Global crypto funds just recorded 3 consecutive weeks of outflows for the first time ever.

Over the last 3weeks, total crypto fund outflows were $767 million.

Last week alone, ~$435 million of crypto assets were removed from these funds, the most since late March.

The majority… pic.twitter.com/ltVY6gce2K

— The Kobeissi Letter (@KobeissiLetter) April 29, 2024

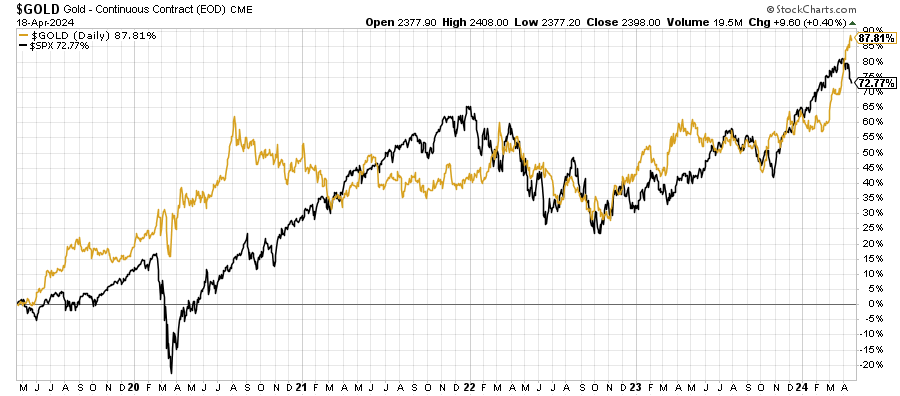

Gold has been experiencing one of the most remarkable performances in history. The so-called barbarous relic is up by more than 15% year to date. By comparison, the S&P 500 rose by only 5% during this time. When looking at a more favorable period for stocks, since the October 30 low, gold is up almost 20% and the S&P 500 is up by 22%. Finally, over the last five years, the yellow metal (gold line) has returned almost 88% versus the 73% return of the S&P 500 (black line). This is truly unheard of.

While most of the mainstream financial media has been excited that stocks have been rising, in the meantime gold prices have been quietly outperforming the most popular stock index in the world. And this is all despite rising real (adjusted for inflation) interest rates and the US dollar.

https://globalmarketsinvestor.substack.com/p/whats-next-for-gold