As the specter of recession looms over the United States, calls for a “Fed pivot” echo through financial circles. However, a closer look at the economic landscape reveals that the Federal Reserve, led by Chair Powell, remains steadfast in its current approach, overlooking potential warning signs.

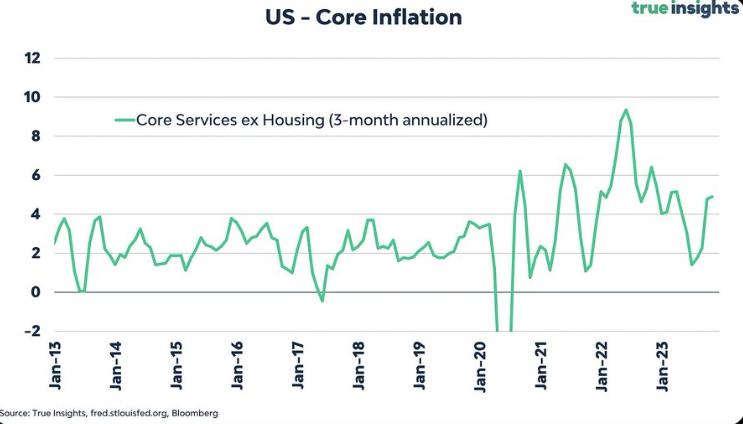

Chair Powell consistently highlights “Core Services Ex Housing Inflation” as the pivotal category to monitor. In the latest Consumer Price Index (CPI) report, this crucial indicator surged by 0.44% in the last month alone. On an annualized basis, it reaches an alarming ~5.3%, well surpassing the headline number of 3.1% and exceeding the Fed’s inflation target by more than 2.5 times.

The presumption behind “Core Services Ex Housing Inflation” is rooted in the impact of rising labor costs, given that labor constitutes the largest component of services. The Fed’s focus on this metric underscores its vigilance beyond headline inflation figures. Despite attempts by the media to downplay inflation’s impact on wages, the reality remains: inflation persists, outpacing wage growth for many.

CPI data, known for underreporting actual inflation, reveals staggering increases across various sectors, painting a concerning economic picture. From medical care and apparel to food and transportation, the disparities between cost increases and wage growth are stark. As Hasbro announces a significant workforce reduction amid slumping sales, it serves as a poignant recession indicator, reflecting the tangible economic hardships faced by individuals.

Financial analyst Paul Dietrich of Briley Wealth warns of a severe US recession in early 2024, drawing parallels with historical precedents. Historical patterns before the recessions of 2001, 2008, and 2020, marked by significant stock market gains followed by sharp contractions, underscore the potential risks. Weakening labor market signals, including rising unemployment claims, further fortify the ominous forecast.

As the nation grapples with these red flags, the Federal Reserve’s hesitancy to pivot on rates raises concerns. Navigating the economic challenges ahead requires a nuanced understanding of these warning signs, as the possibility of a severe recession looms on the horizon.

Sources:

The Fed will learn with everyone else that they are powerless to stop what's coming:

To start, a commodity meltdown / EM currency crisis.

U.S. yield collapse, carry trade unwind.

Vol explosion, Tech crash.

Housing collapse.

Powell juggling pies falling down stairs. pic.twitter.com/V2bWR4rpWd

— Mac10 (@SuburbanDrone) December 12, 2023

We continue to believe that a long Fed PAUSE is underway.

Getting core inflation from 4% to 2% is going to be a difficult task.

The Fed's job is still far from over here and tomorrow we'll get more insight.

Follow us @KobeissiLetter for real time analysis as this develops.

— The Kobeissi Letter (@KobeissiLetter) December 12, 2023

Think we are ready for a "Fed pivot?"

Here's why you should think twice:

Fed Chair Powell has often pointed to "Core Services Ex Housing Inflation" as the "most important category" to watch.

In the latest CPI report, Core Services Ex Housing Inflation jumped 0.44% over the… pic.twitter.com/4Oi7fnj6TP

— The Kobeissi Letter (@KobeissiLetter) December 12, 2023

The legacy media is now trying to make people believe that inflation is no longer outweighing wages.

Inflation is still going up. Unless your income is up 30% since 2021, odds are you are way behind on wages versus inflation.

And CPI is notoriously wrong about actual inflation.… pic.twitter.com/50HrGzlV7H

— Wall Street Silver (@WallStreetSilv) December 12, 2023

🚨JUST IN: Janet Yellen says inflation heading back to 2%

She doesn’t believe the “last mile” in returning inflation to the Federal Reserve’s 2% goal will be especially difficult

Inflation is “certainly meaningfully coming down" Yellen said

It's not going down yet.

It's just… pic.twitter.com/gHDHLynjH8

— Genevieve Roch-Decter, CFA (@GRDecter) December 12, 2023

Hasbro is laying off 20% of its workforce, blaming slumping sales of toys and games

You don't get a better recession indicator than people cutting Christmas for their kids.pic.twitter.com/dKWYELRBb0

— Financelot (@FinanceLancelot) December 12, 2023

Increases over last 3 years…

CPI Medical Care: +5.7%

CPI Apparel: +10.3%

US Wages: +15.0%

CPI Shelter: +18.5%

CPI New Cars: +20.7%

CPI Food away from home: +20.8%

CPI Food at home: +21.1%

Actual Rents: +21.8%

CPI Used Cars: +22.8%

CPI Electricity: +25.4%

CPI Gas Utilities:…— Charlie Bilello (@charliebilello) December 12, 2023

Hasbro Layoffs: A Giant of Gaming Stumbles

Severe Recession Risk as Stock and Job Markets Show Red Flags for 2024

151 views