Income inequality has surged to levels not witnessed in over a century, prompting discussions on its broader societal implications. Rising inflation expectations have raised questions about the stability of purchasing power, leading to a heightened focus on potential actions by the Federal Reserve to address economic conditions.

There is a potential disconnect between perceived and actual wealth, with a cautionary note about the need for realistic assessments. Regional dynamics, particularly in Florida, are expected to play a pivotal role in upcoming economic trends, possibly tied to supply considerations.

Gold’s trajectory, nearing the $2000 mark, is attributed to a combination of factors, including the weakening U.S. dollar, falling yields, and geopolitical conflicts in Ukraine and the Middle East. Beyond these immediate drivers, gold’s long-term appeal is reinforced by three key secular forces: mounting U.S. government debt, unpredictable inflation, and increasing economic volatility.

In essence, the provided information paints a picture of a complex economic landscape, with interconnected factors shaping the current scenario and influencing future trends. The dynamics encompass socio-economic challenges, monetary policy considerations, regional variations, and the enduring appeal of precious metals in times of economic uncertainty.

Sources:

Income inequality in America recently hit the highest levels seen in more than a century

Let that sink in pic.twitter.com/2NionC1pyP

— Game of Trades (@GameofTrades_) November 26, 2023

believe it or not but the Fed is het to do something…@dailychartbook pic.twitter.com/isa2wS2m9O

— The Market Dog (@TheMarketDog) November 24, 2023

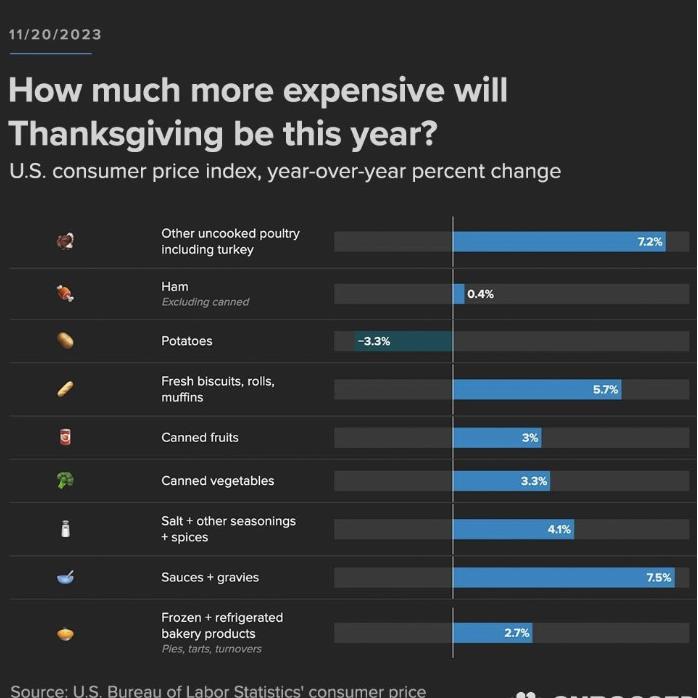

Where inflation is the highest, this Thanksgiving:

Affordability always mattered.

It’s just that we are all a bit delusional about how wealthy we really are.

Supply incoming. And all eyes should turn to Florida for what’s next. https://t.co/gxR37aZCbT

— Melody Wright (@m3_melody) November 26, 2023

LOL:

President Biden: I’m determined to put an end to trickle-down economics. I look at the economy through the eyes of the people I grew up with in Scranton and Claymont

pic.twitter.com/Hcpyh4rIO0— Win Smart, CFA (@WinfieldSmart) November 26, 2023

Gold is steadily approaching the $2000 threshold, primarily driven by:

– USD declining

– Yields falling

– Dual geopolitic conflict (Ukraine & Middle East)Moreover, Gold has 3 key secular forces that make it attractive for the long-term:

– Rising US government debt

– Inflation… pic.twitter.com/X3FydHSrPi— Game of Trades (@GameofTrades_) November 26, 2023

Target is running Black Friday deals that are 100% fake. Zero change in price. Don't be fooled by the scheme.

Are there any real Black Friday deals? Or are all of the stores doing this?

🔊 … listen and watch pic.twitter.com/5hfwwU7pcR

— Wall Street Silver (@WallStreetSilv) November 25, 2023

Just when you thought Black Friday couldn’t possibly be any more dystopian… pic.twitter.com/TvMypZ4can

— Amy Nixon (@texasrunnerDFW) November 26, 2023

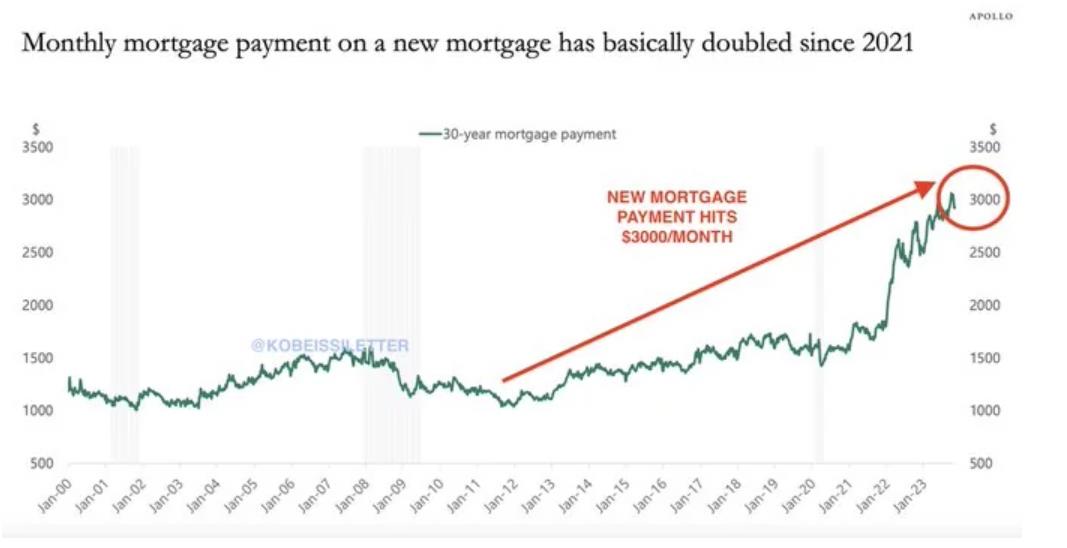

The monthly payment on a new mortgage has DOUBLED since January 2021. We in a housing affordability is crisis.

Are We About to Repeat the Lost Decade of the 1970s?

During the 1970s gold went up 15-fold, even faster than oil. Silver went up 8-fold. The U.S. economy’s current state of high inflation and slow growth mirrors the 1970s’ stagflation, but with much higher national and private debt today. This situation limits the Federal Reserve’s ability to aggressively combat inflation without triggering a financial crisis. In this context, investing in gold becomes a prudent strategy, as it has historically maintained value during periods of economic uncertainty and inflation.