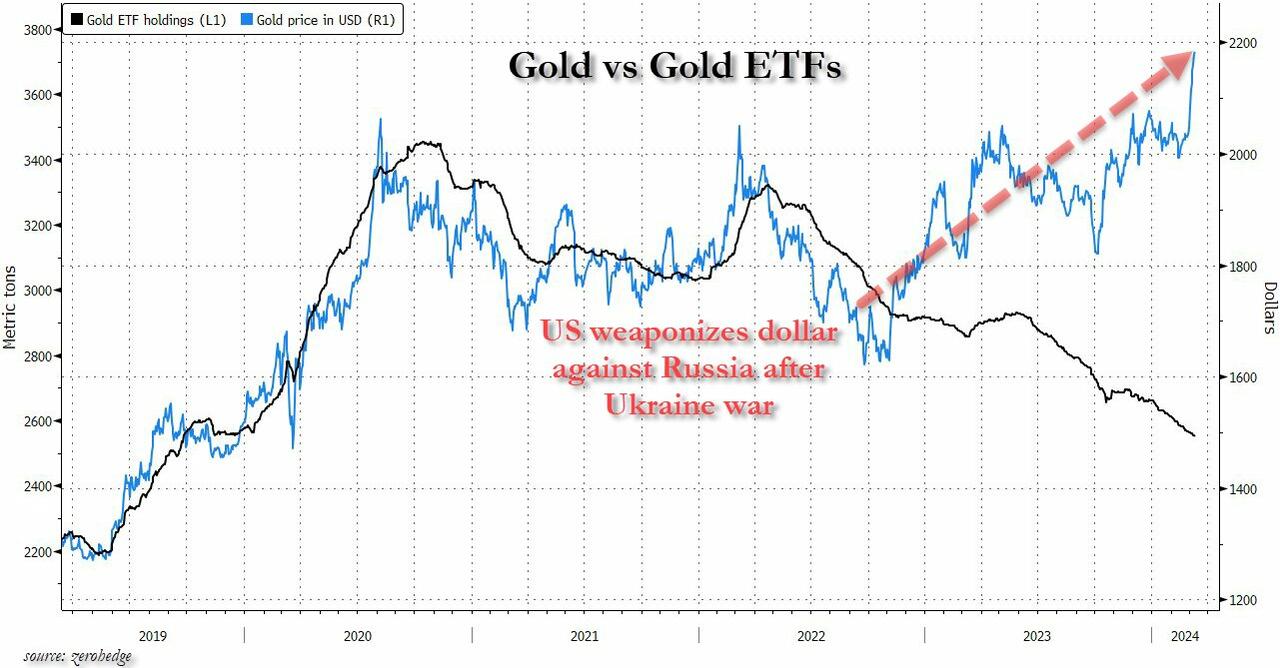

Something remarkable happened to the price of gold back in early 2022 around the time of the Ukraine war: having previously tracked gold ETF inflows to the tick, the price of gold suddenly disconnected and exploded higher even as “paper gold” as some call it, slumped. We showed this for the first time back in April with the following chart which showed the clear decoupling between paper and physical gold in 2022.

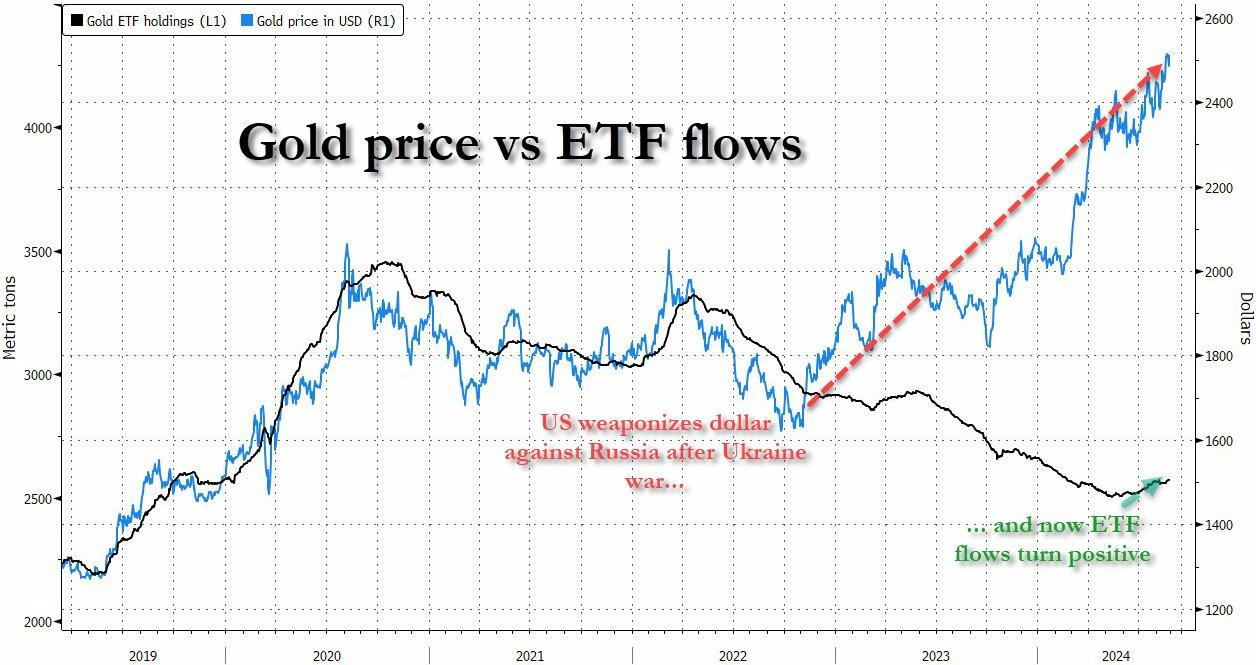

A few months later, and two years after gold ETF holdings continued to drop even as the price of gold rose, it finally happened: attempts at brute gold price manipulation via shifts in ETF holdings finally ended, and with gold at all time highs, ETF flows finally turned positive, a move which we noted would send gold surging even higher (it did).

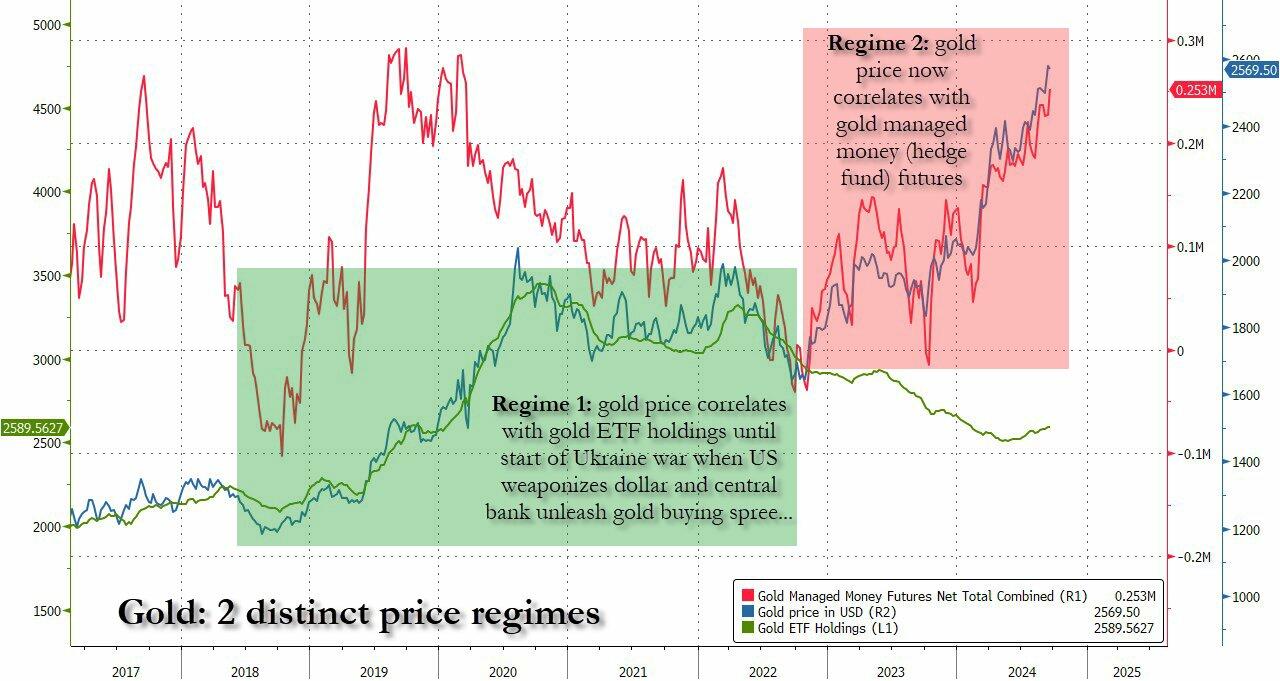

Which brings us to this weekend, and yet another remarkable observation: while gold did correlate very closely with ETF holdings in the years prior to the Ukraine war (regime 1), since then gold has completely lost all correlation with ETF holdings, and instead has been correlating tightly with another data series: Managed Money (i.e., hedge fund) net futures (regime 2).

MORE: