The French poet, Arthur Rimbaud famously wrote that “Nothing is true.”

Hmmm.

Fairly sensational, no?

Deciphering the nuance behind such poetic phrases is almost as difficult as deciphering the meaning behind so many political (and hence central banking) phrases.

Reality Amidst Fantasy: Putin Speaks

Of course, not everything is a lie—but in the backdrop of a now openly discredited legacy media and the growing swells of mis-information, dis-information and mal-information, one has to be selective in sifting through pounds of fantasy for an ounce reality.

Recent headlines regarding the Carlson/Putin interview, for example, will draw passionate reaction, commentary and bias depending largely upon whether or not one views Putin as Hitler 2.0 or a Realpolitik pragmatist, Zelenskyy as George Washington reborn or a puppet thespian, or Tucker Carlson as a media lightweight or awe-shucks truth seeker.

Nothing we say here will change such personal biases floating above a cesspool of politicized and weaponized tricks and messages, from the DOJ to the WSJ, or the FOMC to NYT.

Stick to the Math

That is why math and factual data, far more than prompt-readers, sell-side bankers and power-prioritized politicos offer the safest lighthouse in the current financial and geopolitical fog.

So, let’s stick to math and facts and let us/you be our/your own judges.

Putin Getting Cheeky?

Putin, for example, wondered out loud why the US is spending billions in an avoidable war protecting its Ukrainian satellite nation despite its own country drowning in over 33 (in fact 34) trillion in public debt, a clear immigration disaster on its southern border and undeniable signs of de-dollarization as China and Russia, along with a whole lot of BRICS+ nations, move gradually away from the Greenback.

He also made a few sly, and potentially prophetic observations about the slow demise of the petrodollar, a theme we’ve addressed many times.

Was this just dis-information? Pro-Russian propaganda and hence more biased lies?

You can decide for yourselves.

Putin is no angel, after all, but that doesn’t mean he’s stupid, and when it comes to certain mathematical facts, he does have a few points worth considering…

Debt Matters

When it comes to US national debt (now over 120% of its GDP), we and many others, have been openly warning for years that it’s not only a national embarrassment (and managerial sin), but that such abstract trillions of debt are also mathematical deterrents to genuine (rather than debt-based) “growth.”

After all, debt-based “growth” is not actual growth, it’s just more debt—akin to giving teenage frat boys a credit card to party every semester while ignoring the subsequent invoice until graduation…

We’ve also reminded that the war on inflation, which Powell famously described as “transitory,” is not only far from over, but that its worst battle wounds (i.e., inflation pains) are yet to come.

In plain speak, Powell needs inflation and a debased dollar (via inevitable rate cuts and more mouse-clicked trillions, i.e., QE to the moon) to pay for (and inflate away) not only Uncle Sam’s rising, and embarrassing public debt, but the trillions more in unfunded liabilities off the public balance sheet.

Caught in this fatal undertow of debt, the Fed, and hence the US economy and dollar, is now openly trapped, and whatever one thinks of Putin, he knows this to be true.

Powell’s “higher-for-longer” rate hikes since 2022 were indeed dis-inflationary, but they also strengthened the USD, crushed bond prices and sent bond yields too high (and too costly) for foreigners holding over $13T in debt obligations pegged to those rising yields.

This forced foreigners to sell large chunks of their $7.6T in USTs to come up with the cash (i.e., USDs) to pay their dollar-denominated debts.

The net result was an increasingly disorderly bond market as the USD and yields rose while bond prices tanked, which only added more depth to US deficits (fiscal dominance), more pain to small businesses, more interest expense for Uncle Sam, tighter lending at the banks and increasing IOU issuance (i.e., more debt) from the US of A.

The Big Rub

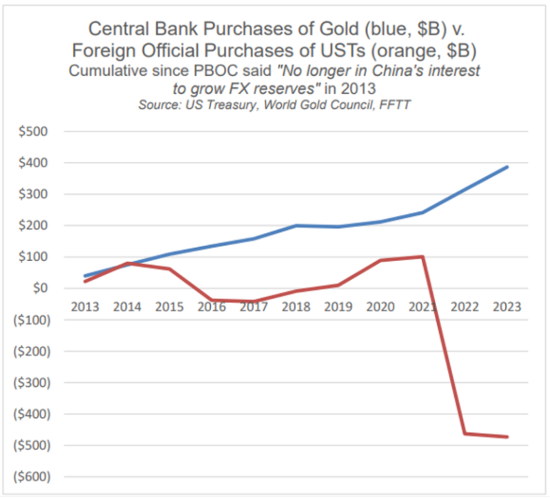

But here’s the rub—and it’s a BIG RUB: No one wants those IOU’s. (They prefer gold.)

Trust in American debt just aint what it used to be, and faith in that weaponized USD (as we warned since 2022) is fading—slowly, yes, but surely.

Recently, Jay Martin, Andy Schechtman, Grant Willaims and myself knew this; central banks know this, and not surprisingly, even that clever and hated/loved Mr. Putin knows this…

Thus, unless Uncle Sam wants to default on its debt (aint gonna happen) or allow a UST auction to fail (aint gonna happen), the only realistic option for more needed dollar liquidity (short of a Bretton Woods 2.0) is going to boil down to more synthetic liquidity, first from the repo markets and Treasury General Account (as seen in Sept of 2019 and 2022, and in March and October of 2023) and finally, from QE to the moon (as seen in March of 2020).

As for when the bow breaks and “Super QE” kicks in (and the USD falls and inflation once again rips), don’t ask me for a date, as NO ONE knows—but it’s coming, and at a faster pace than even Putin thinks…

Where the Rubber Meets the Road for Investors

So, what does all this debt, bond, currency and Fed disfunction mean for YOU, the markets and your fiat money?

Well, a helluva lot.

As for Main Street, the suffering, as I’ve shown and argued many times, is as loud and clear as Oliver Anthony’s guitar.

Stated simply—the middle class is already screwed.

Stocks, Gold, BTC and Bonds

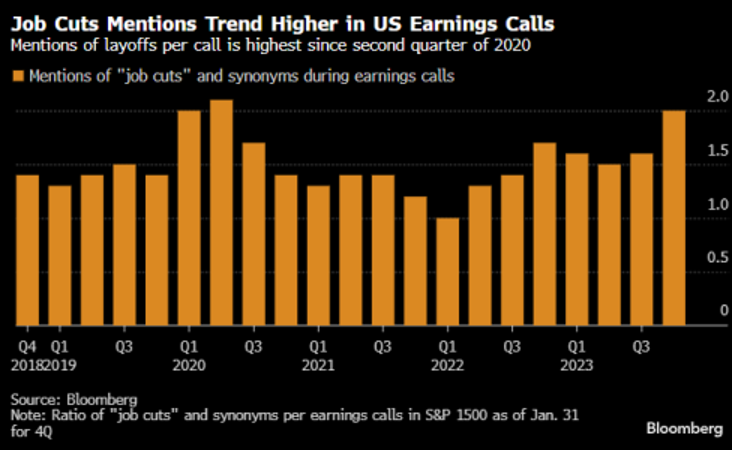

Job cuts are objectively trending up, which ironically boosts earnings for companies with less over-head due to, well less employees…

Full-time employment has tanked by 1.4 million Americans in the past 3 months at a pace rarely seen in US history while politicians are bragging about GDP growth.

But, and to repeat, that GDP “growth” is coming from deficit spending (deficit to GDP at 8%), not a robust Main Street.

Think about that a second.

In the near-term, these disfunctions, lay-offs, lower-rate projections by the Fed and embarrassing debt levels are actually bullish for equities, a point which seemed to shock one of my recent interviewers.

Be Careful You Near-Term Dragon Slayers

But tread carefully in this so-called “bull market” of new stock highs, as there’s a great deal of comical rot beneath its rising wings.

Notwithstanding a 2024 market opening of all-time highs marked by extreme volatility, short-earnings momentum and AI mis-pricings reminiscent of the dot.com mania, the market is dangerously narrow—lead by Amazon, Microsoft, Nvidia and META.

The fact that Microsoft is bigger than the French GDP has me wondering about my anti-trust books in law school as well the definition of corporatism in the annals of fascism… As warned elsewhere, what I see is more akin to feudalism not free-market capitalism.

Meanwhile, in the span of 30 days, Nvidia has become another Tesla in terms of market cap, with mind-numbing factor pair moves (i.e., price to value mismatches). The signals we are seeing look almost identical to 1998-2000, 2006-08 and 1970-73, circumstances which ended “with blood in the streets.”

Just saying…

Longer Term Wisdom

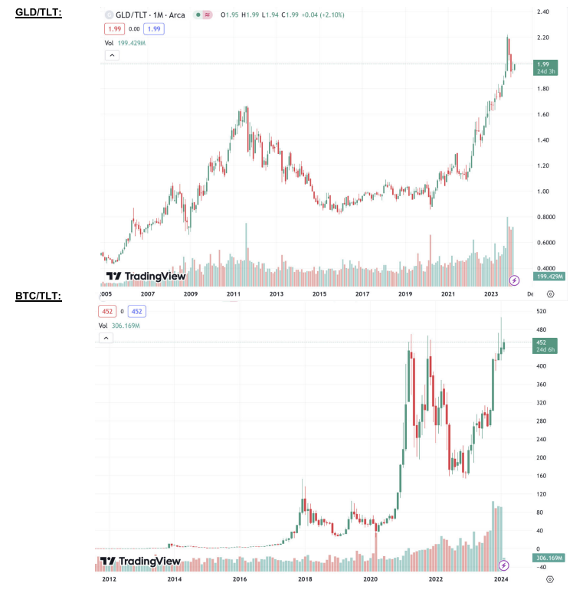

Longer-term investors tend to be more prudent than short-term speculators. They see the broader debt (and death) spiral of the US currency and IOU (measured by the US sovereign bond index, or TLT).

The growing performance of the GLD/TLT, BTC/GLD and SPX/TLT ratios (i.e., gold, Bitcoin and S&P outperforming the US10Y bond), for example, is fairly clear evidence that the markets are seeing what we have been warning, namely: Cash and bonds are no longer a “safe haven” in a nation on its knees in debt and a debased dollar.

Gold Matters

Of course, our bias, and more importantly, our conviction in a world wherein currency debasement is effectively inevitable and already in play regardless of relative strength comedies, is to protect your wealth in the best currency debasement asset history has ever known: Gold.

As for gold, I recently reminded that among the many foreseeable consequences of the stupid idea of weaponizing the USD to “hurt” Putin was the slow but equally inevitable move from Western to Eastern gold repricing, which is just another way of saying “fairer repricing.”

In short, fundamentals are slowly returning to a once completely price-fixed NY and London based gold market.

The SGE Matters

That is, as more nations are moving away from the weaponized USD and net-settling their trade deltas in gold rather than greenbacks (a fact which Putin, love him or hate, coyly reminded Tucker Carlson), the Shanghai Gold Exchange (SGE) is getting busier by the day converting Rubbles, CNY and other currencies into gold to settle trade imbalances outside USD circles.

Premiums on the SGE, as well as pricing of the metal, are moving from West to East.

At some point, the 200-day moving averages in the gold price set on exchanges in London and New York will have to mirror rather than ignore what’s happening in the increasingly more popular Chinese exchange.

And speaking of the SGE, big things are happening right before our eyes.

Gold Withdrawals—Scary or Bullish?

Specifically, the SGE just saw 271 tons of gold withdrawals in a single month, the largest amount seen in 10 years.

Is that not bad for gold? Is it not akin to a “run on the [gold] bank”?

Actually, it’s the very opposite.

First, this move openly signals that Chinese investors trust gold more than their stock and real estate portfolios, something American investors have been slower to realize—often until it’s too late.

But in the US, gold held in ETF’s (which is not a smart place to “own” gold…) is also seeing big withdrawals at the same time the Spot price has been surging rather than falling.

Such Western gold ETF sell-offs occurred before in 2015 and 2013, and it drove the gold price down—not because investors hated it, but because the LBMA banks in London needed more of it.

This time, however, as ETF withdrawals increase, the gold price is going up.

Hmmm.

Why the new direction?

How the West Mistakenly Created a New Gold/Oil Order

Well, it has a lot to do with what we’ve been saying about the SGE.

Unlike 2013, the world now has an increasingly powerful Yuan-driven gold exchange as well as a Yuan-driven oil contract (with, among others, Russia…).

This creates a Yuan-based gold/oil ratio, as we predicted from Day 1 of the back-firing Putin sanctions, and this ratio is competing with the USD-based gold/oil ratio.

Again, and we can’t repeat this enough: Weaponizing the USD against Putin in Q1 of 2022 was a watershed momentin global currency (and hence oil, gold and other commodity markets).

Why?

Because it brought two major powers (Russia & China) closer in geopolitical and financial alignment, along with a growing list of eager BRICS+ nations now making bi-lateral trade deals outside the USD.

Don’t believe us or our warnings two years back? Well: See for yourself, here.

We also said this process would be slow, rather than overnight, but even we are amazed by the speed and scope of these market changes.

Given that global markets will not tolerate two-prices and two-markets for gold and oil, it is our contention (as well as Luke Gromen’s) that “the USD gold/oil ratio must remain the same as the CNY gold/oil ratio.”

The West Forced to Acknowledge Gold’s Monetary Role

As Gromen further argues, and I agree, this means that if the USD price of gold were to crash, then USD oil prices would have to crash along side the gold price, which would “crush” US shale production and “effectively cede the global oil market to Russia and Saudi.”

This makes the US nervous. More importantly, it will force some changes…

Stated more simply (and ironically), thanks to the knee-jerk Western sanctions against Putin, the West now and unwittingly has a vested interest in keeping gold more fairly priced as a primary net reserve asset for commodity and energy trade deltas/imbalances.

After all, the USA can’t simply ignore what the rest of the world is doing with gold and oil.

This, of course, creates even more ironies and more challenges for the openly cornered US.

For example, everyone in DC and Wall Street knows the open secret that a rising gold price, as well as a rising gold role in international trade, is an open insult and embarrassment to an increasingly unloved, debased and mouse-clicked fiat USD.

It’s also an open embarrassment to years of central bank mismanagement of the USD.

But now the West in general, and the US in particular, can no longer ignore the golden elephant in the room nor openly ignore (and quietly manipulate) the gold price.

The East, in short, is now reminding the world, and the West, that in a world of increasingly crappy paper dollars, money-printing and debt gone wild: Gold matters.

It really matters.

Fork in the Road

This means the US-led west will have to face realities about its currency and debt markets, as well as its society and Main Street.

Putin, whether trusted or untrusted, has suggested peace and more cooperation.

Does our power-thirsty and Pentagon-led DC, so openly disconnected from its citizens and once credible State Department, seek the same?

Or will DC simply do what Hemingway warned, and drag us further into wars and a debased Dollar in your wallet?

We shall see…