Citi: pic.twitter.com/qRIJKv8LZt

— The Coastal Journal (@1CoastalJournal) September 9, 2024

Goldman Sachs to post $400 million hit to third-quarter results as it unwinds consumer business

- Goldman Sachs will post a roughly $400 million pretax hit to third-quarter results as the bank continues to unwind its ill-fated consumer business.

- CEO David Solomon said Monday at a conference that by unloading Goldman’s GM Card business, as well as a separate portfolio of loans, the bank would post a hit to revenues next month.

- Solomon also said trading revenue for the quarter was headed for a 10% decline because of a tough year-over-year comparison and difficult trading conditions in August for fixed-income markets.

Dollar General, $DG, has said poorer US consumers are running out of money.

It's stock is down 30% over the last month. pic.twitter.com/DFJ7zLhzs3

— unusual_whales (@unusual_whales) September 9, 2024

Rich vs. Poor

Ferrari vs. Dollar General

Bifurcated Economy pic.twitter.com/MIvYyiMN5s

— Win Smart, CFA (@WinfieldSmart) September 9, 2024

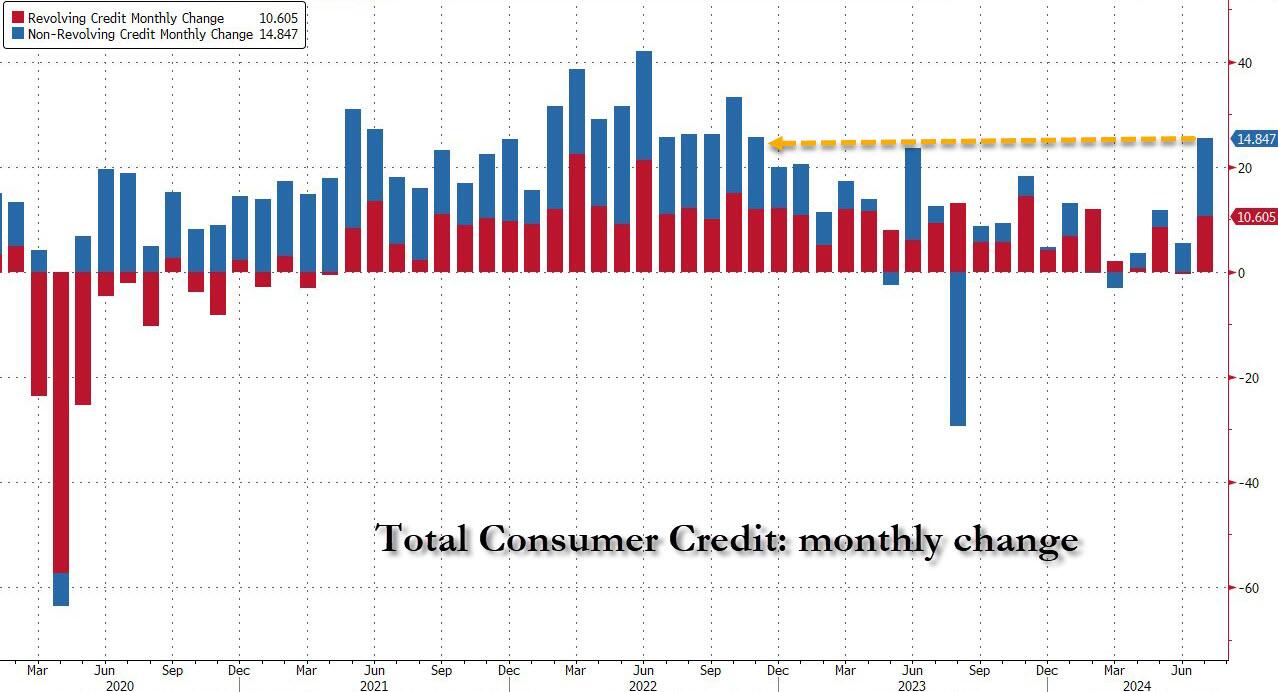

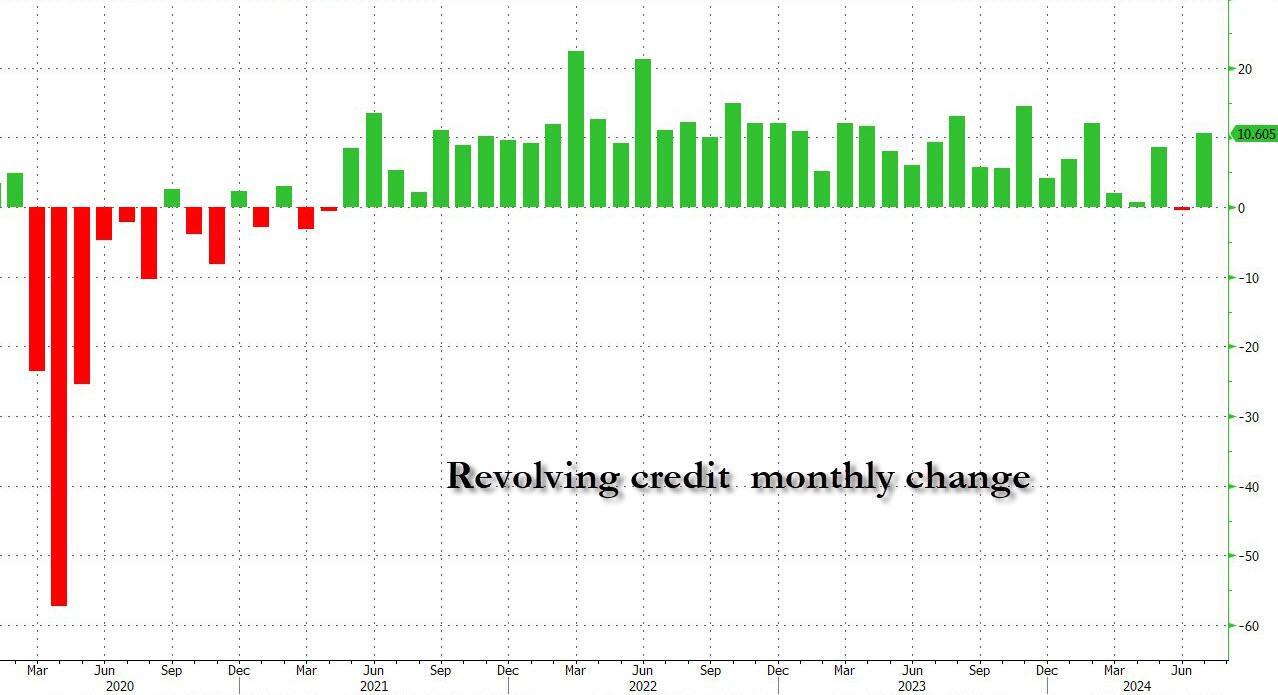

One month ago, when multiple discount retailers (here and here) were lamenting the sudden collapse in US consumer purchasing power, we observed the reason this unexpected hit to US consumption: as the US personal savings rate had collapsed, the growth in consumer credit was slowing, and in July, credit card debt growth posted its first decline since the covid crash, just in time for another month of record high credit card rates.

But fast forwarding just one month later, when in a stunning reversal, July consumer credit growth unexpectedly reversed the dramatic June slowdown, and soared more than $25 billion, to a new record high of $5.093 trillion.

Looking at the components, the sudden spike in revolving credit was most notable as credit card debt growth suddenly reversed its recent slowdown, surging by $10.6 billion, the biggest monthly increase since February and the 2nd biggest of the year.