Central banks globally bought 337 tons of gold in Q3 2023, part of a broader trend. China, the top global gold producer, purchased 181 tons during the first nine months of 2023, contributing to a total of 800 tons acquired by central banks worldwide. This aligns with China’s strategy to reduce its reliance on the U.S. dollar and hedge against potential sanctions, mirroring Russia and Iran.

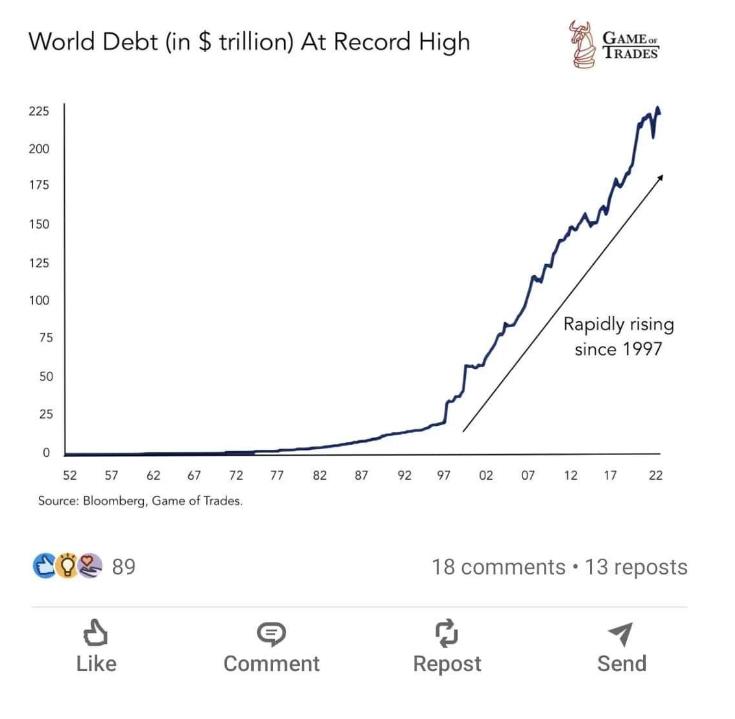

The U.S. national debt has surpassed $33 trillion, forcing the government to issue an excess of Treasury securities. This oversupply has raised interest rates, impacting the economy and intensifying financial market pressures. With a fiscal deficit reaching $2 trillion in 2023 and the announcement of a $1 trillion borrowing plan for a single quarter, finding a credible solution for managing the growing debt remains elusive.

Currency value is shaped by supply and demand dynamics, influenced by central banks’ impact on short-term interest rates. Slower economic growth over the last 30 years has affected the equilibrium between savings and investment, impacting fiat currency stability.

Rising long-term borrowing costs create turmoil in bond markets, pressuring governments and limiting their crisis response capabilities. With government bond yields rising, it is estimated that G7 countries could collectively face interest costs of up to $1.5 trillion by 2026. Central banks shift from quantitative easing to tightening, and with substantial government debt refinancing, the cost of servicing debt escalates, intensifying fiscal stability concerns among global governments.

China Massively Stockpiling The Worlds Gold

Amid Global Unrest Central Bank Gold Demand Swells in Q3

The National Debt Is Finally a Real-Global Problem

Glut of US Debt Results in Scarcity of Treasury Buyers

The Price of Fiat Currency Is Going Up, and It’s Not Only Because of the Fed

Bond Market Turmoil Triggers Fiscal Alarm Among Global Governments

World Debt