…In total, Goldman Sachs has lost a staggering $6 billion pre-tax since the beginning of 2020 “on a big chunk of its consumer-lending businesses, including its credit cards”, a sad confirmation of our 2018 warning. Several factors contribute to Goldman’s massive losses associated with Apple Card, including lax underwriting standards and the resulting charge-off rates that are nearly double those of other credit cards.

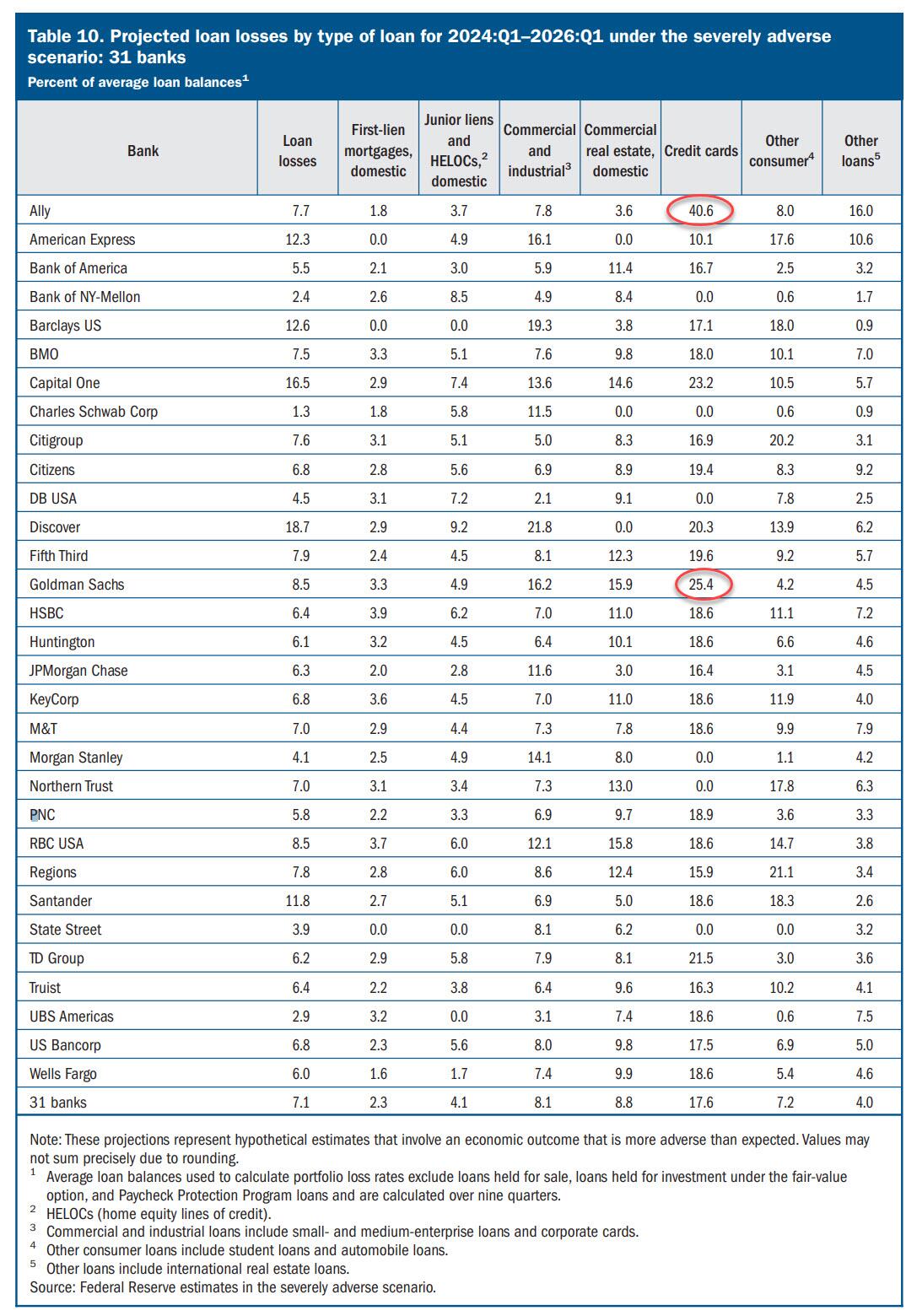

In fact the latest Fed stress test revealed that Goldman – the former master of the universe – now has the second crappiest, subprimiest credit card portfolio of all US banks; only Ally bank, whose stock got absolutely crushed last week, is worse.

In the years ahead of the covid crisis, Goldman had planned to its Apple Card to bolster the bank’s efforts and expand into consumer banking. However, in the intervening years, the bank – which had exactly zero previous experience with consumer lending – bank began pivoting away from consumer-financing in 2022 after accumulating staggering losses, focusing its attention on its core strength: catering to big business and ultrarich clients.