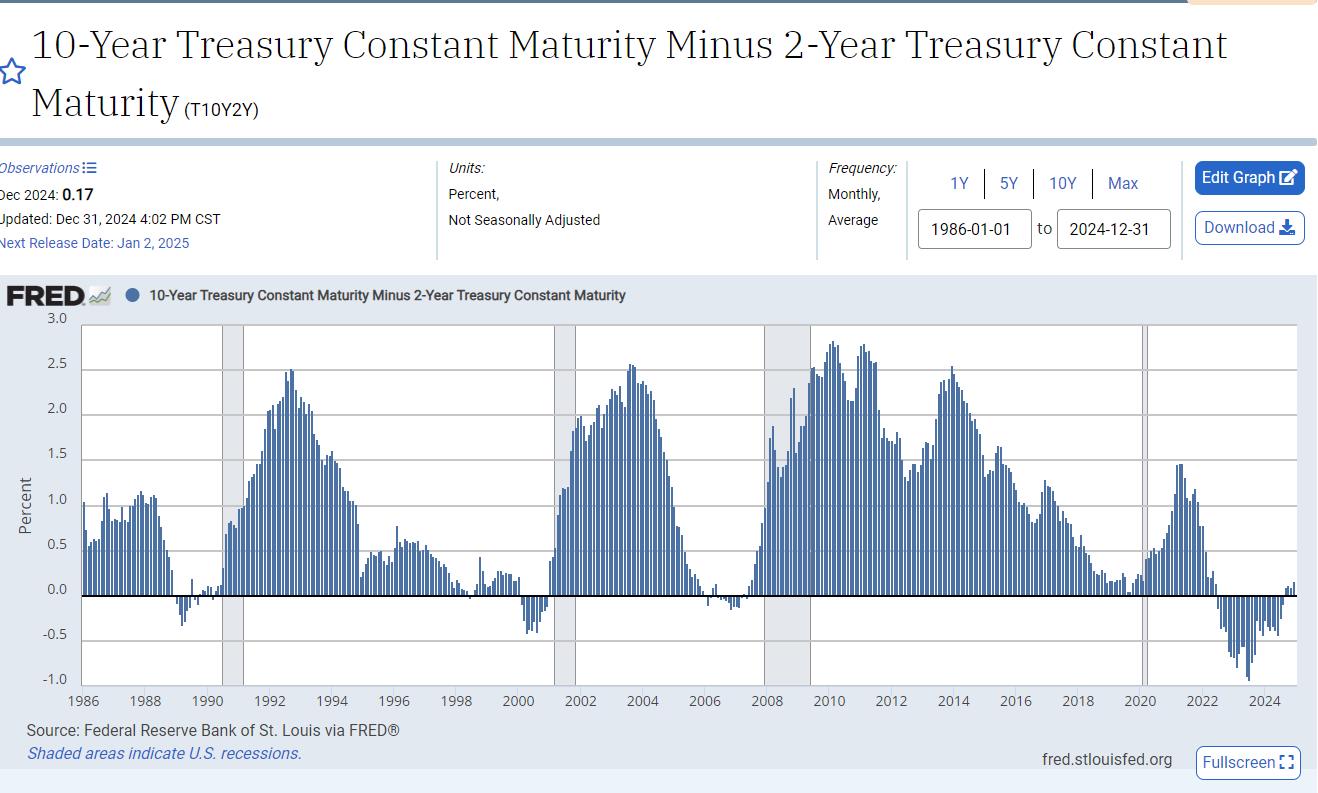

History suggests the recent uninversion of the 10y-2y chart portends a recession to begin soon….

https://fred.stlouisfed.org/graph/?g=1CyYI

Rest of world going down fast as we speak. look under your desk. will drag US down. decoupling is fantasy.

The government funded distractions always hit when they're about to crash markets

— Financelot (@FinanceLancelot) January 2, 2025

Locals shouldn’t be surprised by this. #MacroEdge https://t.co/B5qMHW1o7Z pic.twitter.com/vEoxJAg1hA

— Don Johnson (@DonMiami3) January 1, 2025

Only 19% of S&P 500 $SPX stocks are trading above their 50-Day moving average, the fewest since Halloween 2023 pic.twitter.com/W4xemgwaL1

— Barchart (@Barchart) January 2, 2025

Homebuilding stocks are a good leading indicator of the stock market

They’ve been declining, despite the bounce in the S&P 500

Indicating that the market weakness might not be over yet pic.twitter.com/OPn4UKC4VF

— Bravos Research (@bravosresearch) January 2, 2025

Ignore this at your own risk 👉 Treasury market dynamics like these (10Y-3M spread flipping positive as the 2Y rate drops sharply) have never ended well.

2025’s blind optimism is a gamble.

Doesn’t mean you need to sell the farm tomorrow but something to keep an eye on. pic.twitter.com/ZcJwZQYyE2

— Kurt S. Altrichter, CRPS® (@kurtsaltrichter) January 1, 2025

I am long term bullish, but the US #stocks bubble inevitably bursting at some point will inevitably impact everything worldwide opening up a generational buying opportunity in the right #stocks and assets https://t.co/6F8t31LXfQ

— JustDario 🏊♂️ (@DarioCpx) January 2, 2025

"If these ratios begin to decline from here, it's a clear signal to adopt a more cautious approach and reduce exposure to risk assets … [if they] break out above their previous highs, it would indicate strong confirmation that the bull market has room to run."

Alf pic.twitter.com/Q1KrdwxXP1

— Win Smart, CFA (@WinfieldSmart) January 2, 2025

BREAKING: US households' allocation to stocks as a percentage of financial assets rose to 43.4% in Q3 2024, an all-time high.

This percentage has surpassed the previous record of 41.7% set in Q4 2021, according to the Fed data.

Households’ stock allocation is now even higher… pic.twitter.com/uxmJkw84kh

— The Kobeissi Letter (@KobeissiLetter) January 2, 2025

The US manufacturing sector is in a recession pic.twitter.com/XxqYsZcZNE

— Win Smart, CFA (@WinfieldSmart) January 2, 2025

Office CMBS Delinquency Rate Spikes to a Record 11%, Blowing by the Financial Crisis Peak

h/t mark000

100 views