Truth comes only in thin slices like a beam of light.

So, the Fed did exactly as expected here and reduced its likely rate hikes from the three the markets were expecting to just one, likely in December. That, I’ve said, is the best the markets can expect; but I did not say it was the best the stock and bond markets would expect; so the stock market did as can now always be expected of them and fabricated what Powell and the whole FOMC said (ALL FOMC member dot-plots for future interest got raised), and leaped into predicting the Fed would do a lot more than it said and a lot sooner

This is the same old tripping out and flying high on the Fed pivot nonsense, and the markets have been wrong on it every single month for well over a year; but being wrong doesn’t even matter here in balloon world where everything is a financial bubble of epic (balloon) proportions all the time.

While the central bank on Wednesday pushed out the start of rate cuts to perhaps as late as December, markets (and many economists) beg to differ.

I mean, why not cast a perpetually losing bet just because you want it to be so. Bet until you make it so. And so they do for their own asset valuations.

Traders price a roughly 65% chance of a quarter point move in September and more or less fully price in a move by the November meeting — which falls two days after the U.S. presidential election.

In spite of what Powell said or even how he said it, they priced it all back in. Good luck with that actually happening. Just remember, these are largely the same people who priced in cuts for March and then for June and now for ….

The latest inflation numbers offer some explanation as to why the markets are ignoring the Fed’s own take on when a first rate cut is likely to come.

On the way up, they say never fight the Fed, but they have been fighting the Fed all the way down, and they keep winning even though they are wrong on every bet. They mange to jigger prices up anyway with new fantasy beliefs because the whole financial media is lined up to make sure that happens.

The last inflation numbers, if looked at without the fantasy-filter glasses, clearly showed the Fed had made no progress at all on inflation for almost a year. In fact, the last ever-so-slightly lowered month-on-month measure, only took the year-on-year measure to a low that is higher than the whole past year’s sling of sideways bouncing lows, which leaves us with a line that shows rising highs and rising lows. Unless the next reading in CPI goes quite a bit lower, still, “higher highs and higher lows” is actually the definition of a rising trend. It may be rising VERY slowly, but it is rising still.

So, the market is just filtering out the material it needs to fill its hot-air balloon and try to get some more lift for a longer ride. It doesn’t matter that it is all riding out over nothing, so long as you can keep heating the air inside the balloon.

U.S. consumers prices were unexpectedly unchanged in May – a sign that price pressures are easing even if overall annual inflation is still running high at just over 3%.

How is going nowhere a sign that pressures are easing. It’s a sign of nothing easing. Unchanged as in, the hope for disinflation went nowhere. The Fed’s battle, after a pause that is now nearly a year long, is stuck solid, having not moved the inflation rate down over that entire time.

Most economists continued to expect two rate cuts, starting in September, arguing that inflation had turned the corner after surging in the first quarter.

They argue this because it is what they have been arguing throughout 2024, and they can’t admit they were wrong even after this much time and because they work for major investment firms and banks. In my weekend Deeper Dive, I’ll go over the two major forces that are likely going to decide where the battle goes, and one of them, which aided the latest drop can easily add next month’s rise; the other is already in the bag so we can see where it will go (unless, of course, the truth gets adjusted out of what has already happened).

So, world markets — it appears — have chosen to take their cue from the inflation data, released just hours before the Fed’s monetary policy statement, rather than the Fed messaging.

Not only did they ignore all of the inflation data that didn’t show what they wanted, they ignored everything the official FOMC statement said and everything Powell said (who did surprise me by not going more dovish than Fed policy and not undercutting that policy as he has at most past meeting). They cherry-picked the last three inflation reports to avoid seeing that the trend for the last 11 months continues to be decidedly upward in each report.

It is no surprise at all that CNBC reports today:

“S&P 500 posts its fourth straight record close, buoyed by cooler inflation data”

Of course it did.

As I wrote ahead of the Fed’s FOMC meeting summaries yesterday:

Before much is made of today’s CPI report, as much will be made simply because it gave a small nod in the direction that the stock and bond markets both lust for…. [Then I laid out the graph that proves the long upward trend in inflation holds.] We are one month short of a year now in which the Fed has made ZERO progress on inflation…. So, there is much ado about nothing in the markets….

The Fed isn’t going to cut rates until it sees a lot more than a single month that moves in the right direction after a series of many months running the wrong direction, as shown in that graph. They need more than what could be nothing but a head fake … just as so many jobs reports and unemployment numbers have been. So, December is the earliest I can see a cut coming, and that will only be inflation turns back down throughout that time … unless, of course, the Fed completely destroys the economy before then as I’ve always said is the most likely way this mess of fantasy finance ends.

The job blob

In this world of financial balloons, jobs look more like an inflatable blob.

Jobs are likely falling more and unemployment rising more than what the Fed can see because the labor gauges are all broken and smashed to bits for a variety of reasons tha I’ve laid out along the way. Inflation is also dishonestly reported with most of the good news in blips along the way due to massive government “adjustments,” huge lag times in some numbers, and all-out-stupid ways of determining some numbers as I keep reporting along the way when the rigging shows enough to see it. (See, as just one example: “What a Wonderful World: CNBC reports that government unemployment numbers are cooked to perfection!”

The average citizen is not fooled in his or her gut by what the government numbers are falsely proclaiming. They can feel that those claims out of synch with their experience, and that is why they are unhappy with the economy sleepy, creepy Uncle Joe keeps trying to convince them is great. The government is doing its best to gaslight them for the election. However, all along the way, I try to present little windows where you can see through to the truth.

Zero Hedge, for example, asks today,

Did we suddenly get a peek at economic reality?

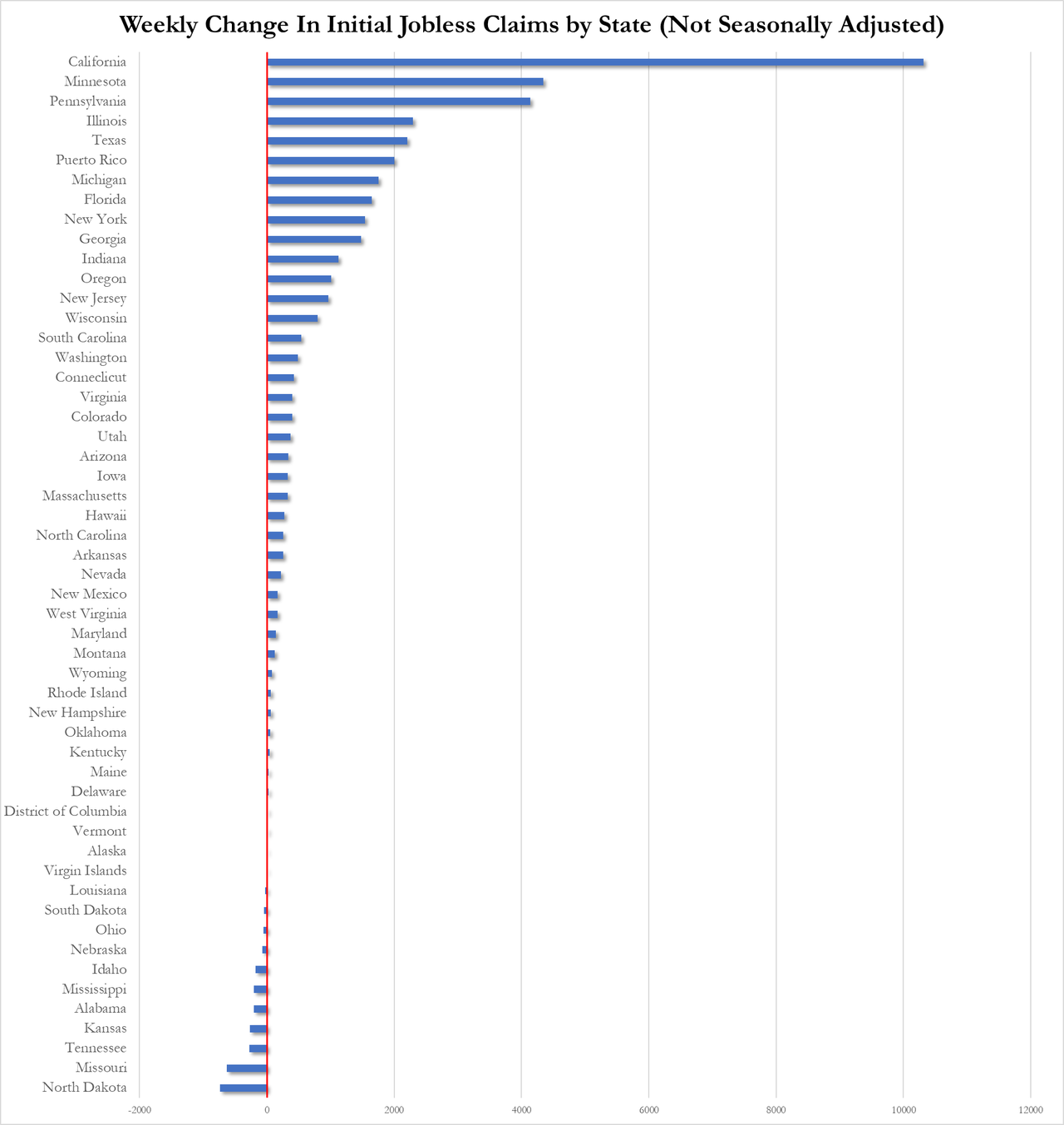

The number of Americans applying for jobless benefits for the first time surged last week to 242k (up from 229k and well above the 225k exp). That is the highest since August 2023.

Then they show how the vast majority of all those job losses came from California, and time out shortly after CA’s latest and greatest minimum wage law went into effect:

Then they ask,

That’s based on 10,000 California workers from McDonald’s alone just being laid off due to the minimum wage in CA. That, too, was a piece of the truth pie that I handed out for free to everyone two day’s ago:

“Restaurant Apocalypse: The Do-Gooders Created All the Destruction! Every Bit of it.”

Here’s another sliver of the truth pie today: The stories below report that US corporations have never held such massive cash stockpiles as they do today—a record $4.1 trillion! Do you really suppose, then, that they HAD to raise prices as much as they did to cover their own rising costs? Sounds to me like massive profiteering and price-gouging to fatten the pockets of the executives at the cost of the entire nation because that money will largely be deployed in buybacks and dividends. They are making bank as they clam they need to raise prices more.

Some do need to raise them more. Some, like those restaurants, are barely hanging on and are closing shops all over the place; but others clearly are making bank in a big way … in good part off those price increases.

Of course, the mainstream press spins the success a little differently for their corporate advertisers, a.k.a, their bosses’ friends:

Corporate cash piles have been on an upward slope since the beginning of the pandemic, with the economy’s continuing strength allowing companies to sock more money away and generate returns on short-term holdings.

Odd how the pandemic would cause the economy to be so much stronger that companies would make more money due to the increased strength that started with the beginning of the pandemic. Does anyone ever question this stuff?

How about they got richer off the ultra-low interest that they borrowed on to create huge cash piles for their buybacks? How about they got richer by seizing the natural rise in inflation to bury increased profits by inflating more than they actually needed to while consumers were accepting that prices were just going to go up? And how about how magnificently many of them profited under the huge stimulus/rescue programs created by Trump and the ReTrumplican party in 2020 to save us all from the lockdowns they mandated in order to save us all from the Covid that our government likely helped create? And how about how a handful of them profited immensely off Covid vaccine research money from the government and covid vaccine production and administration money in a risk-free business realm guaranteed to them by that same congress? How about how many of those stimulus programs paid for by your grandchildren were continued by Biden, and how about how Biden doubled down on that by creating new Build-Back-Better programs that are paid for by your grandchildren or future grandchildren to create jobs we didn’t even need, given “the economy’s continuing strength.”

This is all madness and lies that doesn’t add up with itself because the whole system is being deeply exploited and mined and milked with heaps of debt that those of us alive today won’t ever be paying off … and most of it not going to average Joe. It’s going to Sleepy Joe’s and Troubled Trump’s rich friends. That is why Trump told his friends at Mar-a-Lago a few years back, “I just did something that will make you all very, very happy.” (After getting his massive corporate tax cuts passed without any requirement that they don’t get spent on stock buybacks.)

So, is it any wonder stocks go up even when the Fed holds tight for nearly a year and promises to keep holding tight for most of the rest of this year? Those with money to gamble want to buy in before those cash stockpiles start turning into buybacks.

You can support your favorite party if you want, but either party is equally guilty of making sure the rich get richer far faster than you do (if you’re in the average person camp), and that you pay for it with high inflation and high interest on your own debts. Now, however, they have gone so far that the government is struggling to balance the debt.

Even then, Yammerin’ Yellen says today …

U.S. debt load is in ‘reasonable place’ if it remains at this level.

And no one in the mainstream media yells back at Yellen, “And just how on earth is it going to ‘remain at this level’ with all of your boss’s Build-Back-Better deficits continuing to roll in at around $3-trillion a year?”

That would seem to be a reasonable question to me.

“If the debt is stabilized relative to the size of the economy, we’re in a reasonable place,” she told CNBC’s Andrew Ross Sorkin during a “Squawk Box” live interview.

That is two massive “ifs.” What if the debt is not stabilized at all … as has been the case throughout Biden’s term … and Trump’s term … and Obama’s term … and …

And what if the size of the economy shrinks, rather than grows with the debt, as is likely now that even fake GDP is trundling downward.

Then what kind of problem blows up inside of your “reasonable place.”

There is nothing reasonable about any part of this massive mess they are all building.