The recent downgrade of France’s debt rating to negative by Moody’s has sent shockwaves through Europe, reigniting fears of a potential debt crisis reminiscent of the turmoil seen in previous years. The term “EU debt crisis 2.0” is now being thrown around, warning that the continent might once again grapple with severe financial instability.

While France’s fiscal health raises alarms, it’s essential to recognize that it’s not alone in its struggles. Countries like Italy and Greece also face high debt levels and persistent economic challenges. These widespread issues suggest that the entire region may be on shaky ground, making the overall economic and political climate crucial in determining if a new crisis is on the horizon.

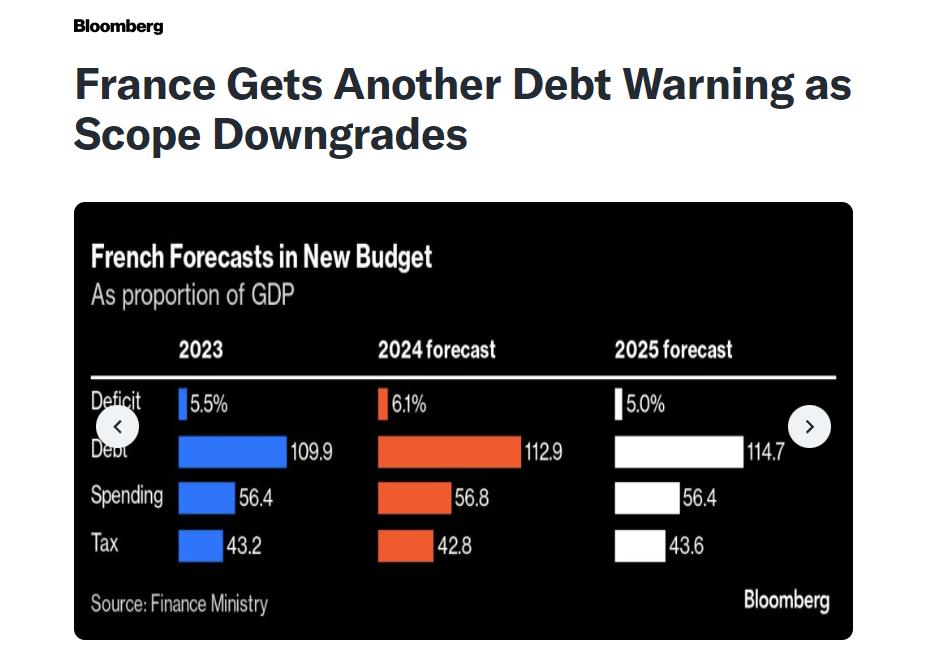

Moody’s cited increasing risks that the French government may not effectively implement measures to combat sustained budget deficits or manage deteriorating debt affordability. Such concerns could lead to more downgrades across Europe, with countries like Italy, Spain, and Belgium also at risk due to their substantial debt burdens.

Unfunded liabilities, particularly pension obligations, compound these issues, presenting significant risks for nations like France, Italy, and Spain. If not managed properly, these liabilities can severely impact a country’s credit rating, adding to the looming financial anxiety.

As the continent faces these mounting pressures, the potential for widespread downgrades and a renewed crisis could disrupt markets and economies across Europe. The ramifications of this situation could be profound, affecting not just France but the entire EU landscape.

Sources: