Authored by Charles Hugh-Smith via oftwominds,

Following the conventional path is a deadend. It isn’t easy to carve a path outside the well-worn pathways of debt servitude, but it is possible.

America has become a nation bifurcated into haves and have-nots, and this is generating large-scale, enduring economic, social and political consequences. In a nutshell, older generations who bought homes and other assets at low prices decades ago have benefited enormously as credit-asset bubbles have pushed the value of these assets to the moon. These generations are wealthy not from any boost in national productivity–they’re wealthy simply because they happened to buy assets in the early stages of a multi-generational bubble.

Younger generations are experiencing a double-whammy: they’re priced out of homes and other assets and they’re being crushed by the stagflation that comes with credit-asset bubbles: now that the deflationary impact of globalization has faded, the super-low interest rates of ZIRP (zero interest rate policy) and vast expansions of credit and currency have finally generated embedded inflation and suppressed the only real engine of stable prosperity, increasing productivity.

This generational / class divide has led to giving up on the American Dream–or the Chinese Dream: in China, Financial Nihilism is called lying flat or let it rot, expressions of individual rejection of the social pressures to overwork and sacrifice one’s life for a rat-race with rapidly diminishing returns. This is an apt description of Financial Nihilism.

That the American Dream–homeownership and steady improvements in earning and wealth–is out of reach of most young Americans is painfully obvious, and their response is Financial Nihilism: borrowing and spending freely to enjoy whatever is still within reach and giving up on homeownership and retirement, a trend captured in acronyms such as YOLO (you only live once).

This may sound carefree, but it is a profound expression of despair and hopelessness. This reality is visible in headlines such as these:

Consumers are so demoralized by inflation and high rates that they’ve given up on saving for the American Dream and are spending money instead, economist says.

Key Engines of US Consumer Spending Are Losing Steam All at Once: Americans rely on credit, as disposable income declines.

Gen Zers are paying hundreds for dirty sneakers to show off their ‘nonchalant attitude’.

Financial Nihilism is the inevitable result of a Gilded Age level of extreme wealth-income disparity between the haves and have-nots, a stark reality few seem willing to examine as a driver of terminal social decline. What is a young person entering the job and housing market supposed to think about our economy and society after absorbing these realities?

The wealthiest 10% of Americans own 93% of stocks even with market participation at a record high.

An estimated 26% of Fort Worth’s single family homes are owned by companies, city says.

Gen Z Sinks Deeper Into Debt: Inflation drives many to credit cards to cover costs, leaving them with bigger balances.

That the ladder of upward mobility is broken is self-evident. The ratio of home prices to median income–at record levels of unaffordability–is telling. So is corporate ownership of vast swaths of America’s housing stock: the corporate rich get richer as they jack up rents, while the poor get poorer paying higher rents for zero advance in the quality or quantity of the product.

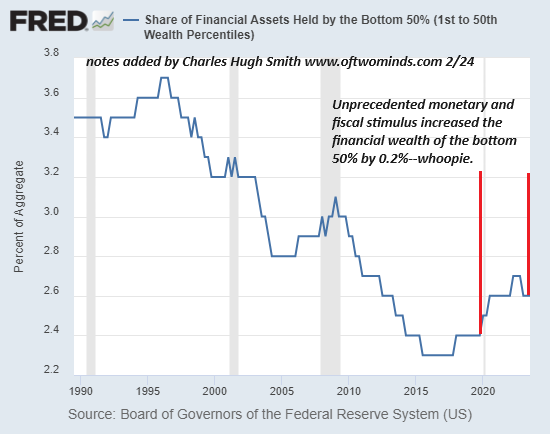

The bottom 50% of American households own a vanishingly small share of the nation’s ballooning financial wealth:

The hopelessness of escaping this downward slide into precarity / financial insecurity is debilitating, and so it is little wonder Why Americans Are Dying from Despair: The unfairness of our economy, two economists argue, can be measured not only in dollars but in deaths.

“Among advanced economies, this deterioration in pay and job stability is unique to the United States. The problem isn’t that people are not the way they used to be. It’s that the economy and the structure of work are not the way they used to be. This has had devastating effects on the family and on community life.

A more unexpected culprit identified by Case and Deaton is our complicated and costly healthcare system. In order to revive the American Dream for people without college degrees, we must change the way we pay for health care.

The dispiriting politics of stasis and scapegoating can prevail for a very long time, even as the damage comes into clearer view. We are better at addressing fast-moving crises than slow-building ones. It wouldn’t be surprising, then, if we simply absorbed current conditions as the new normal. We are good at muddling along.”

The decay of everyday life isn’t limited to financial precarity: work and unpaid shadow work demand more of us as diminishing returns bleed us dry. Is Anyone Else’s Life as Stupidly Complicated by Digital “Shadow Work” as Mine Is? (May 22, 2024)

The Loneliness of the American Worker: More meetings and faceless chats. Fewer work friends. How the modern workday is fueling an epidemic of isolation.

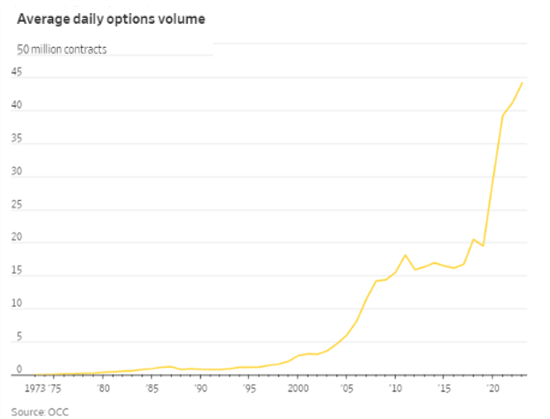

Simply put, the system isn’t working for the younger generations and those who didn’t have the means to buy assets a generation ago. This drives gambling (as the only available avenue to financial security) and populism (rejecting The Establishment in favor of Outsiders who propose throwing a monkeywrench into the well-oiled machine of those relishing their position atop the status quo).

This chart of option volume reflects the explosion of speculative betting in the stock market:

Following the conventional path is a deadend: borrow a fortune to get a bachelor’s degree, sacrifice yourself to enrich your corporate/state masters, borrow an absolutely crushing sum to buy a house–there’s a term for this path: debt servitude.

So what solutions are within reach? The unconventional ones that make up the de-risking toolbag of Self-Reliance. Gordon Long and I discuss these tools in our podcast Financial Nihilism, Inflation & The Collapsing American Dream.

Among the many solution-strategies we discuss, here are a few I highlighted:

It isn’t easy to carve a path outside the well-worn pathways of debt servitude, but it is possible for those willing to grab a machete and hack their way to a life that works for them. This is why I wrote a general guide to de-risking and solutions that are within our own control, Self-Reliance in the 21st Century.

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free