In the wake of the economic tumult since 2020, American households are grappling with the harsh reality of surging prices. The cost of groceries has spiked by 25%, used cars have seen a staggering 35% increase, and rents are up roughly 20%. A revealing snapshot of consumer spending in 2020, where a four-person household shelled out an average of $238.32 per week on food at home, has now ballooned by 32%, reaching $315.22 in 2023.

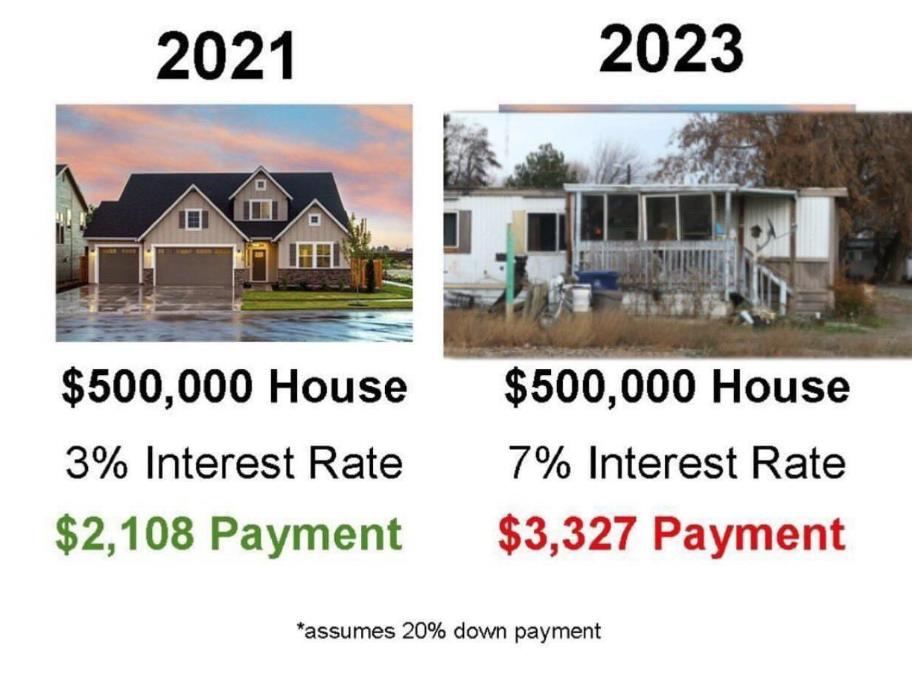

Despite the Federal Reserve’s attempts to rein in inflation through rate hikes, the desired effects are elusive. According to Torsten Sløk, the Fed’s challenge is compounded by households locking in historically low mortgage rates during the pandemic. This phenomenon necessitates the Fed to sustain higher interest rates for an extended period to dampen economic activity and bring inflation back to its 2% target.

The backdrop to this economic scenario is the government’s injection of $4 trillion in stimulus, coupled with a deliberate reduction in interest rates. The aftermath is evident—rampant inflation and the inevitability of higher interest rates. The notion of “free” money, it seems, comes at a considerable cost that American consumers are now acutely feeling.

Sources:

Just How Bad Is the US Cost-of-Living Squeeze? We Did the Math – Bloomberg

📺In Case You Missed It

📸@dailychartbook

"Fed hikes are not having the desired effect because households have locked in low levels of mortgage rates during the pandemic.As a result, the Fed will have to keep interest rates higher for longer to slow down the economy and get… pic.twitter.com/IdMUMnVUqr

— José Ricaurte Jaén | 📺In Case You Missed It (@JoseRicaurteJ) November 27, 2023

The government printed $4 Trillion in stimulus and dropped rates — The result is inflation and higher interest rates. There’s no such thing as “free” money.