The dream of homeownership in the U.S. is fading as the math for buying a home undergoes a significant shift, according to a recent Wall Street Journal report. The Federal Reserve’s decision to raise interest rates has had a profound impact, making homeownership a distant goal for many Americans, even those who were financially within reach just a few years ago.

While the pandemic already inflated home prices, low mortgage rates provided some relief. However, the landscape changed dramatically as the Federal Reserve raised interest rates to combat inflation. With rates now higher, the dream of homeownership has become less affordable than ever in recent history, and prospects for improvement remain dim. Predictions indicate that home prices are unlikely to return to pre-pandemic levels, and the Federal Reserve has shown little inclination to reverse its aggressive interest rate policies.

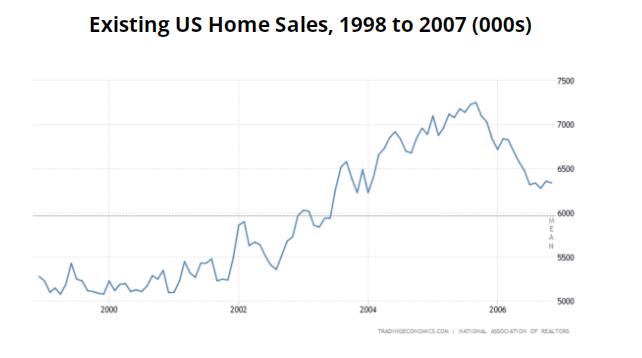

Mortgage rates, although slightly lower in recent weeks at around 7%, remain more than double what they were two years ago. Economist David Stockman attributes the current housing market challenges to the unintended consequences of the Federal Reserve’s attempts to control interest rates. Despite a historical perspective that suggests 7.5% mortgage rates were not unusual in previous decades, the current situation signals a crisis, indicating deeper systemic issues affecting the housing market.

The report emphasizes the need to scrutinize the Fed’s role in this housing predicament, raising questions about the unintended effects of their interest rate policies. As Americans grapple with the new reality of elusive homeownership, the future remains uncertain, with economic factors contributing to a complex and challenging housing market landscape.

Sources:

Source without paywall:https://t.co/OFHkx5LaXj pic.twitter.com/X78kNWwMI9

— FXHedge (@Fxhedgers) December 18, 2023

David Stockman on How The Fed Wrecked The Dream Of Homeownership