Treasury Secretary Yellen wants stocks and bonds higher.

The reason is simple.

Next year 2024 is an election year. And Yellen is a playing politics for the Biden Administration. After all, it’s hard to convince voters to re-elect someone when their 401(k)s are shrinking by the week.

This is why Secretary Yellen chose to have the Treasury shift its issuance from its traditional breakdown of 15%-20% short-term debt/ 80%-85% long-term debt to favor issuing more short-term debt for the foreseeable future.

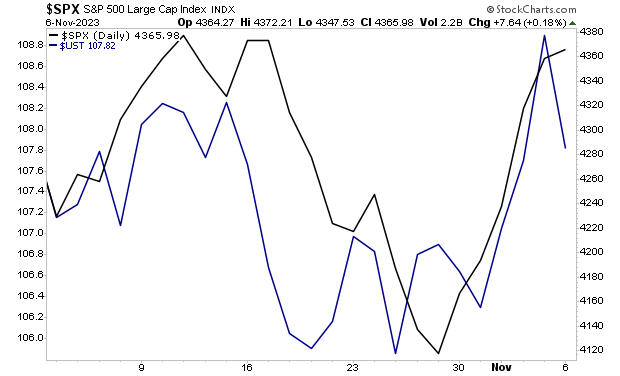

Doing this alleviates some of the pressure on long-term Treasuries as well as stocks which are priced based on the former’s yields. This is THE reason why both assets (stocks and bonds) erupted higher last week after declining for most of the last three months.

The BIG problem with this is that Secretary Yellen is choosing to rely heavily on short-term debt at a time when the Biden Administration is running its largest deficit as a percentage of GDP outside of WWII.

The U.S. has added nearly $2 TRILLION to the debt in the last 12 months alone. This is happening at a time when the Treasury is ALSO rolling over trillions of dollars worth of debt.

By relying on short-term debt (12 months of less in duration), Secretary Yellen is setting the stage for an absolute disaster in late 2024/ early 2025.

Why?

All of this short-term debt will be coming due between now and then. By late 2024, the U.S. will have nearly $35 trillion in debt. And if inflation hasn’t collapsed by then, all of the new short-term debt will need to be rolled over when rates are HIGH.

Interest payments on the debt are already at $800 billion. What do you think will happen to them when the U.S. has $35 trillion in debt and needs to roll over a large amount of this while rates are still in the 4% range or higher?

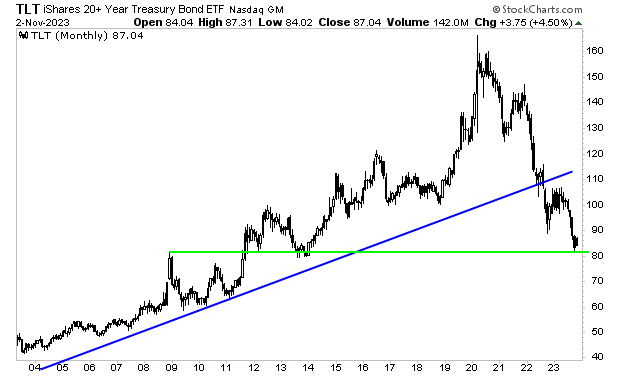

The long-term end of the bond market has figured it out. Stocks will too eventually.

As I keep warning, the Great Debt Crisis of our lifetimes is fast approaching.

In 2000, the Tech Bubble burst.

In 2007, the Housing Bubble burst.

The Great Debt Bubble burst in 2022. And the crisis is now approaching.