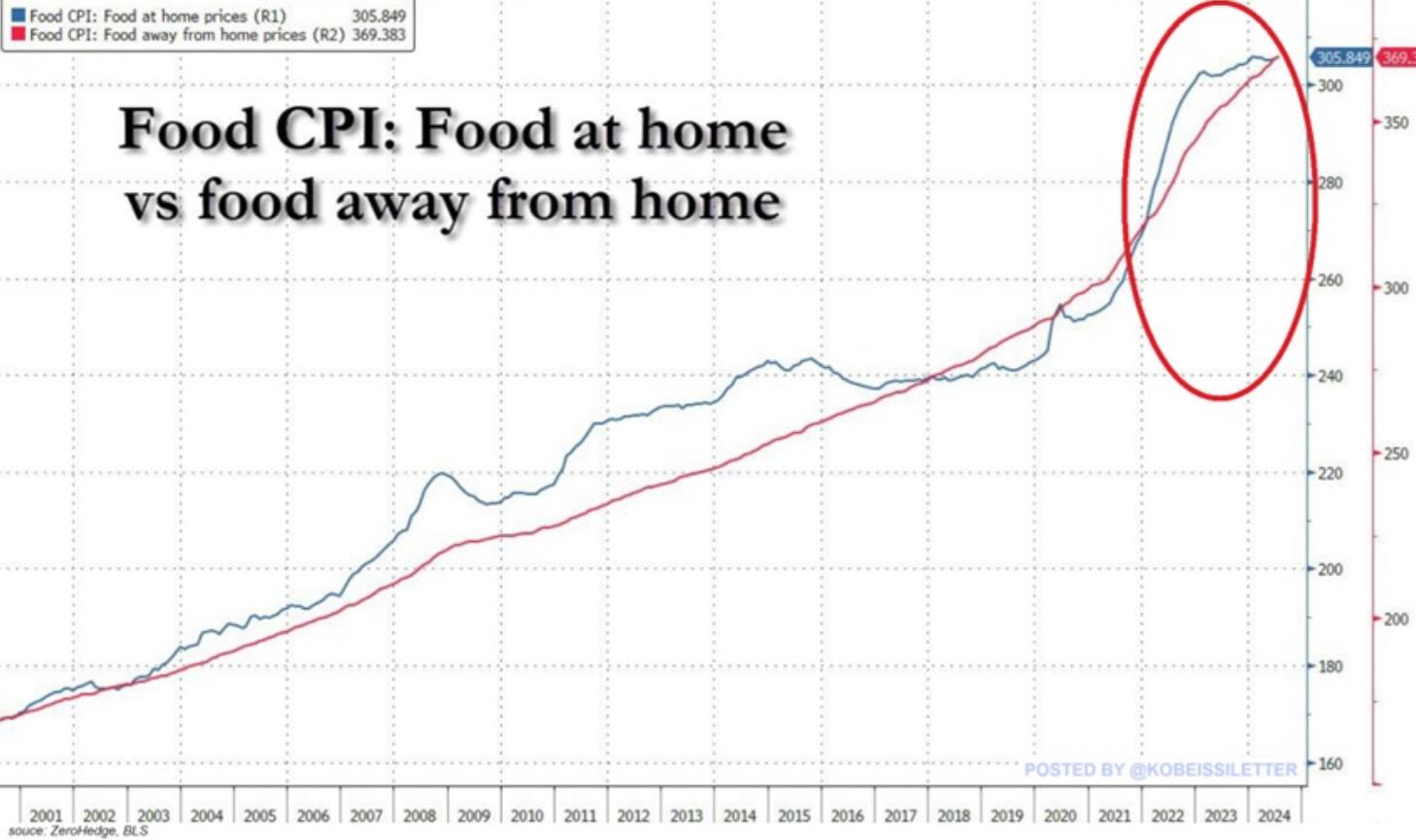

Food prices in the U.S. have just hit a staggering all-time high, fueling an already out-of-control cost-of-living crisis. Over the last decade, the price of food at home has surged by 30%, while the cost of dining out has skyrocketed by an eye-popping 51%. Since 2020, these increases have accelerated, with grocery prices up 22% and restaurant bills climbing by 27%.

But the pain doesn’t stop at the checkout aisle. Transportation and housing costs have both jumped by 27% and 24%, respectively, leaving everyday Americans stretched thin. To make matters worse, the U.S. dollar has lost nearly 25% of its purchasing power in just four short years, all while wage growth has slowed to a crawl. Basic necessities—once taken for granted—are now slipping out of reach for millions.

The housing market offers no refuge either. In June, the typical homebuyer’s down payment hit 18.6% of the purchase price, the highest level in over a decade, up sharply from 15% just a year earlier. It’s no wonder that affordability is collapsing as families struggle to secure even the basics.

In this environment, central banks are scrambling to protect themselves, with gold demand hitting record levels in the first half of the year. As inflation tightens its grip and the economy teeters, many are left asking: How much further can this go before something gives?

Sources:

BREAKING: Food prices in the US reached a new all-time high in July.

Over the last decade, food prices at home and away from home are now up 30% and 51%, respectively.

Since 2020, food prices at home have increased 22% and food prices away from home are up 27%.

At the same… pic.twitter.com/R1IcucZAiC

— The Kobeissi Letter (@KobeissiLetter) September 4, 2024

The typical homebuyer’s down payment was 18.6% of the purchase price in June, the highest level in over a decade and up from 15% a year earlier.

— unusual_whales (@unusual_whales) September 5, 2024

Cut to protect 4.1% unemployment and an average of 175K per month nonfarm payrolls? Nonsense.

— Sold At The Top (@soldatthetop) September 5, 2024

Central bank gold demand in H1 was the highest on

record pic.twitter.com/5f1vcAl2SZ— Win Smart, CFA (@WinfieldSmart) September 3, 2024

Do we really want 4 more years of this? pic.twitter.com/0ai2KXvYn4

— Wall Street Silver (@WallStreetSilv) September 5, 2024

https://www.usinflationcalculator.com/inflation/food-inflation-in-the-united-states/