https://public-inspection.federalregister.gov/2023-14556.pdf

Prerule Stage:

SOURCE OF STRENGTH (SECTION 610 REVIEW):

- Purpose: The Federal Reserve, along with the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC), is working on a proposed rule.

- What It’s About: This rule, as mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act, wants bank holding companies and similar entities to be a financial “safety net” (or “source of strength”) for their insured banks. In simple terms, if the bank runs into trouble, these companies should be able to help out.

The Fed has been sitting on this one since Fall 2017:

https://www.reginfo.gov/public/do/eAgendaViewRule?pubId=201710&RIN=7100-AE73

Long-Term Actions (matters where the next action is undetermined, 00/00/0000, or will occur more than 12 months after publication of the Agenda):

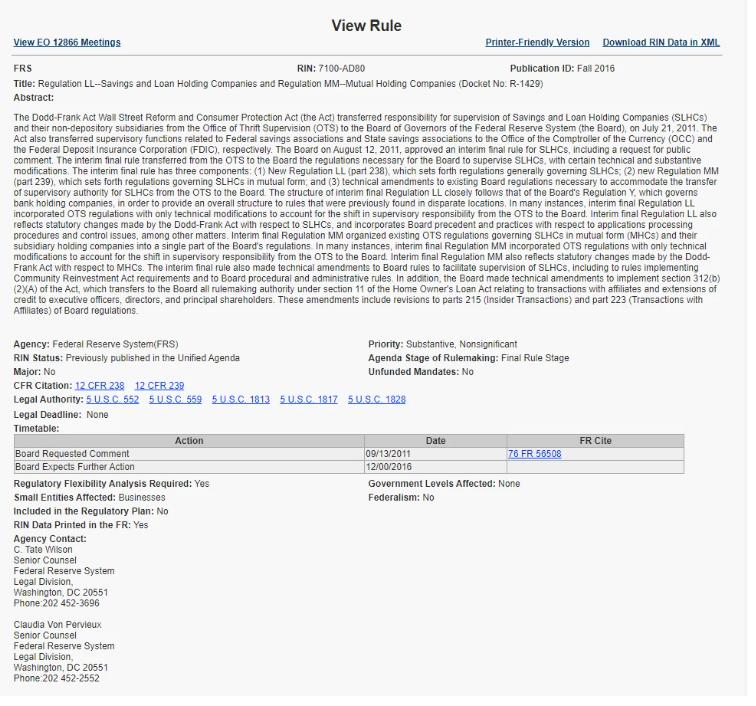

REGULATION LL & MM – Regarding Savings and Loan Holding Companies:

- Background: The Dodd-Frank Act made some changes in 2011. It moved the responsibility for overseeing Savings and Loan Holding Companies (like some special types of banks) from the Office of Thrift Supervision (OTS) to the Federal Reserve. The supervision of certain savings associations also got shifted to other agencies like the OCC and FDIC.

- What Did The Federal Reserve Do: They released a temporary rule in 2011 that took the old OTS rules but made them fit under the Federal Reserve’s structure. They did this in two main parts:

- Regulation LL: This set out the general rules for these special banks. It mirrored a lot of the rules for regular bank holding companies. It also included some updates because of the Dodd-Frank Act, and it brought in some standard practices from the Federal Reserve.

- Regulation MM: This dealt specifically with a unique type of these banks called “mutual” banks. Like with Regulation LL, it adopted many of the old OTS rules but made them fit the Federal Reserve’s system and reflected the Dodd-Frank Act’s changes.

- Also: The Federal Reserve made additional technical changes to other rules to make sure they could supervise these special banks correctly. For example, they made changes to rules about community investment and how banks deal with insiders.

The Fed has been sitting on this one since the Fall of 2016?:

TLDRS:

- The Fed is giving a heads up about its regulatory plans for the next six months.

- They’re looking at ensuring big bank companies can support their banks looking to consider rules that have been stuck in the doldrums since 2017 and 2016!