by Dampish10

There can be no assurance that Steward will successfully execute its plans or that the Company will recover all of its deferred rent and loans outstanding to Steward.

As a result, MPT cannot be assured that Steward will make all scheduled lease payments throughout the remaining approximate 22-year fully extended term of its master lease.

Just a funny story I wanted to share:

TLDR: Watch the fire burn, years of bad management has finally caught up to them and next year starts an entirely new issue… Massive Debt Maturing…

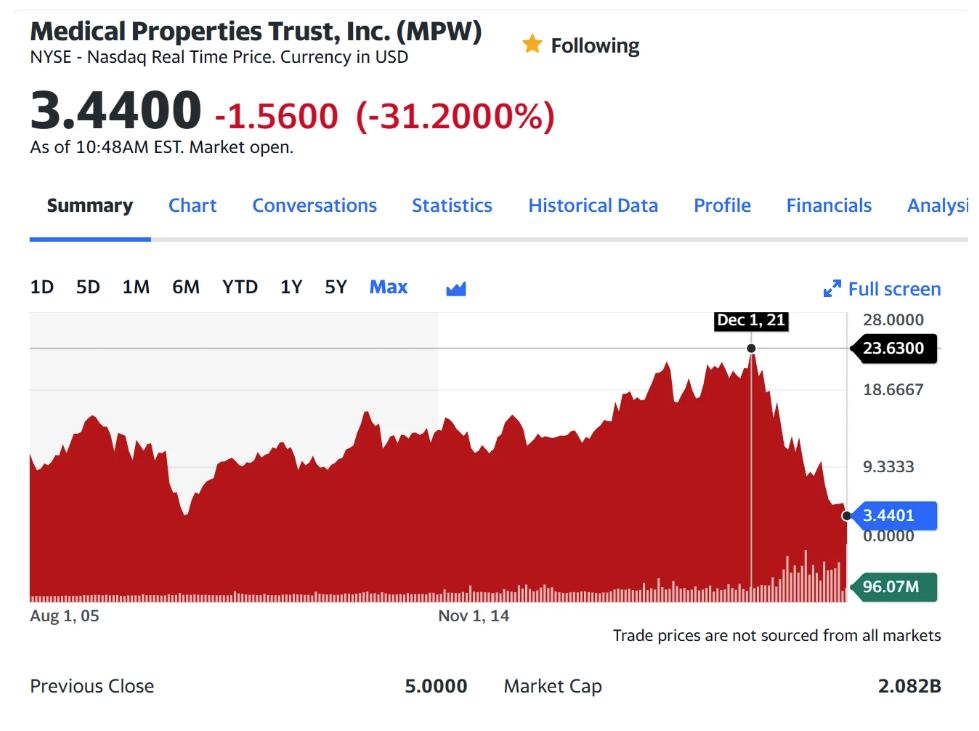

I own no position in $MPW but I’ve been following it for a while and like watching this dumpster fire with the ‘drama against short reports’ from their own CEO making a public video (Available on their website) a few months ago defending the company.

Basic info:

- Ticker: $MPW (Medical Properties Trust)

- Yield: 17%

- Properties: 441 over 10 countries- actively selling

- 55 Tenants

- Leverage: 50%

- % shares shorted: 24.97% (149,570,000 shares) – MarketBeat (12/15/2023)

$MPW is one of the larger Healthcare REITs out there, and has always struggled thanks to horrible management… but this is truly regarded.

“To protect MPW’s assets and hospital operations we are giving Steward (their most overleveraged tenant) a $60M bridge loan”

This Tenant (Steward) has been struggling now for 2 consecutive years and $MPW in response has deferred rent to them numerous times, and given them hundreds in loans to keep them afloat. Now its finally coming back to bite them.

-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-

The good:

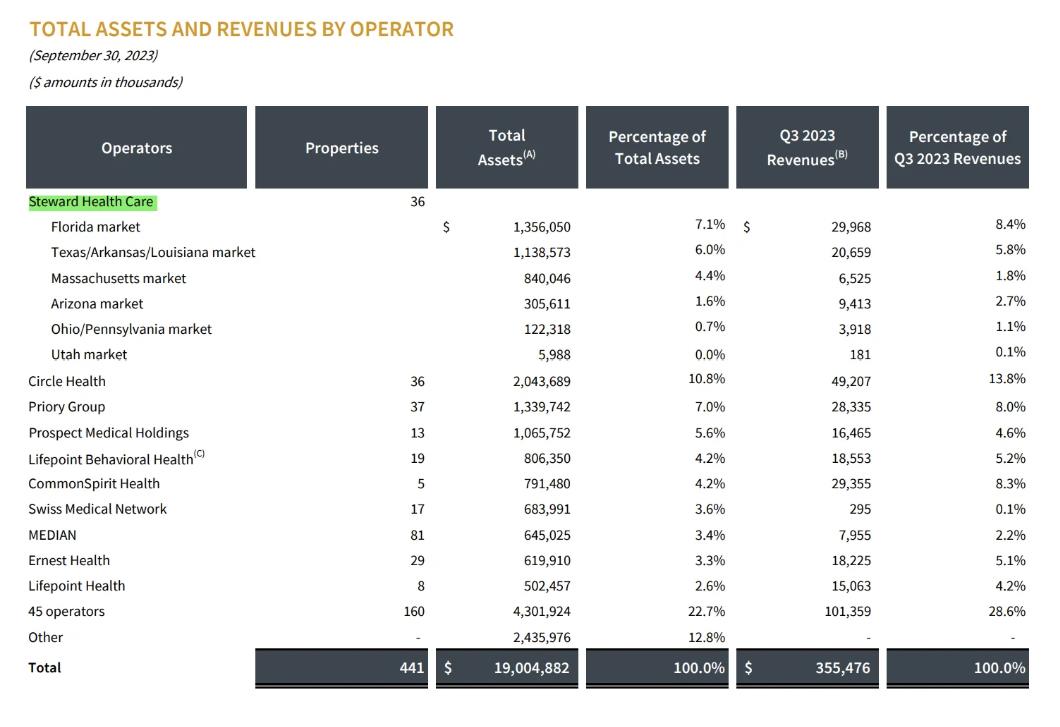

Steward runs ~19% of $MPW’s total assets.

Source: Medical Properties own website

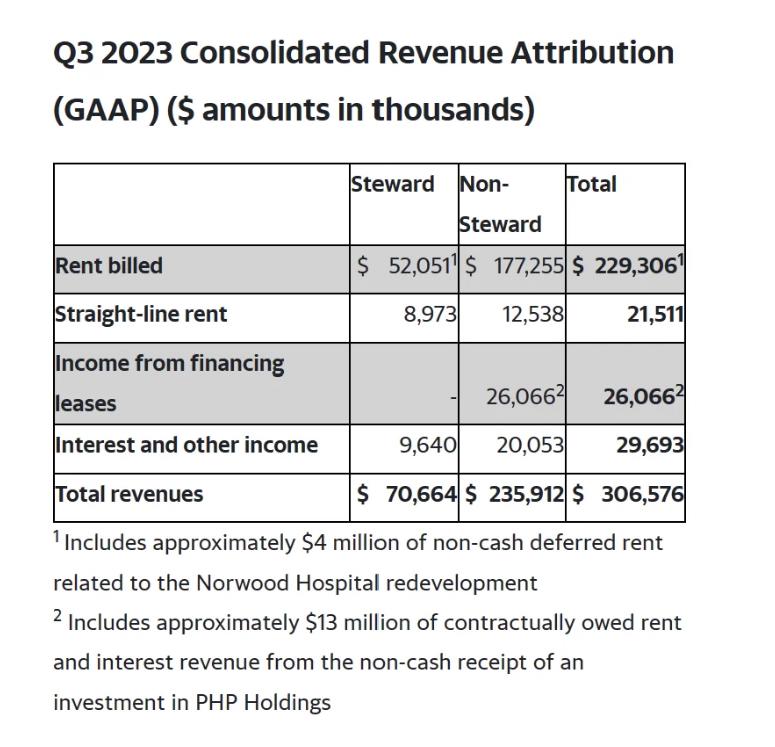

Removing Steward’s loan and rent payments the new ‘revenue chart’ looks like this:

$MPW now plans to try and get their money back with consulting multiple law firms, and plans to reduce its exposure to Steward even more.

MPT has engaged Alvarez & Marsal Securities, LLC (“A&M”) as its financial advisor and KTBS Law, LLP and Baker, Donelson, Bearman, Caldwell & Berkowitz, PC as legal advisors to advise the Company on its options to enable the recovery of uncollected rent and outstanding loans. MPT’s management team and advisors have worked closely with Steward and its own advisors to develop an action plan which, if successful, is designed to strengthen Steward’s liquidity and restore its balance sheet, optimize MPT’s ability to recover unpaid rent, and ultimately reduce MPT’s exposure to Steward.

The bad

Losing Steward’s Loan and rent payments decreases AFFO by $0.11 (if Buisness Wire is correct in their assumption) meaning:

- AFFO: $0.30 – assuming Q4 is the same as Q3

- -$0.11 – steward deferral

- -$0.15 – shareholder dividend

- Remaining AFFO: $0.04 remaining – being used to buy back shares/pay down debt

Another -50%+ dividend cut or dividend suspension is incoming and could potentially drop the stock further.

-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-

Tactical Nuke Income (Debt Maturities)

$MPW has 2024 as a final ‘small payment’ of debt.

Starting next year (2025) it starts to hit 13%,then 29%,then 15% of their total debt maturing which they just simply don’t have the cash to pay it off and won’t be able to unless they massively sell off assets.

So that means re-financing at a much higher rate than they current are at.. which means more interest… which means lower AFFO…

Do you see why this is getting out of control yet?

Don’t have any opinion aside from “What a dumpster fire” on it as I’ve watched this thing go from $15 to where it sits today at around $3.50.

Its just weird seeing a Hospital REIT struggle worse than every other REIT out there right now.

Disclaimer: This information is only for educational purposes. Do not make any investment decisions based on the information in this article. Do you own due diligence or consult your financial professional before making any investment decision.