Amidst growing concerns, the United States is witnessing an alarming surge in credit card debt, with 56 million Americans grappling with credit card balances for over a year. The Federal Reserve Bank of New York’s quarterly report reveals an unprecedented milestone, as total card balances reach a staggering $1.08 trillion, reflecting a 40% surge in the last two years.

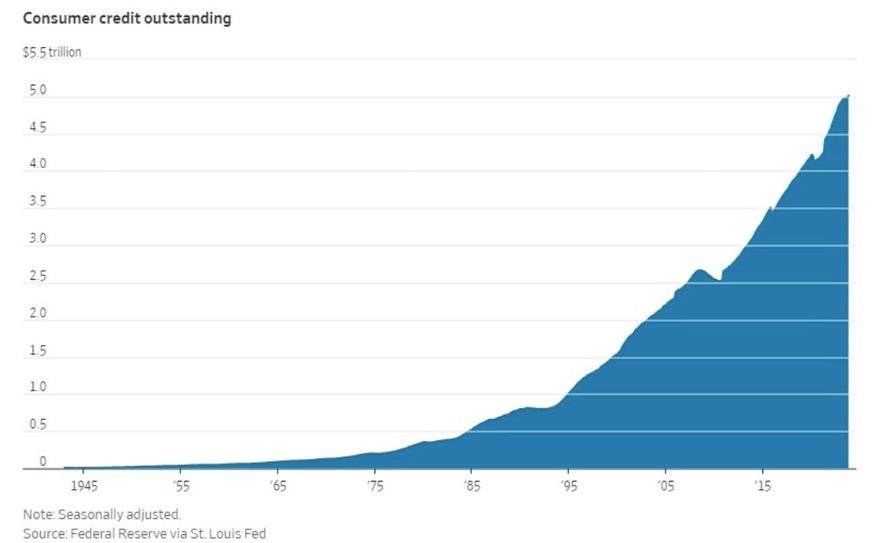

Bankrate’s senior industry analyst, Ted Rossman, notes that while Americans have generally managed their credit card debt well, there are evident pockets of trouble at the household level. More individuals are carrying debt from month to month, and fewer can pay off their balances entirely, according to a Bankrate.com report. This trend aligns with the broader economic landscape, where consumer credit surpasses $5 trillion for the first time. [Source: CNBC]

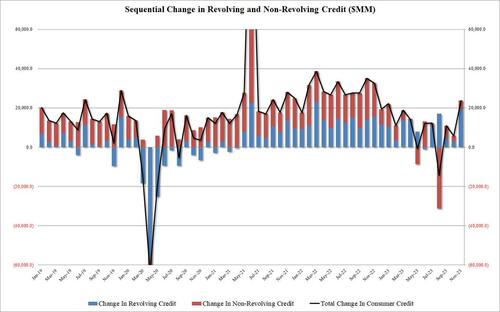

Bidenomics, marked by surging inflation rates, has pushed households to rely on credit cards to cope with rising costs. Under this economic framework, food prices have spiked by 20.4%, home prices by 33.5%, and regular gasoline prices by 28.2%. This alarming scenario raises concerns about a potential credit crisis, as Americans navigate the economic challenges posed by the current administration. The latest monthly consumer credit report from the Fed reveals a substantial monthly increase of $24.75 billion in November, the largest since January 2023, fueling worries about the sustainability of the credit market.

Bidenomics is working as intended… right? pic.twitter.com/jxCZ9JJqKk

— Wall Street Silver (@WallStreetSilv) January 9, 2024

Recession? What Recession? 🔥🔥🔥 pic.twitter.com/ZrFPDmf39k

— Wall Street Silver (@WallStreetSilv) January 9, 2024