The last few weeks are pointing to clear directional markets in the coming weeks, months and probably years.

– Stocks have peaked

– Gold and Silver have resumed a secular uptrend. (price targets later in the article)

– US 10-year Treasury yields are heading much higher. (even if there is a temporary Fed cut)

– The Dollar has peaked

These are brave predictions, especially since forecasting is a mug’s game.

But I don’t really care if I am right in the short term.

Why? Well, because risk is much more important than timing or price.

We are now at a point when risk is at its maximum. That is the time to get out of the bubble assets of stocks, bonds, property, and the US dollar.

In highly leveraged bubble markets, things can turn so quickly that paralysis hits investors. And then they wait for a pullback or the Fed to get out at higher prices.

But this time might be different, which means many investors will ride the market to the bottom, maybe 75-95% lower.

PHYSICAL GOLD & SILVER – CRITICAL WEALTH PRESERVATION

More importantly, now is the time to think about wealth preservation in the form of physical precious metals.

We invested heavily in physical gold early in 2002, both for our investors and ourselves. Since then, we have enjoyed a safe 8-9x return, depending on the base currency. That is better than most major asset classes in this century.

More importantly, only 0.5% of global financial assets are in gold. The major shifts that will take place in markets in the coming months could increase this to 1.5% to 5%.

But there is not enough gold in the world to satisfy the increased demand – AT CURRENT PRICES.

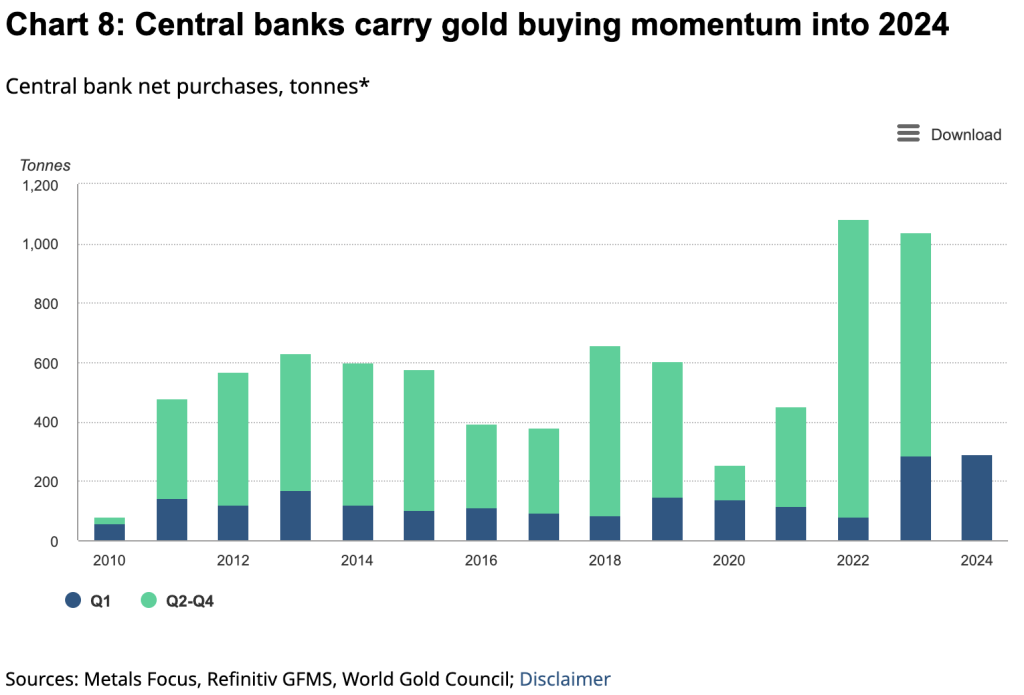

Between Chinese demand and Central Bank / BRICS gold purchases, just under 3,000 tonnes are absorbed. Gold production of 3,000 tonnes in 2023 was the lowest since 2014.

Central banks have doubled their gold purchases in the last 12 years.

Central Banks have also indicated that they intend to increase gold purchases in the next few years.

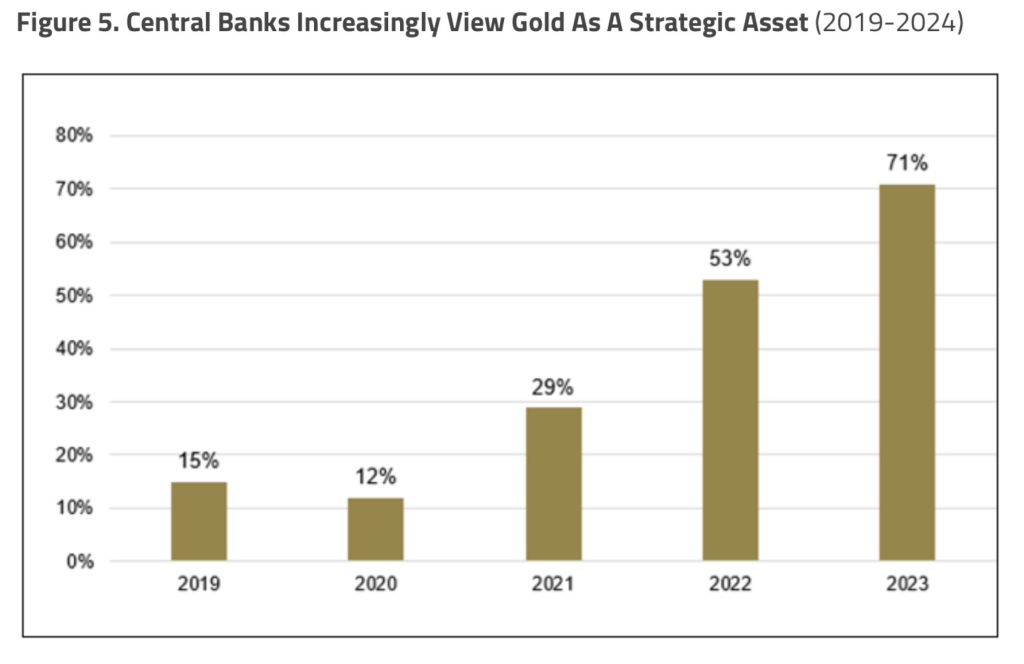

The graph below from the World Gold Council tells a very important story about Central Banks’ coming gold purchases.

The increase from 12% in 2020 to 71% today of Central Banks viewing gold as a Strategic Asset is very significant. It clearly indicates their intended exit from US dollars as a Reserve Asset to GOLD.

For central bank reserves, the expected switch out of weak dollar is likely to accelerate. Also, no central bank wants to hold its reserves in a currency that can be confiscated by the US government, as happened to Russia.

Add to that a major increase in Chinese demand as well as in institutional gold purchases including family offices.

So, where will the gold come from? Not from increases in production, as only marginal increases can be achieved.

So, the expected increase in demand can only be fulfilled by higher gold prices.

With the coming major shift out of paper assets into commodities and a flight to safety, only minor increases of the 0.5% of global assets held in gold today, could lead to the gold price going up by multiples.

There just isn’t enough gold available to satisfy demand at current prices.

A RACE TO A CATASTROPHIC FINALE

That Western economy and currency system is now racing to the bottom towards a catastrophic finale.

This might sound sensational but rather than being sensational, it is a historical certainty.

As Ludwig von Mises said:

What is clear today is that there will be no “voluntary abandonment of further credit expansion”. Instead, we will see a grand finale of money and debt creation. This will neither drown the sorrows of the people nor solve the debt disaster.

Instead, it will lead to:

- Debt defaults – implosion

- Currency collapse

- Recession – depression

- Inflation – hyperinflation

- Political unrest

- Social unrest

- More migration and no border controls

- Further geopolitical conflicts

- Shortages of products, food, etc.

- Eventually an implosion of major parts of the financial system

So, is all or most of the above fantasy or scaremongering?

Yes, of course it could be.

But based on history, major eras always end in a similar fashion. Since we are looking at a global bubble of proportions that has never occurred in history before, no one can predict the exact timing of the unravelling of the biggest debt and asset bubble in history

So, what about timing?

Well, I willingly admit that I have been wrong on timing. I thought the 2006-2009 would have been the trigger. But we must give credit to Western governments and Central Banks for temporarily saving the system at a massive cost.

This has led to the top 0.1% having created unlimited paper wealth in the last 15 years while ordinary people are much worse off.

The difference between the super rich and poor has grown exponentially. This will later have severe consequences for society.

Also, the credit expansion since 2008 has been exponential.

Should we give governments and central banks credit for that?

Yes and no.

The rescue action achieved a temporary postponement of the inevitable which is an implosion of debt markets leading to a banking crisis.

DESPERATION

Having recently visited a Van Gogh exhibition at the Artipelag Museum in the archipelago of Stockholm, which reminded me of the desperation of mankind.

Van Gogh produced 400 oil paintings and 700 drawings. Still, in his lifetime he sold only one painting for 700 francs. Van Gogh had mental problems, most certainly exacerbated by a lack of income. In an action of desperation he cut off his ear.

In recent years Van Gogh paintings have sold for $50 million to over $100 million.

Van Gogh’s action shows us how desperate people or nations commit desperate acts.

The world will experience many desperate actions in coming years as especially the Western world economy implodes.

US DEBT GROWING EXPONENTIALLY

The dilemma is that since 2009 the risk in debt markets has been growing exponentially. In this article I explain exponential moves.

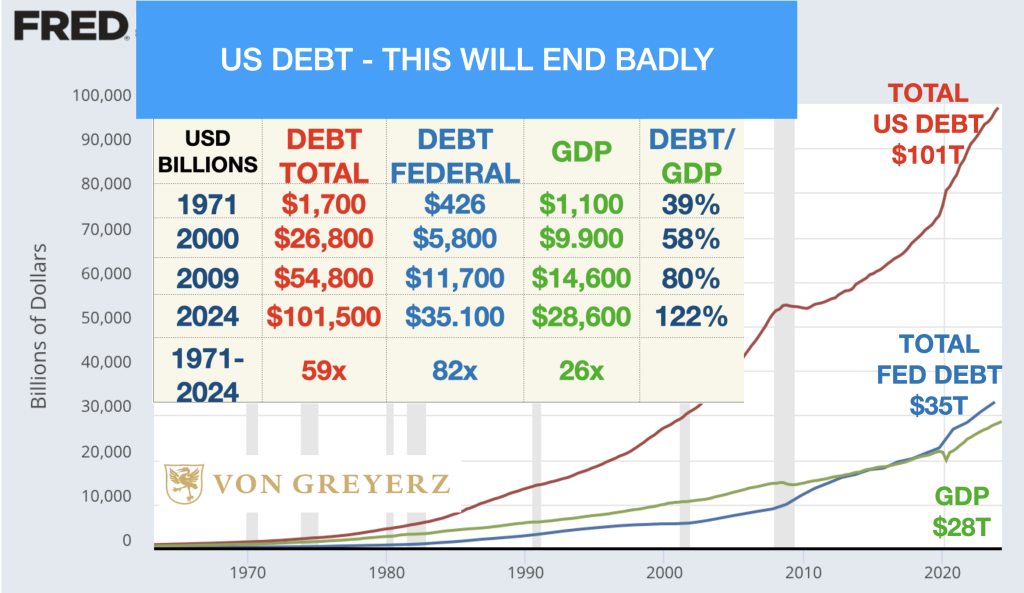

The table below tells the story.

US total debt has quadrupled in this century. And US federal debt is up 6x since the year 2000 and up 4x or by 26T since the 2008 crisis.

Just look at the steepness of the debt curves.

As the US desperately prints unlimited amounts of worthless money, we are now seeing the exponential growth of credit that is the clear indication of the end of a debt cycle.

And if we look at Federal debt is also growing exponentially.

What is also certain is that deficits in the US are continuing to expand.

This is an absolute catastrophe, not waiting to happen since it is already happening in front of our eyes.

I expect inflation to go up substantially in the next few years and probably be above 10% in early 2025. The interest cost can only be printed and never paid.

Add bank failures, much higher social security payments, higher military costs and we can add a few trillion dollars annually.

Does nobody realise that the US is on the way to perdition?

And if we look at Debt to GDP, it was 58% in 2000 and is now 122% and increasing.

Before Nixon closed the ‘gold window’, debt was 39% of GDP. Now the Government and the Fed are desperately creating money out of thin air. And this is money which has ZERO value.

All the printed dollars, all the credit expansion, all the weapons and warmongering by the US will not stop the US and the Western world going bankrupt.

As the air and value totally go out of the debt markets, the world will not only see an implosion of debt markets, but also of the other side of the balance sheet which is asset markets such as stocks, property and bonds which will also implode.

And so, the world will enter the biggest asset destruction, and wealth transfer in history.

TECH STOCKS – FOR WEALTH DESTRUCTION

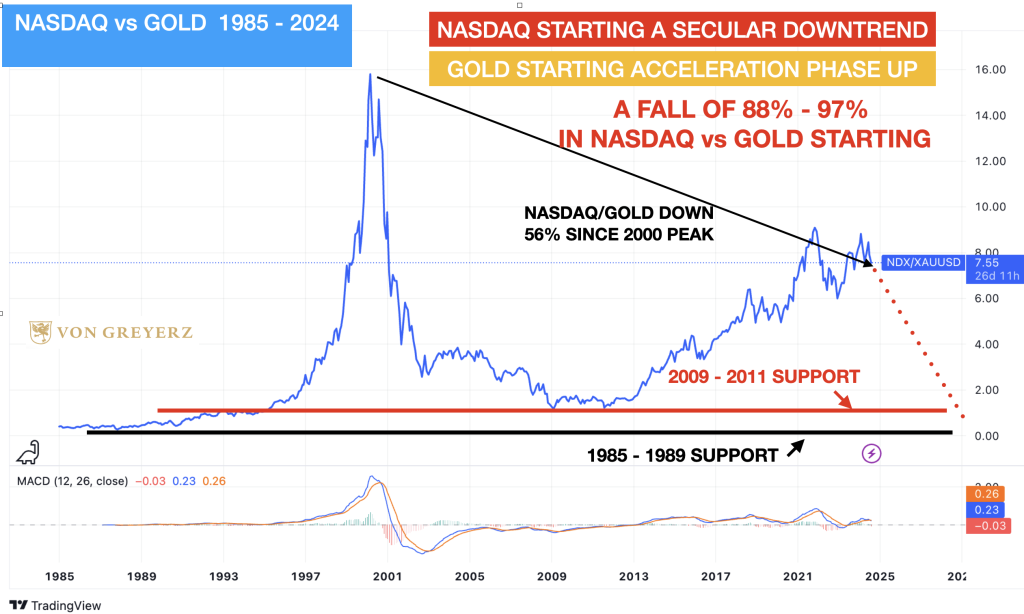

Just look at the graph below showing the likely fall of Tech Stocks vs Gold.

Don’t forget the 80% Nasdaq fall that started in 2000.

The circumstances today make a recovery in the next 10-20 years very unlikely.

GOLD AND SILVER FOR WEALTH PRESERVATION AND WEALTH ENHANCEMENT

Gold and Silver are fundamentally and technically in a perfect position for substantial rises.

In the next move Silver is likely to hit $50, probably pause there for a while and then move strongly higher. The volatility will be very high.

Gold’s move will be slower and more solid to a bit over $3,000 but later reach much higher levels.

But remember that price levels are secondary when it comes to physical precious metals.

IT IS ALL ABOUT WEALTH PRESERVATION!