By Pam Martens and Russ Martens: August 12, 2024 ~

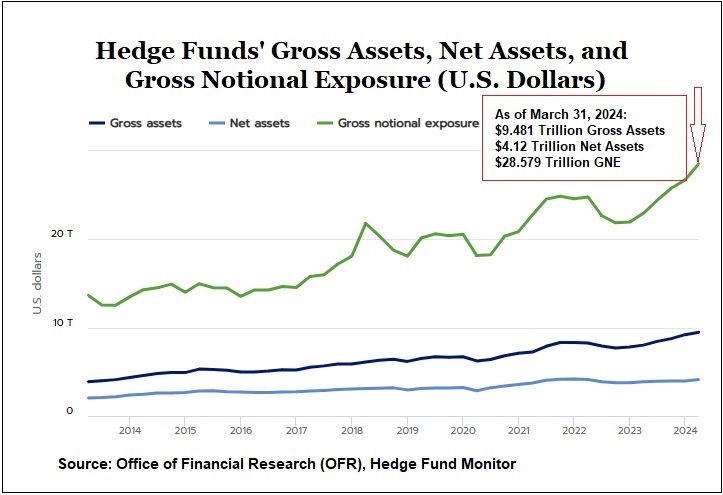

According to a report at the U.S. Treasury’s Office of Financial Research (OFR), the Gross Notional Exposure at hedge funds has skyrocketed by 24.5 percent in the span of one year: from $22.946 trillion on March 31, 2023 to $28.579 trillion on March 31, 2024. (Run your cursor along the top green line at this link to observe the stunning growth in hedge fund exposures despite the banking crisis in the spring of 2023 when the second, third and fourth largest banks blew up.)

Gross Notional Exposure (GNE) is defined by OFR as “the sum of the absolute value of long and short exposures, including those on and off the balance sheet.”

The OFR was created under the Dodd-Frank financial reform legislation of 2010 to keep bank and market regulators informed of growing risks, in the hope of preventing another financial crisis like that of 2007-2010 from occurring.

Unfortunately, Wall Street’s lobbying, bullying and regulatory capture has exponentially outstripped the clout of the OFR. As a result, all that the public can do is read about the potentially catastrophic risks inherent on Wall Street today at the OFR’s website and wonder when the next blowup and Fed bailout will occur. (See our report: Former New York Fed Pres Bill Dudley Calls This the First Banking Crisis Since 2008; Charts Show It’s the Third.)

The OFR carries this mild statement as to what can go wrong at over-leveraged hedge funds: “…Leveraged hedge funds are dependent on creditors’ willingness and ability to continue to lend. Further, declines in collateral and asset values can lead to margin calls that require hedge funds to tap their liquid assets….”

Allow us to fill in the gaps in that statement. The largest megabanks on Wall Street – which since the repeal of the Glass-Steagall Act in 1999 are also allowed to own taxpayer-backstopped, federally-insured, deposit-taking banks – are the major source of providing that leverage to hedge funds. This hedge fund lending and servicing operation at the megabanks is given the benign title of “Prime Broker.”

MORE:

https://www.financialresearch.gov/hedge-fund-monitor/categories/size/chart-3/

https://www.bis.org/publ/qtrpdf/r_qt2403y.htm

TL;DR: Hedge Funds Are a Ticking Time Bomb

- Hedge fund risk is skyrocketing: Gross Notional Exposure (GNE) of hedge funds has increased by 24.5% in one year, reaching $28.5 trillion.

- Megabanks are fueling the fire: Major banks like Goldman Sachs, Morgan Stanley, and JPMorgan Chase are the primary lenders to hedge funds through their Prime Brokerage divisions.

- History repeats itself: These banks have a history of risky behavior with hedge funds, as seen in the 2008 financial crisis with Morgan Stanley and FrontPoint Partners, and Goldman Sachs’ involvement in the ABACUS deal with Paulson & Co.

- JPMorgan Chase is a special case: With a history of criminal convictions and its ties to Jeffrey Epstein, JPMorgan Chase exemplifies the reckless behavior of Wall Street.

- Lack of regulation: Despite the Dodd-Frank Act, Wall Street has managed to evade meaningful oversight, allowing for excessive risk-taking and potential for another financial crisis.

Conclusion: The authors warn of a potential catastrophic event due to the unchecked growth of hedge funds and the risky practices of the banks that support them. They call for increased regulation to prevent another financial disaster.

h/t welp007