Somehow, today’s Existing Home Sales number don’t soothe me.

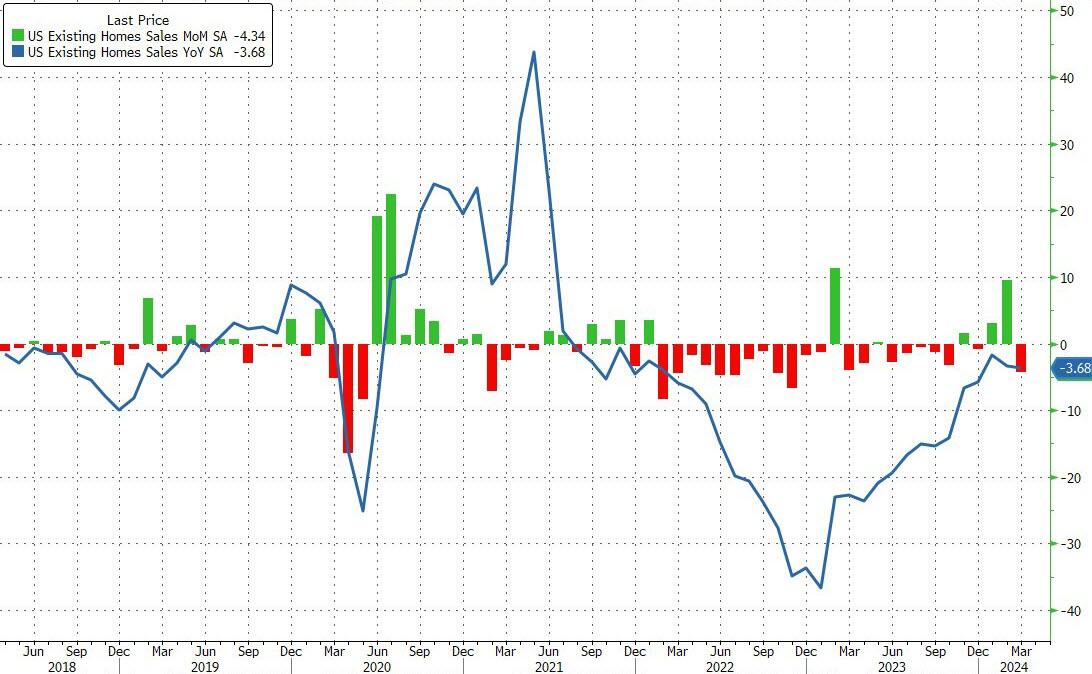

After the collapse in housing starts and permits in March, it is no surprise that existing home sales disappointed in the same month, dropping 4.3% MoM (-4.1% exp) after surging 9.5% in February. That is the biggest drop since Nov 2022.

Sales were down almost 10% from a year earlier on an unadjusted basis, as sales of both single-family homes and condominiums and co-ops dropped.

Source: Bloomberg

This dragged total existing home sales SAAR back down to 4.19mm…

Source: Bloomberg

“Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves,” said NAR Chief Economist Lawrence Yun.

“There are nearly six million more jobs now compared to pre-COVID highs, which suggests more aspiring home buyers exist in the market.”

…and it’s about to get worse…

Source: Bloomberg

Total housing inventory registered at the end of March was 1.11 million units, up 4.7% from February and 14.4% from one year ago (970,000). Unsold inventory sits at a 3.2-month supply at the current sales pace, up from 2.9 months in February and 2.7 months in March 2023.

“More inventory is always welcomed in the current environment,” Yun said.

“It’s a great time to list with ongoing multiple offers on mid-priced properties and, overall, home prices continuing to rise.”

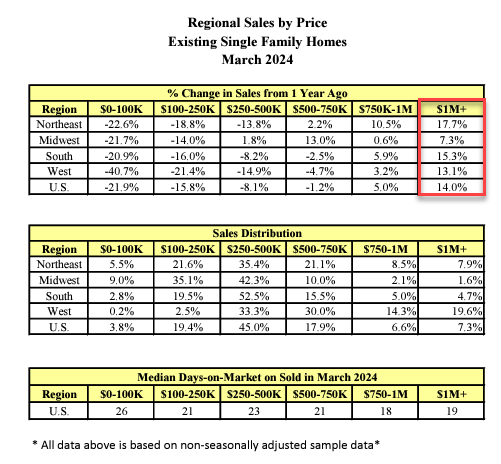

All price levels saw sales decline except $1mm+…

The median selling price increased 4.8% from a year ago to $393,500, the highest for any March on record.

Source: Bloomberg

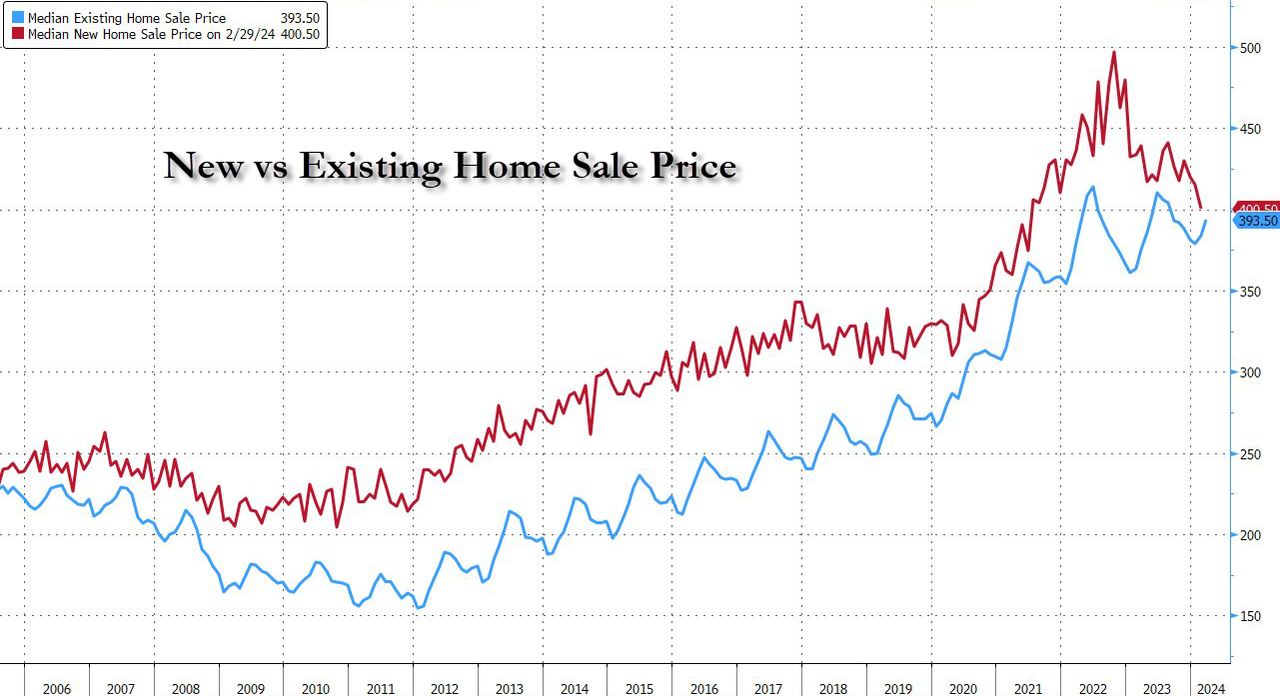

…and existing home prices are about to top new home prices…

Source: Bloomberg

First-time buyers made up 32% of purchases in March, up from 26% a month earlier.

Somehow, I don’t think Biden will brag about this report.