via Mike Shedlock:

The Fed’s preferred measure of inflation, the PCE price index, went negative for the month. Let’s discuss.

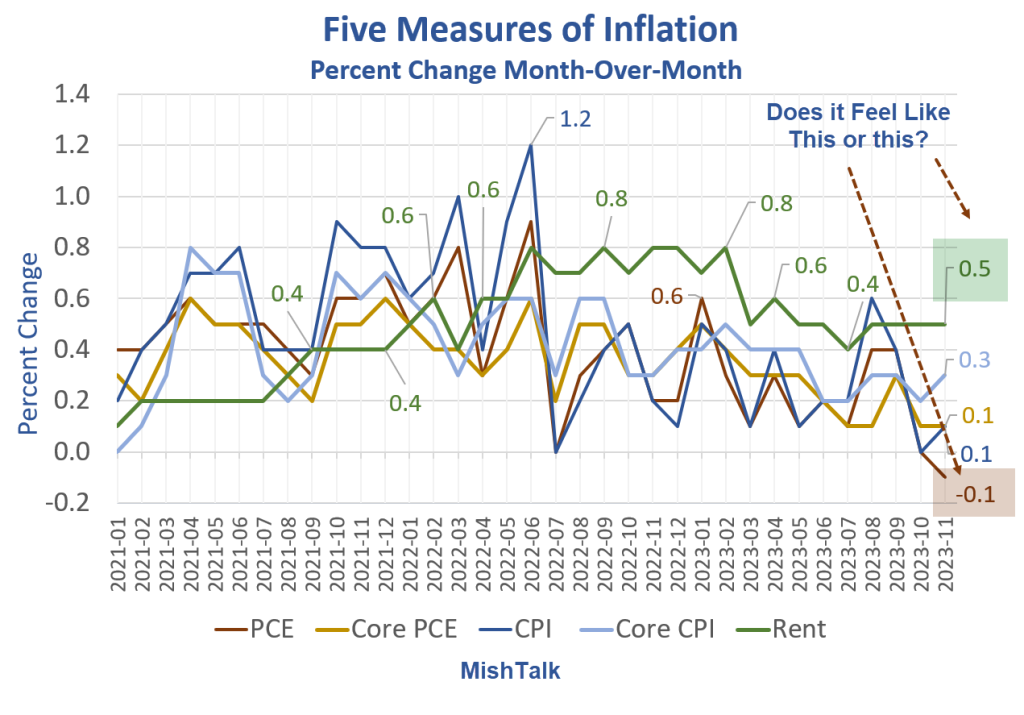

Chart Notes

- Today the BEA reported that the Personal Consumption Expenditures (PCE) Price Index fell 0.1 percent.

- More accurately, PCE fell 0.07 percent rounded to 0.1 percent.

- Core PCE which excludes food and energy rose 0.1 percent.

- The CPI rose 0.1 percent.

- Core CPI rose 0.3 percent.

- Rent of primary residence rose 0.5 percent.

Market Based Measures

And now we get to update PCE "market-based" measures which were negative MoM DESPITE including the horribly lagging OER (up 7.3% annualized MoM). Again, substitute the LEADING data from Zillow and we are strongly negative. From June 2022, we're annualizing 1.48%, right back… https://t.co/lOlcNGzabo pic.twitter.com/JGDxOfwRyk

— Michael Green (@profplum99) December 22, 2023

“And now we get to update PCE “market-based” measures which were negative MoM DESPITE including the horribly lagging OER (up 7.3% annualized MoM). Again, substitute the LEADING data from Zillow and we are strongly negative. From June 2022, we’re annualizing 1.48%, right back inline with pre-Covid metrics.”

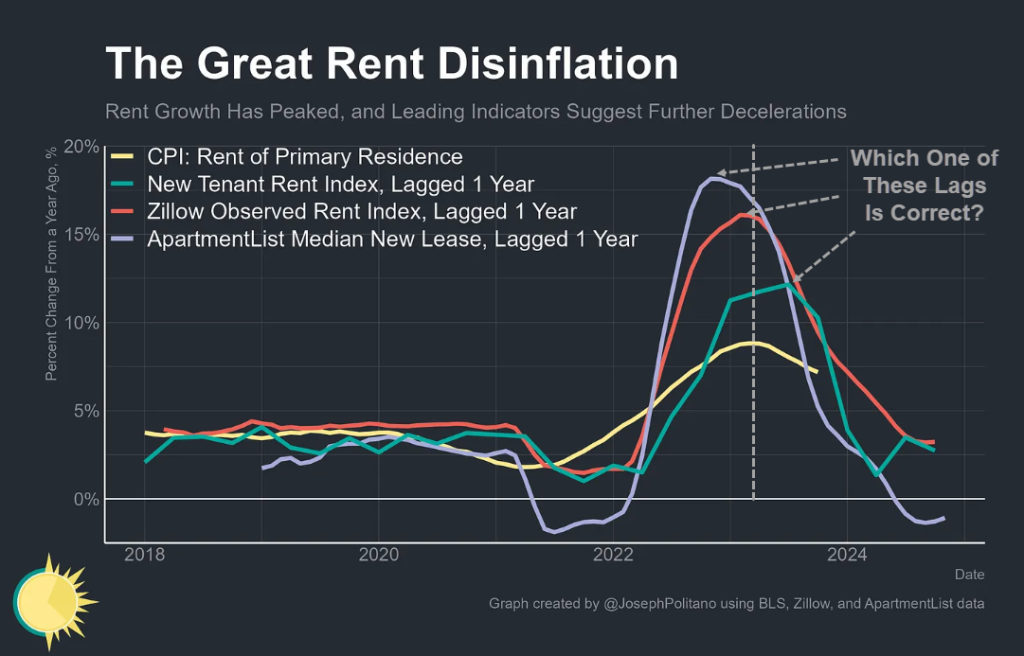

A Curious Claim that the BLS Is Overstating Rent and Exaggerating Inflation

What About Lags?

I discussed “market-based” measures in A Curious Claim that the BLS Is Overstating Rent and Exaggerating Inflation

Once again, Professor Plum is relying on Zillow. I repeat “If you have a favorite lag period, you can find supporting evidence no matter what it is.”

Please read my post if you haven’t already, because it smashes the idea that BLS rent and OER are not “market-based” numbers.

Rent Jumps Another 0.5 Percent

Rent of primary residence, the cost that best equates to the rent people pay, jumped 0.5 another percent in November.

The headline CPI looks tame in November, rising only 0.1 percent. But for the second month, a good headline number is an energy mirage. Rent, which is sticky, rose at least 0.4 percent for the 28th month.

For discussion, please see Rent Jumps Another 0.5 Percent, Only a Decline in Gasoline Prevents a Hot CPI

PCE vs CPI

So why is the PCE -0.1 percent and the CPI +0.1 percent with core CPI +-0.3 percent?

It has to do with weighting. The PCE includes prices paid on behalf of someone (think Medicare, Medicaid) whereas the CPI only includes prices paid directly by someone.

Thus the CPI overweighs rent while the PCE overweighs medical expenses.

Housing

Neither the PCE nor CPI is a good measure of inflation because neither includes home prices that are on a tear.

This is an enormous mistake by the Fed because inflation matters, not just consumer inflation and the Fed made a huge mess of things.

Professor Plum rails against OER and that is reasonable except for the fact that OER is market based. OER reflects actual rent paid.

The weight is questionable however, because most people own their own homes and do not rent. This is another reason both measures are “bullsheet” but we have what we have.

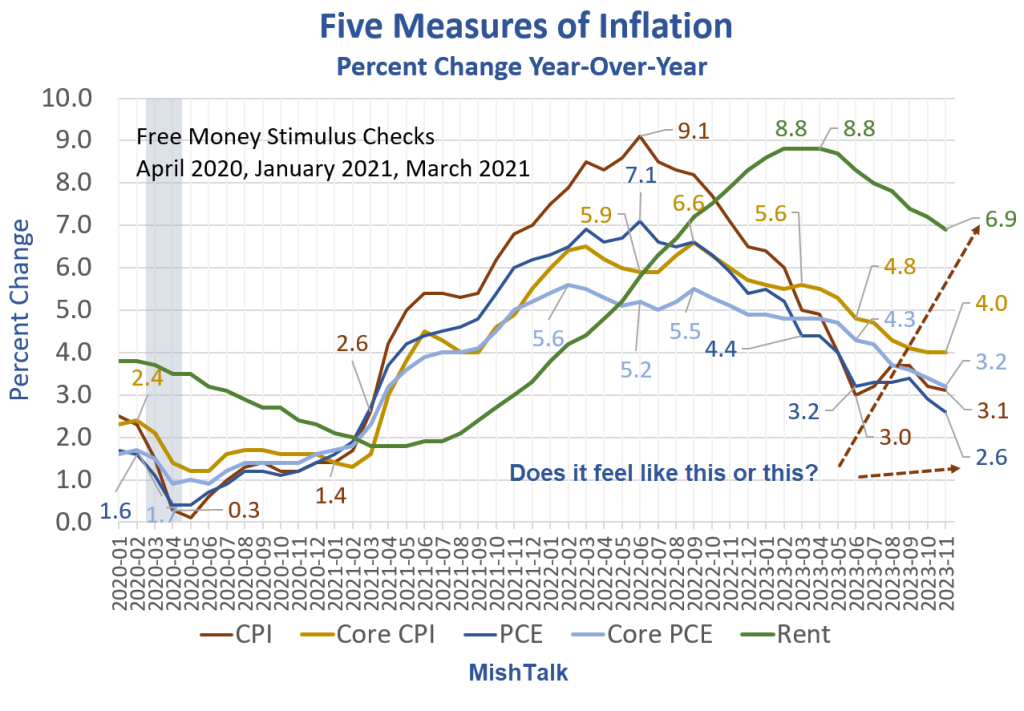

Five Measures of Inflation Percent Change Year-Over-Year

If you rent or are looking to buy a home, you know damn well how it feels.

About 36 percent of the people rent. About 11 percent want to buy a home.

And those who pay their own medical insurance will tell you how much “bullsheet” is in PCE medical prices.

What About Polls?

The Wall Street Journal reports “Among Democrats and independents who lean that way, 45% say Biden’s policies hurt them personally or had no impact on them. Among voters overall, 53% of voters said Biden’s policies hurt them, and less than a quarter—23%— said they were helped by his policies. Some 49% of voters said Trump’s policies personally helped them, while just 37% said they hurt them.”

Hardly anyone thinks Bidenomics is working. Why? Because the PCE is “Bullsheet”, that’s why.

Zillow is Bullsheet

If rent lagged by a year as Zillow thinks, then Zillow has been wrong for 16 straight months!

Simply put, Zillow is “Bullsheet” too, so stop referring to it.

Rent Will Decelerate, But When?

Year-over-year inflation is dropping. The cheerleaders are out in force. Hooray!

Based on lags, new leases, and units under construction, people have been saying that rent will “soon” decline or “has” declined for two full years!

I say it’s “Bullsheet” and I have been right.

I do expect at some point rent will decline, but when, how fast, and for how long are all unknown.

No One Will Fix This

On September 7 I offered this view: Debt to GDP Alarm Bells Ring, Neither Party Will Solve This

“Neither party will fix the deficits. Neither party will do anything about mounting debt. No one will do anything about anything because the political system is totally broken.” Mish

But when do the deficits and debts matter?

That was the focus of a follow-up post on December 3,

When Does US Federal Debt Reach an Unsustainable Level?

Please consider When Does US Federal Debt Reach an Unsustainable Level?

A possible message of the Treasury market and gold is that neither believes the Fed is in control or won’t be starting five years from now.

Transitory to Where?

Cheerleading declines in rent that have not even occurred is ongoing. But let’s assume that sometime soon rent prices stabilize.

How much pent up inflation is on deck? That’s the key question that the cheerleaders miss. I don’t know and they don’t either, but at least I admit that. However, we can discuss the inflationary forces.

Inflationary Forces

- Global wage arbitrage and just-in-time manufacturing have reversed to inflationary onshoring and just-in-case manufacturing.

- Neither party will fix deficits and out of control spending.

- Trump’s tariffs and sanctions were hugely inflationary but Biden is much worse.

- Biden’s energy policy and regulatory madness is hugely inflationary.

- Retiring boomers need more medical care services. Their jobs are replaced by unskilled zoomers with a totally different work ethic.

- Massive wage increases in union contracts over a many year period and ongoing minimum wage hikes in many states.

Biden is Using the Term Bidenomics Again, What Else Can He Do?

Yesterday, I asked Biden is Using the Term Bidenomics Again, What Else Can He Do?

When you have done everything humanly possible to increase inflation and sow the seeds of more inflation, and when the best thing you can come up with is a lie, the fallback strategy of repeating the lie is all you can do.

For years I was one of the biggest deflationistas around.

But many factors supporting lower interest rates and lower inflation have changed 180 degrees from tailwinds to headwinds.

If inflation is transitory, then transitory to what?

For discussion, please see Huge Moves in the Yield Curve This Year, What’s Going On?

Regarding the huge inversion between 1 month and five years then strongly steepening: Could it be the bond market smells a short quick recession followed by a big inflation problem coming down the pike?

It’s possible the Fed delivers Nirvana. But all the cheerleaders will have you believe we are already in it.