The extent to which demand for existing homes has collapsed and remains collapsed is astounding, but ultimately not surprising: Demand plunged in 2022 when mortgage rates soared, and plunged a lot further in 2023 as mortgage rates continued to rise to almost 8% by October 2023. But then as mortgage rates dropped starting in November, and kept dropping in 2024, demand stayed at these collapsed levels through September, despite mortgage rates having dropped to near 6%. And now that mortgage rates have bounced off the September lows since the rate cut, demand has collapsed further, even as inventories have been rising all year (look below the article at the top of the comments for inventory and supply charts of existing homes and new houses).

And everyone knows why: Prices are too high. That prices are too high, after the crazy spike, can bee seen in the charts of our Most Splendid Housing Bubbles in America. And people have gone on Buyers’ Strike. We’ve been saying that for a long time, and Fannie Mae found in a survey just before the rate cut that lower prices are exactly what buyers are waiting for – lower prices, lower mortgage rates, and higher wages. In other words, people are still on Buyers’ Strike, and they’re staying on strike.

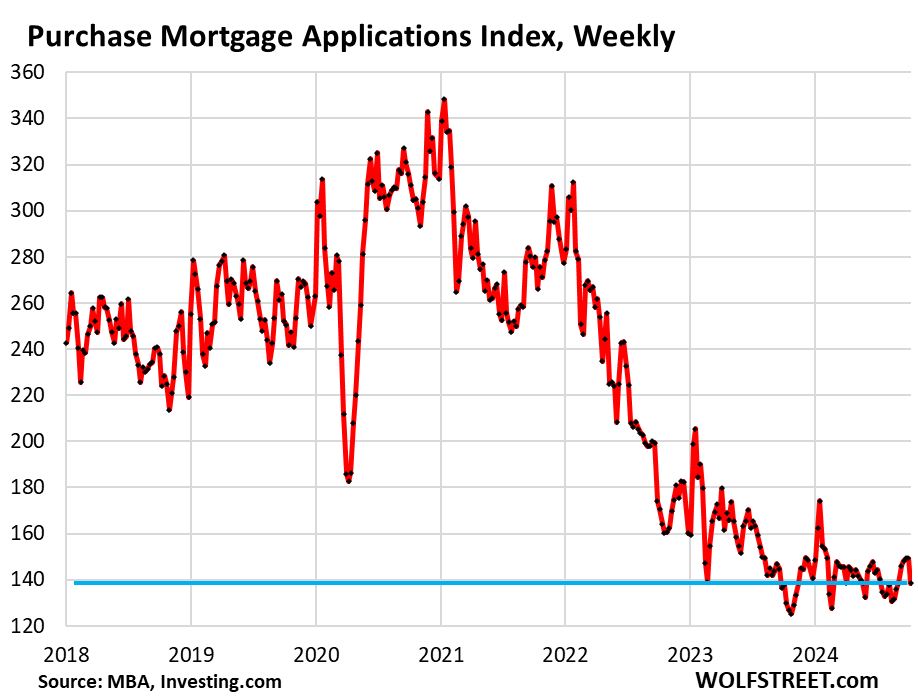

And it was confirmed today by the plunge in weekly applications for mortgages to purchase a home – a plunge from already historically low levels – according to data from the Mortgage Bankers Association. The Purchase Mortgage Applications Index has stayed in the same historically low range since the beginning of 2023:

MORE: