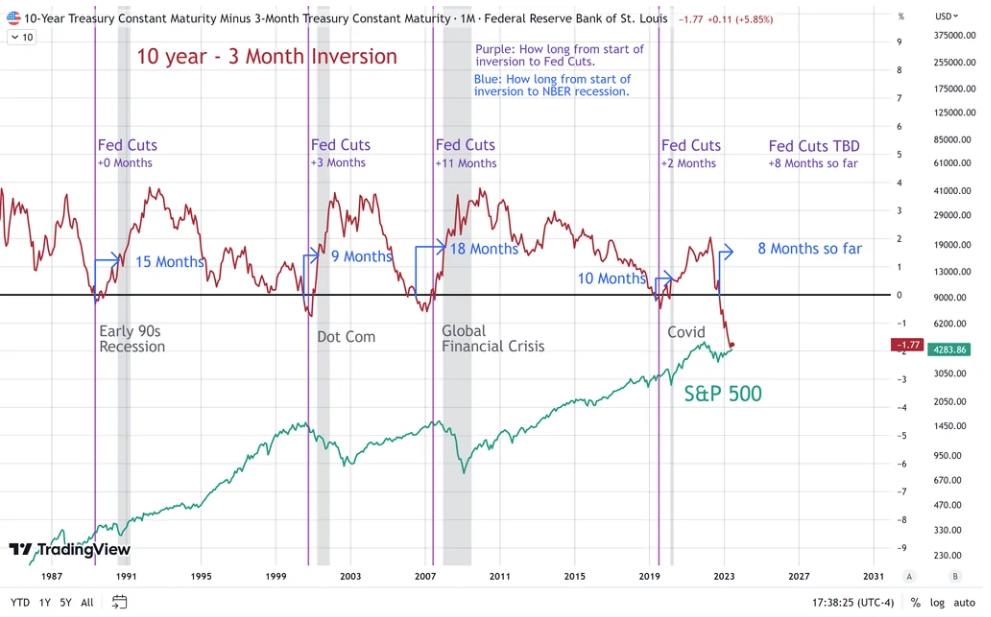

It looks like the 10-year Treasury Constant Maturity Minus 3-Month Treasury Constant Maturity is inching closer to an inverted yield curve. This typically happens before a recession, so the Fed may start cutting rates soon.

A Curated Collection of Media – Your go-to for sharp finance and politics coverage.

by FATPEPPAPIGGAMER420

It looks like the 10-year Treasury Constant Maturity Minus 3-Month Treasury Constant Maturity is inching closer to an inverted yield curve. This typically happens before a recession, so the Fed may start cutting rates soon.