The financial landscape is showing signs of entering the second phase of the credit cycle, where financial institutions suddenly face the realization of credit losses. This is causing notable instability and liquidity challenges within the banking system. Simultaneously, many companies are struggling to meet their debt obligations.

August was a particularly troublesome month, witnessing the highest number of corporate defaults since the 2009 financial crisis. What’s even more concerning is that experts anticipate this trend to persist. It’s akin to witnessing controlled demolitions within the financial realm, and this may be just the beginning. Interestingly, many economic downturns initially appear mild before revealing their true severity.

BIS spoke today concerning the 2nd phase of the credit cycle where credit losses are suddenly realized by financial institutions.

This will create instability & liquidity issues within the banking system. https://t.co/AZAhUqwvaS pic.twitter.com/lHJhaO7p18

— Financelot (@FinanceLancelot) September 18, 2023

🚨Companies are defaulting on their debt.

August had the most corporate defaults since 2009.

And it’s expected to keep rising 👇 pic.twitter.com/i6jX7gfvTQ

— Genevieve Roch-Decter, CFA (@GRDecter) September 18, 2023

Where is it coming from? Equites. Corporates. Munis. Just the Fed intends. The Controlled demolitions are just getting started. pic.twitter.com/3QYI3INnlB

— Stimpyz (@Stimpyz1) September 18, 2023

Almost every hard landing looks at first like a soft landing

What's standing in the way of a soft landing now:

-The Fed staying too high for too long

-A too-hot economy

-A rise in oil prices

-A financial market rupture"Planes land. Economies don't."https://t.co/kC0Yn29IYX pic.twitter.com/MSMbbngiL3

— Nick Timiraos (@NickTimiraos) September 18, 2023

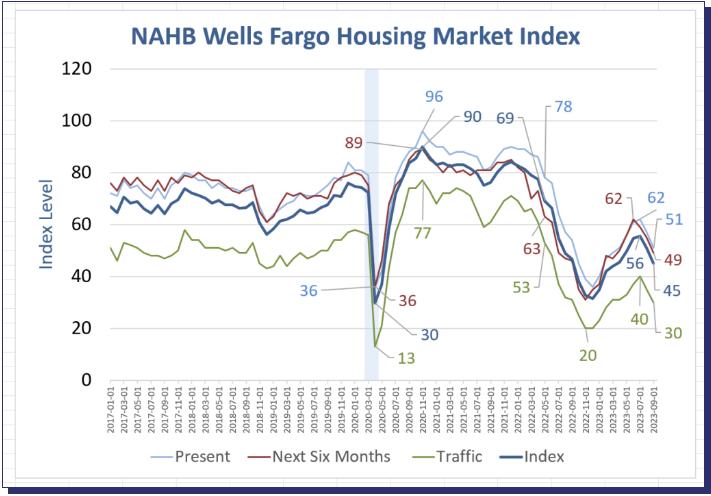

The NAHB Housing Market Index Takes Another Big Dive, Buyer Traffic Plunges