As I keep emphasizing, the U.S. is becoming an emerging market.

Two of the hallmarks of emerging markets are a weak domestic currency and higher inflation. While neither of these are good for those living in the nation, they do make the performance in the domestic stock market look fantastic.

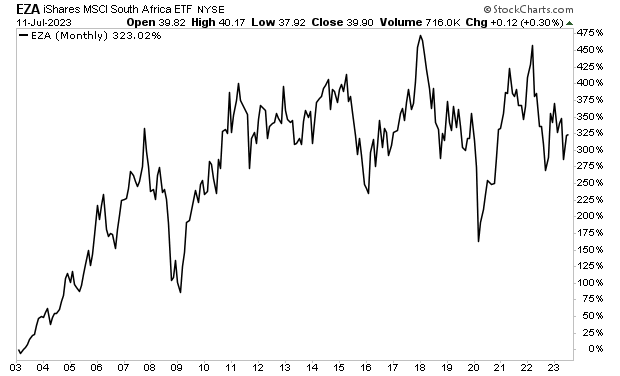

Case in point, take a look at the South Africa stock market’s performance over the last 20 years.

Nothing special, right? It’s effectively been moving sideways since 2010.

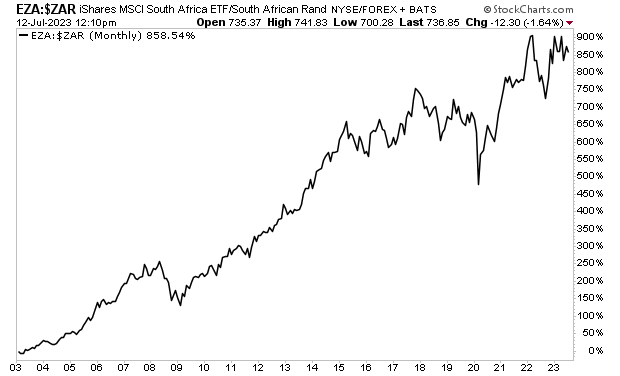

Well, a big reason for that is that the above chart is priced in $USD. Watch what happens when we price South Africa’s stock market in its domestic currency, the Rand.

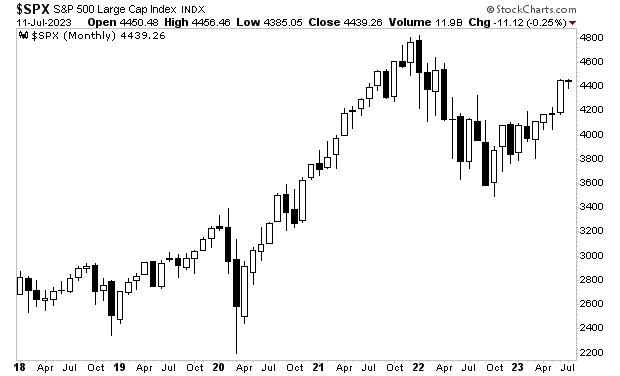

A similar dynamic is playing out today in the U.S.

The S&P 500 look wonderfully bullish. After all, it bottomed in October 2022 and since been roaring higher ever since.

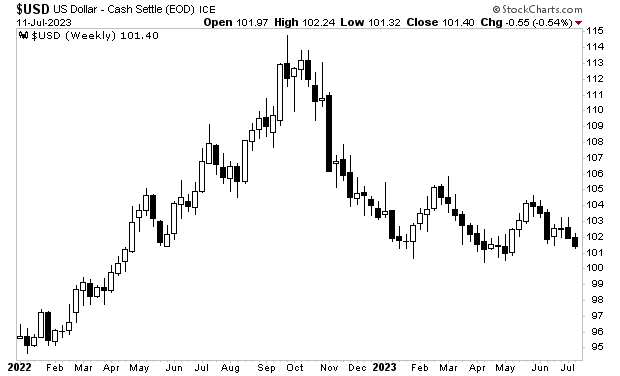

However, much of this performance stems from the fact that the S&P 500 is priced in our domestic currency, the $USD, which has been extremely weak.

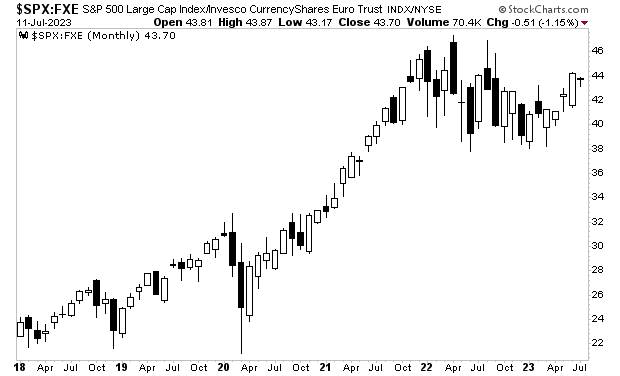

Watch what happens when we price the S&P 500 is another, stronger currency like the Euro.

Not quite some fantastic anymore is it? In fact, the S&P 500 priced in Euros has effectively been trading sideways for most of 2023.

Put simply, a major reason why the S&P 500 has done so well since October 2022 is because it’s priced in $USD. And the $USD has been dropping like a stone.

Again, this is the hallmark of an emerging market.

If you’re an individual investor trying to navigate this market, the framework that worked for investing in the U.S. from 1940 until today is over. You’re no longer investing in a developed nation… you’re investing in an emerging market.

Having said that, this kind of tectonic shift represents a “once in a lifetime” opportunity. Some investments are going to produce fortunes. Others will lose money for years… if not decades. And those investors who are positioned correctly for this will thrive while others struggle.