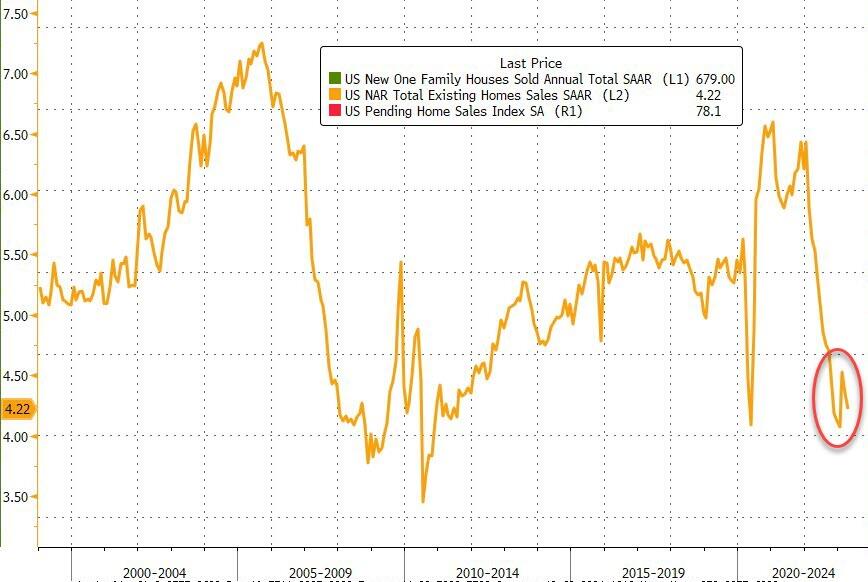

After (unexpectedly) tumbling in March, existing home sales were expected to rise modestly (+0.8% MoM) in April. Analysts were wrong as March’s data was revised marginally up from -4.3% MoM to -3.7% MoM and April printed -1.9% MoM (a big miss). That left existing home sales down 1.9% YoY…

Source: Bloomberg

That pushed the existing home sales SAAR back near COVID lockdown lows…

Source: Bloomberg

This really should not come as a surprise because, while homeBUILDERS remain optimistic that things will pick up, homeBUYERS are the least enthusiastic they have ever been about buying a home… going back almost 50 years…

Source: Bloomberg

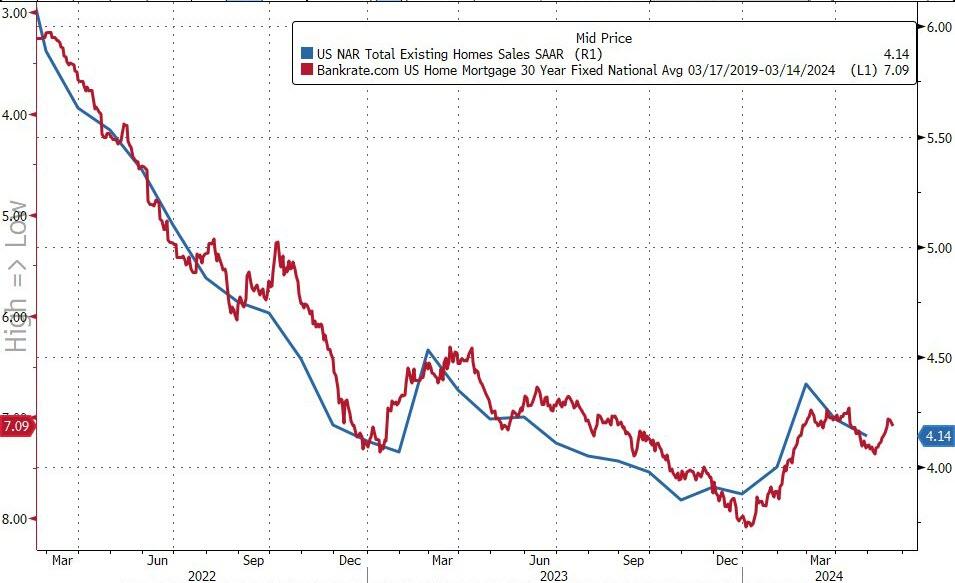

And with mortgage rates still above 7%, we don’t see things picking up meaningfully anytime soon…

Source: Bloomberg

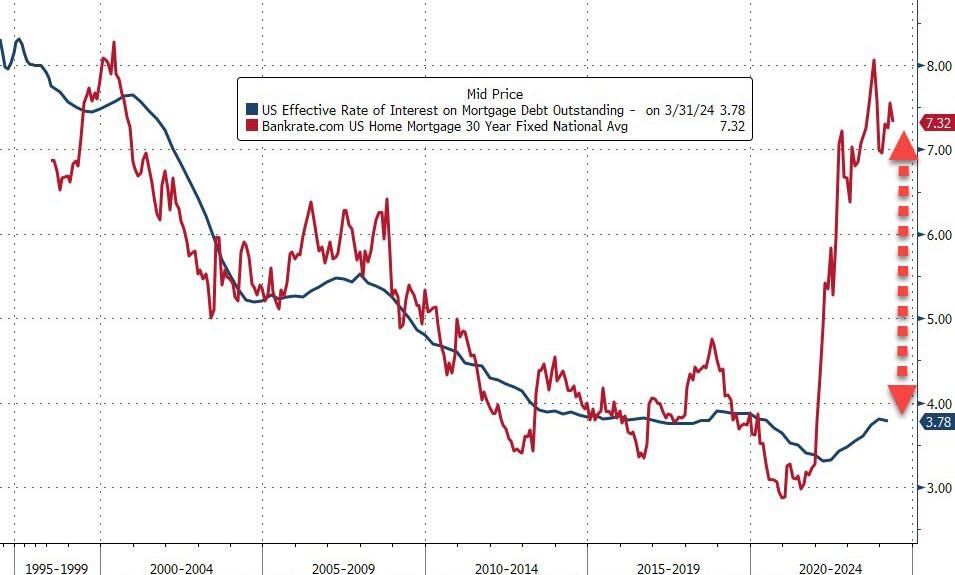

…and then there’s this…

Source: Bloomberg

Sales declined in all four regions, including a 2.6% decrease in the West and a 1.6% drop in the South

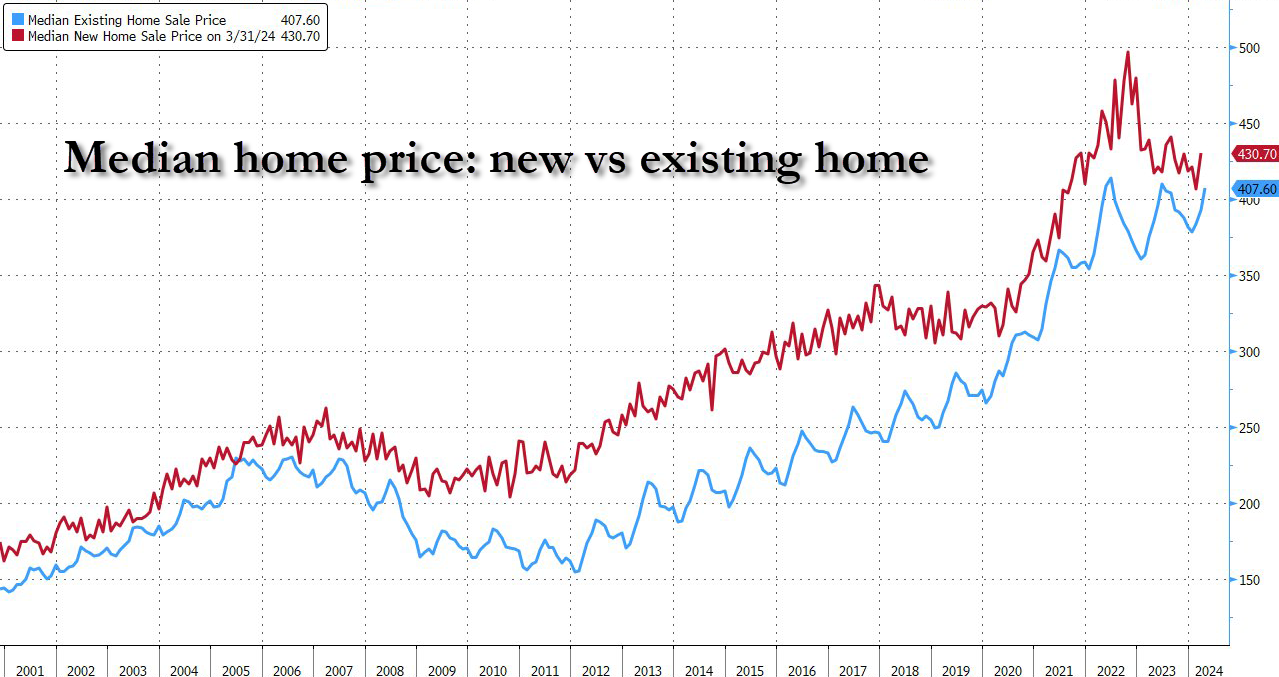

The median selling price increased 5.7% from a year ago to $407,600 – the highest for any April in data back to 1999.

Unlike in the new-home market, where rising inventories and the prevalence of incentives by builders have pushed prices down on an annual basis, the home-resale market is experiencing rising year-over-year price growth.

“Home prices reaching a record high for the month of April is very good news for homeowners,” NAR Chief Economist Lawrence Yun said in a statement.

“However, the pace of price increases should taper off since more housing inventory is becoming available.”

About 68% of the homes sold were on the market for less than a month, up from 60% in March, while more than a quarter sold above the list price.