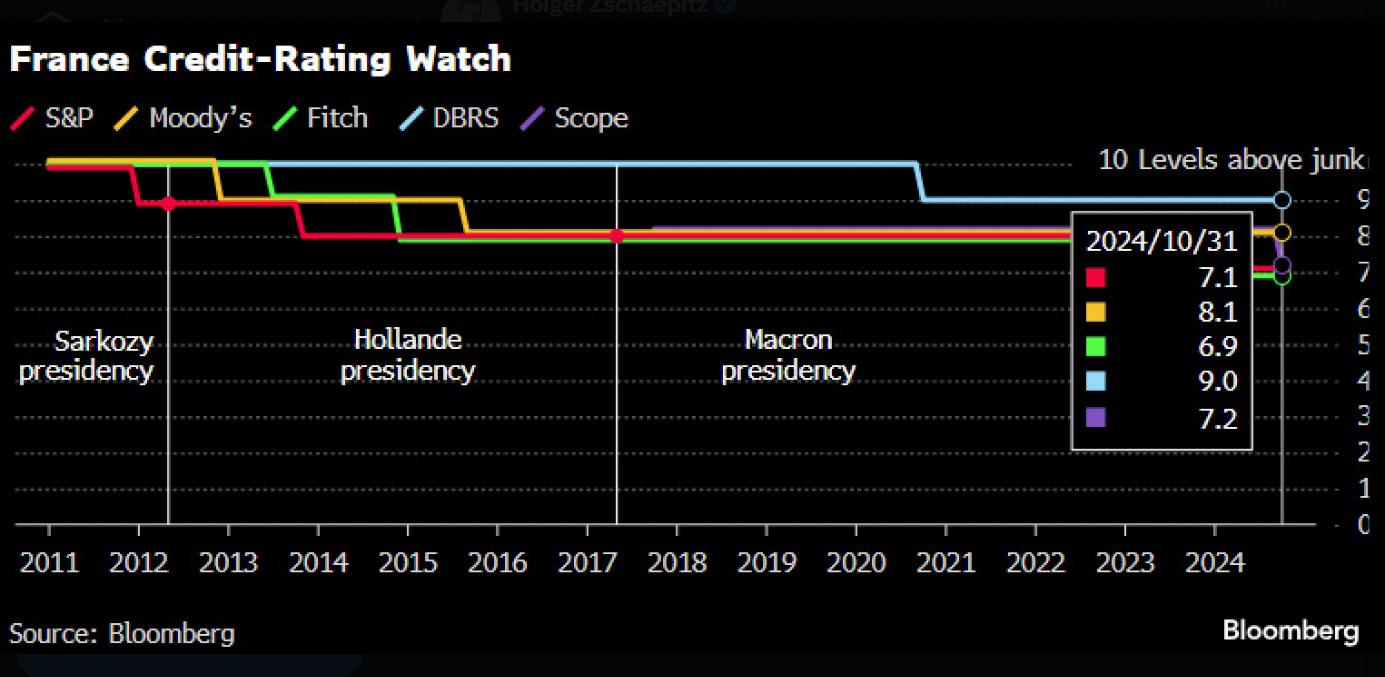

The downgrade is no longer just a warning. On October 18, 2024, Scope Ratings officially lowered France’s long-term credit rating from AA to AA-. This shift, while small on paper, sends shockwaves through both financial markets and government halls, signaling a deepening fiscal crisis.

Public finances are collapsing under the weight of ballooning debt. France’s budget deficit has grown substantially, and public debt is nearing critical levels. Scope Ratings issued this downgrade as a direct consequence of these unsustainable fiscal policies, casting doubt on France’s ability to reverse course.

The problem isn’t just financial—it’s political. France is grappling with deep unrest, as protests and strikes challenge the government’s ability to pass essential reforms. Without these measures, improving revenue and cutting spending seem increasingly out of reach, making it harder for the country to control its spiraling debt.

While Scope Ratings has assigned a stable outlook, suggesting no immediate risk of further downgrades, the situation remains dire. Investors are nervous, and rising interest rates may only deepen the crisis.

France now stands at a financial crossroads. Can the government take the tough measures necessary to pull the nation back from the edge? Or will political paralysis push the economy into deeper chaos?

🇫🇷 #France Gets Another Debt Warning as Scope Downgrades – Bloomberghttps://t.co/0XWJwW5se9 pic.twitter.com/wIWBxcQMcm

— Christophe Barraud🛢🐳 (@C_Barraud) October 19, 2024

#France was downgraded by Scope Ratings in another warning on the state of the country’s finances and the political impediments to containing a ballooning budget deficit. Scope says worsening finances, political outlook warrant cut. Rating firm cuts France to AA- from AA; outlook… pic.twitter.com/wV9qLbyDWs

— Holger Zschaepitz (@Schuldensuehner) October 19, 2024

Government spending in all European countries has been going up, but France really sticks out. Despite highest tax burden in Europe it runs 6% fiscal deficit during good times. What will happen during next recession? Without deep structural reforms France will face a debt crisis. pic.twitter.com/XNN4sy0ByZ

— Michael A. Arouet (@MichaelAArouet) October 12, 2024

Sources: