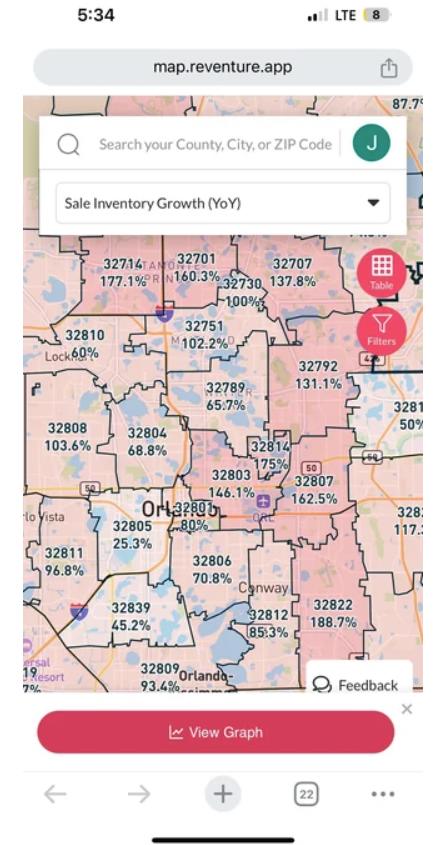

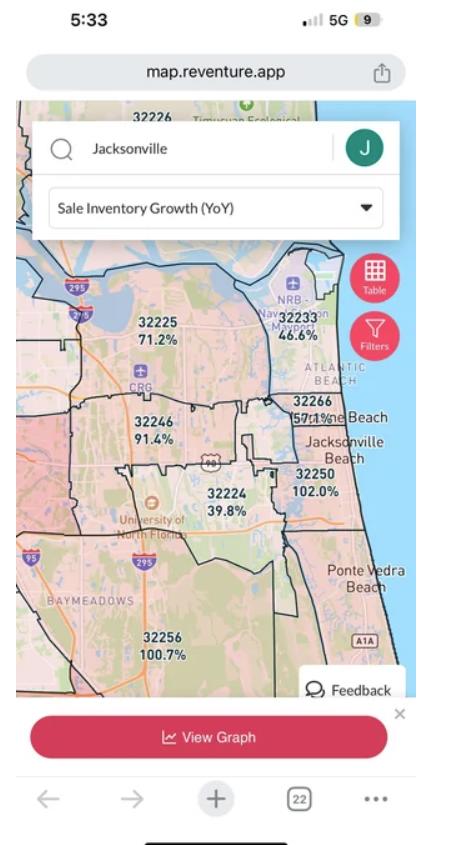

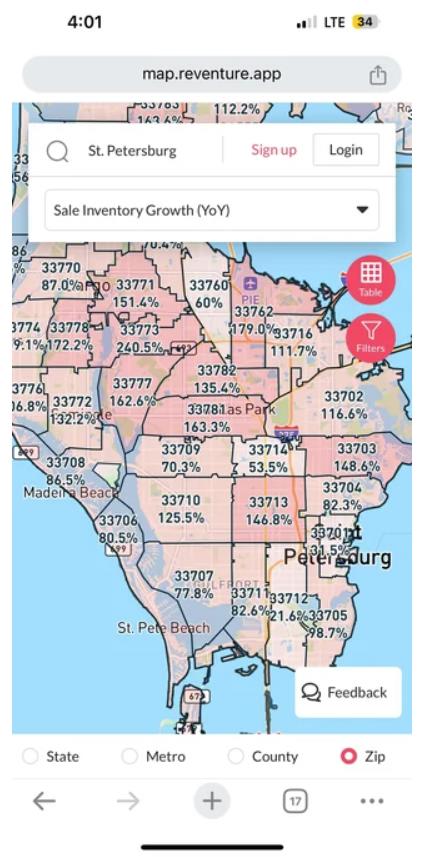

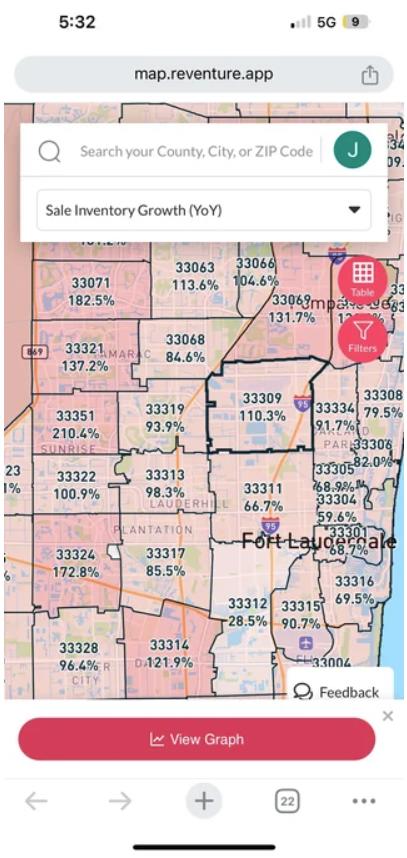

How do we see this type of inventory increases in one year without major price reductions imminent. We need a correction but this one might be extreme. You can’t double inventory, with low demand, and things not correct significantly. Thoughts on what yall are thinking?

Florida is also seeing a lot of private homes insurers drop peoples coverage. Resorting to citizens’ insurance or self coverage. If you lose insurance, you run the risk of foreclosure.

h/t SurfSwordfish