We are living in the USA where corruption, favoritism, open borders and an out-of-control Federal budget and debt are destroying this once great nation.

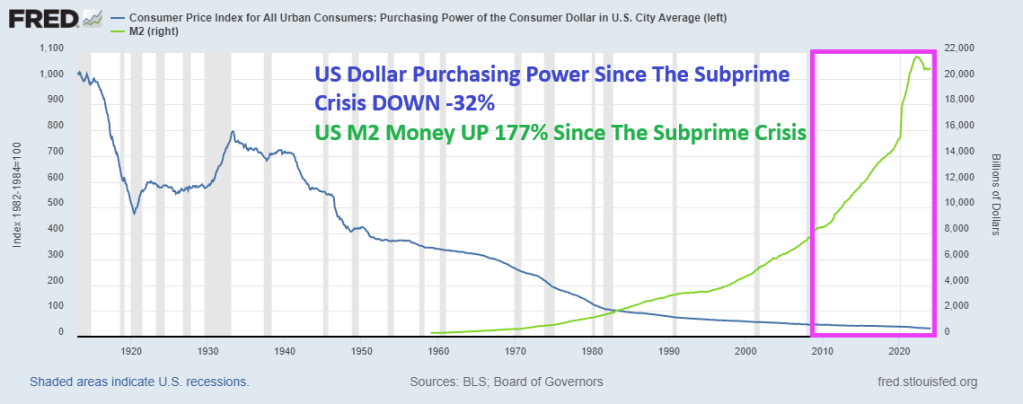

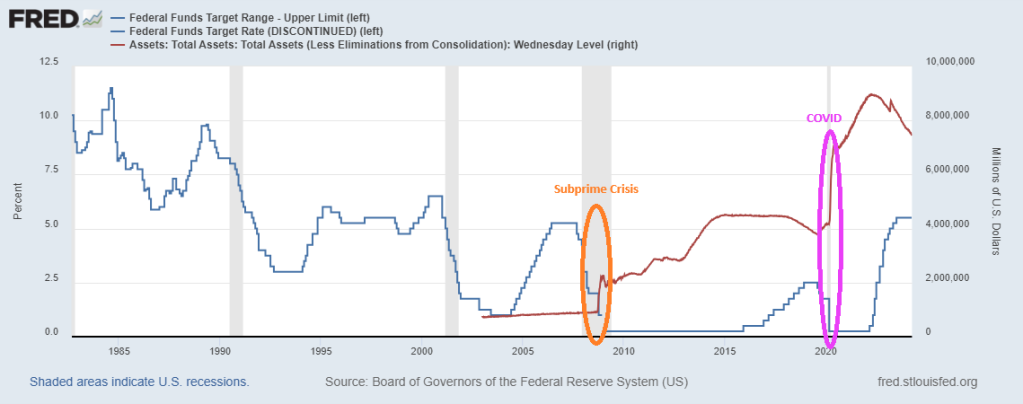

Former Kansas City Fed President Thomas M. Hoenig was absolutely right when he said recently that The Federal Reserve panders to Wall Street, Congress and special interest groups, prioritizing immediate relief over financial stability. Bernanke’s zero-interest rate policies (ZIRP) and Quantitative Easing (QE) were short-term fixes that never went away. Indeed, since the subprime mortgage crisis of 2008-2009, US Dollar purchasing power is DOWN -32% and M2 Money is up a staggering 177%. While Yellen stuck with zero-interest policies until Trump was elected, then raised The Fed Funds Target Rate 8 times. Yellen only raised the target rate once under Obama. Clearly playing political favoritism.

The Federal Reserve’s lack of transparency comes amidst reports that countries are removing their gold and other assets from the U.S. in the wake of the unprecedented Western sanctions imposed on Russia over its invasion of Ukraine. According to a 2023 Invesco survey, a “substantial percentage” of central banks expressed concern about how the U.S. and its allies froze nearly half of Russia’s $650 billion gold and forex reserves. Headline USA filed a FOIA request with the Fed for records reflecting how much gold the Federal Reserve Bank of New York currently holds in its vault, as well as records reflecting the ownership stake that each of FRBNY’s central bank/government clients have in that gold. The FOIA request also sought records about the Fed’s gold holdings prior to Russia’s February 2022 invasion of Ukraine. However, the Federal Reserve denied the FOIA request on Wednesday.

It influences the price of nearly everything, as well as the availability of jobs, the stability of our banking system, and the purchasing power of our money.

When the Fed Chair speaks, the entire world stops to listen.

But the average person has a poor understanding of how this colossally important entity operates. Or even why it exists.

And after a series of asset price bubbles — which some argue we’re in another one now — a chorus skeptical of the Fed’s actions has emerged.

So today we’re doing our best to shine as bright a light as possible on the Fed: how & why it operates, the good & as well as the shortcomings of its actions to date, what direction its policies are likely to take from here, and how all of this impacts the households of regular people like you and me.

Here are my top takeaways from from a speech by former KC Fed President Thomas Hoenig:

- Dr Hoenig admits the Federal Reserve has experienced substantial “mission creep” since its creation as a lender of last resort. Its track record is very much “mixed” in terms of delivering on the intent of its policies. In Dr. Hoenig’s opinion, its efforts to add stability sometimes instead only create more instability.

- While very critical of the Fed’s QE and ZIRP policies in the wake of the GFC, and more recently in the $trillions in monetary & fiscal stimulus unleashed post-COVID, Dr Hoenig thinks current Fed policy is “about right”. Though he expects the Fed to come under serious pressure soon as ebbing liquidity allows recessionary forces to build. He thinks the Fed will need to make an important decision within the coming year: return to QE and re-flame inflation, or allow a recession to occur.

- Dr Hoenig criticizes the Federal Reserve for pandering to various interests, noting that short-term thinking and pressures from Wall Street, Congress, and interest groups often lead to decisions that prioritize immediate relief over long-term stability — a sort of “We’ll act now for optics sake and hopefully figure things out later”

- In Dr Hoenig’s opinion, our fiscal policy is a runaway disaster. He criticizes both political parties of Congress for their roles in the cycle of ever-increasing deficits. Democrats advocate increased spending and tax hikes, while Republicans aim to keep taxes low but fail to curb spending. He warns of dire long-term consequences for future generations due to this impasse.

- Dr Hoenig is very worried about the current stability of the banking system (and this from a former Direct of the FDIC!). He advocates for essential reforms to address government spending, prioritize essential areas without relying on future borrowed funds or inflationary measures, and communicate transparently with the public. He stresses the importance of reducing debt growth substantially below national income growth to avoid a full-blown crisis scenario in the future.

- Dr Hoenig predicts the purchasing power of the US dollar (and other world fiat currencies) will continue to decline due to current policies and the lack of a “discipline” to money creation. Until such a discipline is restored (perhaps a return to some sort of hard backing of the currency), the dollar’s fall in purchasing power won’t abate.

- Dr Hoenig suggests investing time in reading history and biographies as a valuable way to learn about leadership and gain insights into what strategies works and which don’t.

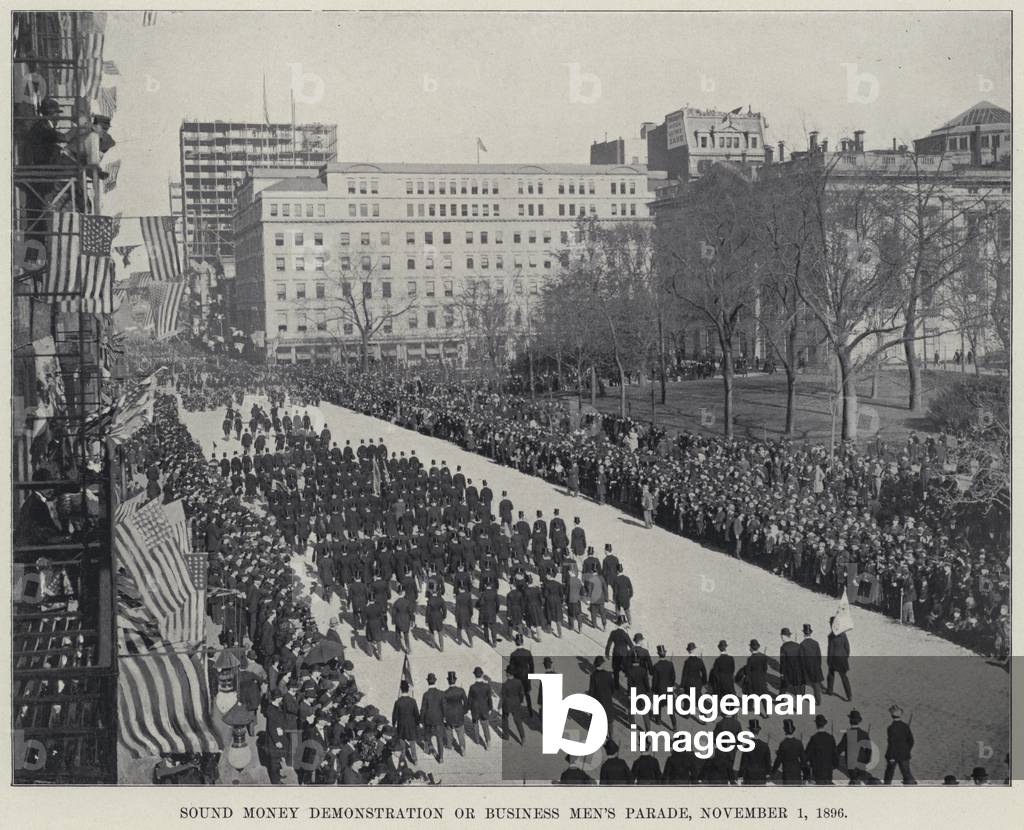

Here is the “Sound Money Parade” in 1896. By the aftermath of the subprime crisis, Janet Yellen (1993-2020) adopted the UNSOUND Money Fest, an orgy of printing and charging near zero interest rates. Powell in 2021 is ever-so-slowly unwinding The Fed’s balance sheet, but Powell has raised The Target Rate to its highest level since 1998 to fight inflation caused by Biden’s policies.

Combine The Fed not telling us how much gold they hold and their overprinting problems since 2008, and you can see why investors are turning to gold and silver and crypto currencies. The adoption of Central Bank Digital Currency (CBDC) is a step towards financial collapse.

Here is a parade you will NEVER see in Washington DC. A Sound Money Parade!

Powell is beginning to act like a sound money fan, but he still is taking his sweet time shriking the balance sheet.

I am thinking of fleeing to Lilliehammer Normay like Frank Tagliano.