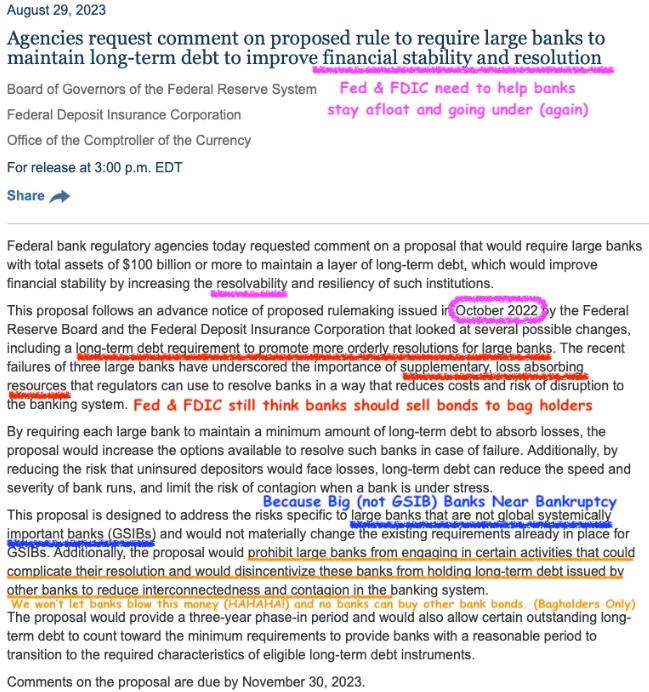

The Federal Reserve requested comment on proposed rule to require large banks to maintain long-term debt to improve financial stability and resolution [Federal Reserve].

This might sound familiar to some of you because the Fed & FDIC tried to do the same thing last year [SuperStonk: Federal Reserve & FDIC Seeking Bag Holders]

Get ready to comment! (I’ll be drafting a template.)

Check for other Fed Proposals which apes may want to comment on. WE NEED EYES EVERYWHERE!

EDIT(ELIA): Here’s why this pisses me off. The Fed & FDIC wants banks to sell bonds so that they can have more “loss absorbing resources” for when a bank goes under. To ensure that bond raise is earmarked for bankruptcy resolution, banks will be prohibited from blowing that bond money. And these bonds are going to be such good investments that *OTHER BANKS CAN’T BUY* because they don’t want other banks being bagholders when one bank goes under.