In a recent Reuters poll conducted from Feb. 14-20, a significant majority of 86 out of 104 economists suggested that the Federal Reserve would initiate a rate cut in the next quarter. Currently standing at 5.25%-5.50%, the fed funds rate is under scrutiny amid escalating concerns over inflation.

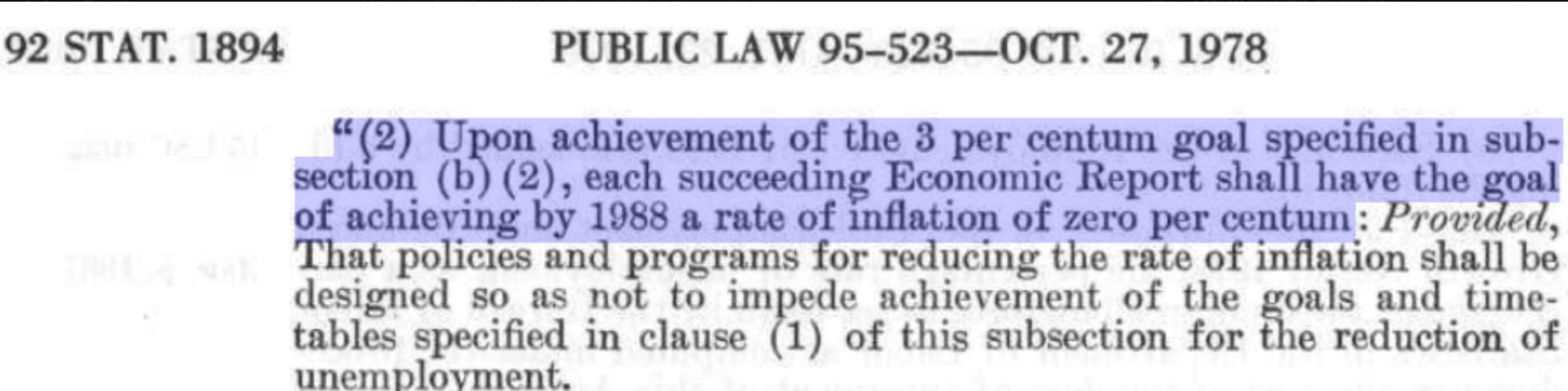

Underpinning this speculation is a critical aspect of the Full Employment and Balanced Growth Act of 1978, which sets a stringent guideline for the Federal Reserve. According to Section 2(b)(2) of this act, each successive Economic Report must articulate a quantified numerical objective, along with a timeline, to achieve an inflation rate not exceeding 3% per annum by 1988.

This legal stipulation underscores the Fed’s obligation to keep inflation levels in check, adhering to the parameters set forth by Congress. With the current inflation rate hovering at 3.2%, the Fed finds itself at a crossroads: obligated by law to take measures to curb inflation, even as market expectations lean towards a rate cut.

This conundrum highlights the delicate balance the Fed must strike between fulfilling its statutory mandate and responding to market sentiments. As inflation surpasses the 3% threshold, the Fed’s hands may be tied by legal requirements, necessitating a reevaluation of market expectations.

In essence, the law mandates the Fed to prioritize inflation control, compelling action to ensure inflation remains below the stipulated 3% threshold. As market speculation diverges from legal mandates, the Fed faces the challenging task of reconciling statutory obligations with market dynamics.

Sources:

Inflation Rate (%)

Türkiye🇹🇷: 67.1

Colombia🇨🇴: 7.7

Iceland🇮🇸: 6.6

NZ🇳🇿: 4.7

Chile🇨🇱: 4.5

Mexico🇲🇽: 4.4

Australia🇦🇺: 4.1

UK🇬🇧: 3.8

Ireland🇮🇪: 3.4

US🇺🇸: 3.2

Korea🇰🇷: 3.1

France🇫🇷: 3.0

Spain🇪🇸: 2.8

Japan🇯🇵: 2.8

Canada🇨🇦: 2.8

Germany🇩🇪: 2.5

Switzerland🇨🇭: 1.2

Denmark🇩🇰: 0.8@OECD pic.twitter.com/TnCZAT9ZDh— Informal Economy (@EconomyInformal) April 8, 2024

https://uscode.house.gov/statutes/pl/95/523.pdf

The actual statute specifies 0% is the Fed's target. Nowhere is the Fed empowered to set its own target in defiance of Congress. What is needed is for someone, everyone, to remind Fed officials of their duty. pic.twitter.com/3m0vgh7Dn3

— Tom McClellan (@McClellanOsc) April 7, 2024

Pretty busy calendar for this week:

1) US March Inflation CPI data is on Wednesday with expectations of a 3.4% y/y increase vs 3.2% y/y in February.

Core CPI is projected to decline to 3.7% from 3.8%.

2) FOMC minutes on Wednesday

3) US March PPI Inflation Data on Thursday pic.twitter.com/51reemHOZH

— Global Markets Investor (@GlobalMktObserv) April 8, 2024