From Peter Reagan at Birch Gold Group

Summary

- The Treasury has borrowed so much to cover its multi-trillion-dollar deficits that debt service payments are becoming the federal government’s largest expense.

- Higher interest rates and high inflation can only decline when the government’s deficit spending ends.

Most governments spend more on critical services like defense and healthcare than on interest payments on debt.

But the United States government will soon be spending more on interest than on either of these other two important categories.

An article on the Axios website revealed that the government is on track to pay more than double the interest expense in the current fiscal year than it paid in 2021:

An upward shift in long-term interest rates is putting the government on track to spend much more on interest payments in the coming years than was anticipated just a few months ago.

If current rates stay high and fiscal policy matches current forecasts, the cost of servicing those debts will surpass defense spending in 2025 and top Medicare spending in 2026. In the current fiscal year, interest spending is on track to surpass $800 billion, more than double 2021’s $352 billion figure.

Marc Goldwein, senior policy director for CRFB, warned Axios at the time:

Interest rates are higher than anyone anticipated, and if they remain high, interest costs will explode, with interest rates well above expected economic growth rates, we also risk a debt spiral – especially if further borrowing pushes rates up more.

Unfortunately, it appears that Marc’s warning was spot-on…

The debt spiral

The federal government will spend about $2 trillion beyond its income by the end of 2023. If households or businesses did that, they would go bankrupt.

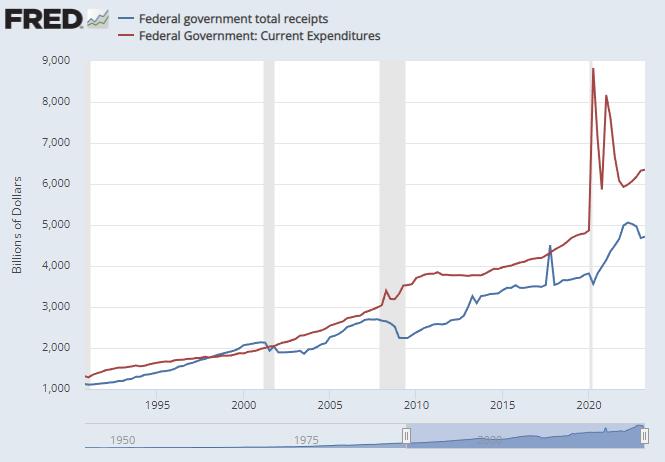

You can see the spending splurge for yourself on the chart below. The red line is total expenditures (which are going up), and the blue line is receipts (which are going down):

On top of that…

The total Federal debt now stands at an incredible $33.5 trillion, and the chart below reveals that roughly two-thirds of it ($20 trillion) has accumulated since 2010:

Basically, the government is borrowing more to spend more, but at what cost? The answer, as you’ll see over the next few paragraphs and charts, isn’t a pretty one.

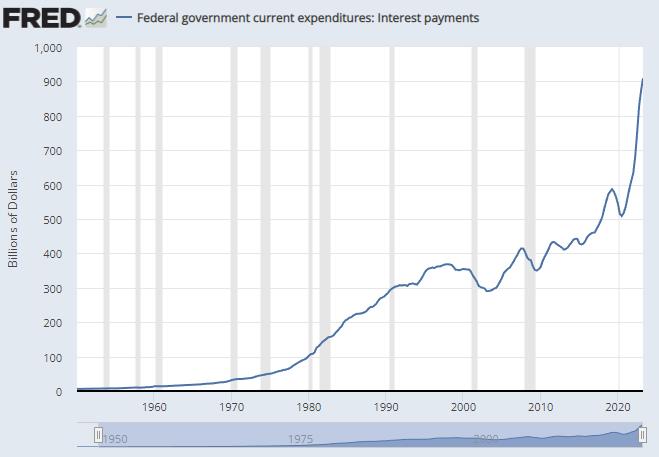

First off, the biggest spending increase this year was interest service payments (solely paying interest on debt) to the tune of $900 billion as of the second quarter of 2023.

You can see this for yourself on the chart below. Those interest service payments alone are up a staggering 25% year-over-year:

Those interest payments are more than the entire 2023 national defense budget of $816 billion that Biden just signed into law, and more than Medicare spending for 2023, which totaled $737 billion.

Let that sink in for a moment. Our government is spending more servicing interest (generated mostly from public debt) than defending the country or providing healthcare insurance benefits for older Americans.

But it appears like this situation will only get worse before it gets better. That’s because as old debt gets rolled over into new (more expensive) debt, these interest-only payments will keep rising.

Here’s how that would happen: The government could get stuck borrowing another trillion dollars at the current sky-high federal funding rate of 5.5%, just to service any new debt.

Back in February of 2022, that same funding rate was near-zero (0.08%).

This is the kind of news that would normally concern every person…

Janet Yellen isn’t worried (but you should be)

Yellen is the same United States official who panic-called CEOs when the debt ceiling needed lifting.

She is the same public official who actually claimed (with a serious tone) that the rest of the world isn’t “de-dollarizing.”

She’s also the same Treasury Secretary who laughably claimed the U.S. can afford to fund not just one, but TWO wars at the same time.

Janet Yellen is now telling Americans that servicing this amount of U.S. debt every year will be sustainable in some magical way. Take a look at how Time magazine captured her thoughts back in May:

More than any precise level, it’s the trajectory of debt that can prove critical. One big threat for those who are watching Yellen’s metric is a scenario in which interest rates stay high even after inflation subsides. That would see debt-service costs add to the burden without being offset by rising prices, like they are now.

That, Yellen has acknowledged, would introduce considerable problems. But she doesn’t expect it to happen because she’s in the camp of economists who anticipate the low-inflation, low-rate regime that dominated the last two decades to return once the pandemic price surge is beaten down by the Fed.

Right now inflation is high and rates are even higher. It certainly doesn’t appear that the U.S. will return to the “regime” Yellen wants it to anytime soon.

That means Yellen is likely to be proven wrong, yet again.

As if she could possibly make herself sound even more silly, she was recently asked how rising debt service costs would affect the economy.

Her response, as quoted in Fortune:

Certainly greater deficit reduction is possible. The President has proposed a series of measures that would reduce our deficits over time, while investing in the economy and this is something we need to do going forward.

That’s a lot of words that end up saying what appears as “not much.”

In fact, Yellen is acting a lot like the people who accelerated the Titanic right into the iceberg thinking it would move past it, instead of getting outside their bubble and making proper calculations to save the ship in the first place.

Bottom line: The U.S. could be running out of the “time” that Yellen claims it has. The truth is, we need much more than a balanced budget, and we need it right now.

Here’s how this affects your financial future

If the U.S. doesn’t have leverage when negotiating conflict with other countries, then the result of any conflict could impact our own economy here, as summarized by the CRFB:

As the Committee for a Responsible Federal Budget notes, a large portion of the U.S.’ national income is sent to foreign investors that hold and control our debt. “We are consequently left with fewer financial tools to manage conflicts with other countries when they have increased leverage over our economy,” claims the nonpartisan, non-profit organization’s site.

That increased leverage could also impact the dollar, result in higher taxes to pay off the U.S. debt, or both.

The U.S. government really needs to form a plan that includes sustainable debt reduction, not just a “balanced budget,” and certainly not another $2 trillion deficit.

But that doesn’t appear like it will happen any time soon.

As you saw on the chart above, the total debt has surged over $10 trillion since 2020. That means about one-third of the U.S. debt was created in just the last three years.

No matter how Yellen might slice it, that is an unsustainable pace of debt accumulation.

And since government borrowing devalues the dollar, on top of rising inflation (again), we’re all going to be paying the price yet again.

Your defense against debt and dollar devaluation

We all know stories about borrowers who make the mistake of not paying down the principal on their debts. Who, instead, simply pay interest – or, much worse, take out new, expensive loans to pay off their expiring, old loans.

Yet that’s the situation the federal government is in. Remember Paul Volcker’s insight:

Without the money supply anchored by a scarce metal, the only thing ensuring the soundness of the dollar (and, therefore, its role as the world’s reserve currency) was effective anti-inflation policy.

There’s nothing backing the value of the U.S. dollar except “effective anti-inflation policy.” Deficit spending and government debt fuel inflation. How can this end well?

I think it’s crucial, right now, that those of us who want a stable financial future for ourselves and our families diversify our long-term savings with physical precious metals.

Metals like physical gold have historically outperformed inflation, and don’t derive their value from a government’s promise to pay. They’re just about the only financial assets that represent real, intrinsic value you can hold in your hand. That’s why they’re the historic safe-haven assets during troubled economic times.

Is your financial future dependent on the future value of the dollar? If so, you may have no future. Please take a moment to learn about diversifying with precious metals.