by James___G

Tech giants and beyond are set to spend over $1tn on AI capex in coming years, with so far little to show for it. So, will this large spend ever pay off? MIT’s Daron Acemoglu and GS’ Jim Covello are skeptical, with Acemoglu seeing only limited US economic upside from AI over the next decade and Covello arguing that the technology isn’t designed to solve the complex problems that would justify the costs, which may not decline as many expect. But GS’ Joseph Briggs, Kash Rangan, and Eric Sheridan remain more optimistic about AI’s economic potential and its ability to ultimately generate returns beyond the current “picks and shovels” phase, even if AI’s “killer application” has yet to emerge. And even if it does, we explore whether the current chips shortage (with GS’ Toshiya Hari) and looming power shortage (with Cloverleaf Infrastructure’s Brian Janous) will constrain AI growth. But despite these concerns and constraints, we still see room for the AI theme torun, either because AI starts to deliver on its promise, or because bubbles take a long time to burst.

Interesting discussion from Goldman Sachs on the range of expected returns from the $1tn investment in AI over coming years.

I find the idea that we’re in a valuation bubble quite persuasive (which is not to say I doubt the impact of AI, but rather that I doubt it will be as profitable as current valuations suggest), but keen to hear what others think.

Nvidia Gets Rare Downgrade as Analyst Warns About Future Upside

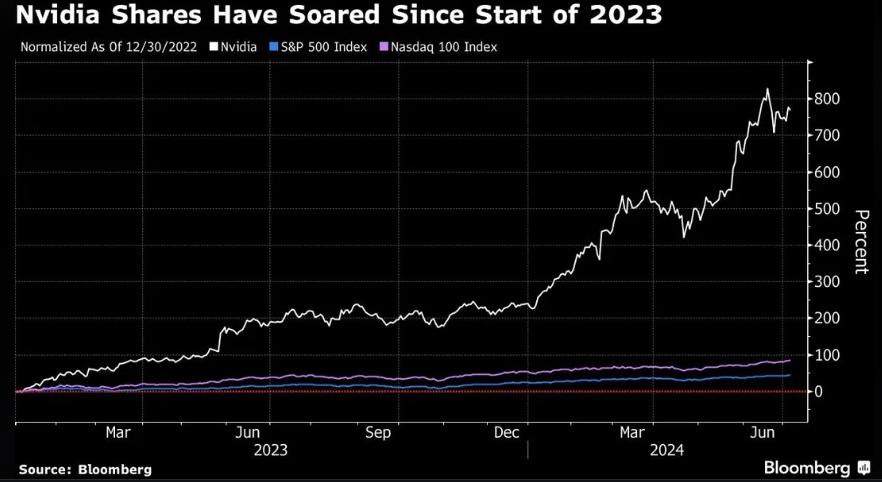

(Bloomberg) — Nvidia Corp.’s (NVDA) breakneck rally since the start of last year has finally run out of room to push higher, according to New Street Research analyst Pierre Ferragu.

Ferragu downgraded the AI-focused chipmaker to neutral from buy, writing that the stock is “getting fully valued” after soaring 154% this year, on top of a gain of almost 240% in 2023. Shares fell 1.9% on Friday, compared with a gain of 1% for the Nasdaq 100 Index.

https://finance.yahoo.com/news/nvidia-gets-rare-downgrade-analyst-155505190.html?.tsrc=fin-notif