As ominous indicators mount, a disconnect persists as many believe the economy is thriving. The collapsing yield curve, paralleled by the decline in oil prices, is underscored by emergency bank REPO interventions. Despite these red flags, some remain oblivious to the economic downturn.

Hedge funds’ consistent sale of US equities for the third consecutive week aligns with fading inflation expectations for the S&P 500, signaling potential challenges in earnings and sales estimates. A discernible shift to a risk-off mood is evident, further accentuated by extreme semiconductor inventory levels, poised for potential destocking, which could exert downward pressure on demand and lead to weaker pricing and margins in the sector.

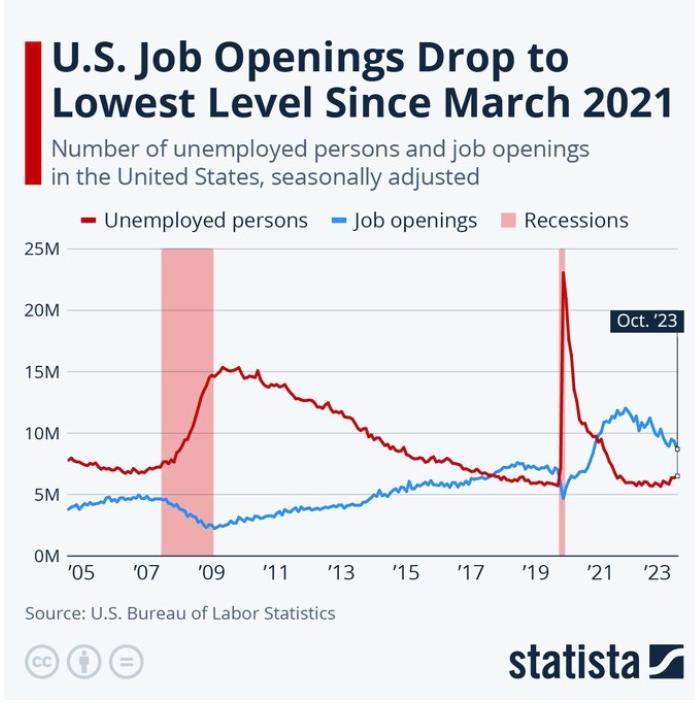

Adding to concerns, the Federal Reserve is predicted to cut interest rates six times in 2024, recognizing clear signs of an economic slowdown according to ING Economics. The alarming dip in US job openings to a two-year low, reminiscent of March 2021 levels, contributes to the narrative of a faltering economy.

As the stock buyback blackout window commences on December 11th, indicating a pause in a significant source of market support, the strain on small businesses becomes pronounced. With short-term loan rates for small businesses reaching a staggering 10%, the current economic trajectory appears increasingly unsustainable, prompting a closer examination of the challenges ahead.

Sources:

The yield curve is collapsing

Oil is collapsing

Emergency bank REPO intervention is spiking… Yet people still believe the economy is booming

— Financelot (@FinanceLancelot) December 6, 2023

Bulls, it's looking like you hit your peak a month too soon.

What does your wife say about that? pic.twitter.com/afQ6LN8XVm

— Mac10 (@SuburbanDrone) December 6, 2023

BREAKING: Crude oil prices drop below $70/barrel for the first time since July 2023.

Since the September 28th high, oil prices are now down ~27%.

Meanwhile, the national average gas price is down for 10-straight weeks to $3.25/gallon.

Even as OPEC+ agreed to additional supply… pic.twitter.com/cTXHRq0K7r

— The Kobeissi Letter (@KobeissiLetter) December 6, 2023

Hedge funds sold US equities for a 3rd straight week.

via Goldman Sachs pic.twitter.com/24vKBgvNy9

— Daily Chartbook (@dailychartbook) December 6, 2023

Inflation expectations tell us a lot about earnings and sales estimates for the #sp500… Paying attention to these expectations is fairly important. pic.twitter.com/TZhHySV9ee

— Michael J. Kramer (@MichaelMOTTCM) December 6, 2023

Also Wells Fargo CEO: https://t.co/GXrNohPo2L pic.twitter.com/GpGh5lUTUT

— RJR Capital (@RJRCapital) December 6, 2023

The risk-off mood appears to be gaining some traction.

— Michael J. Kramer (@MichaelMOTTCM) December 6, 2023

"Semiconductor inventory levels remain extreme, and we could see some destocking over the coming quarters, -40% putting pressure on demand. This is likely to translate into weaker pricing and margins for the sector." https://t.co/TgBSiDpoBM via @dailychartbook pic.twitter.com/KMq7oyiKIf

— Jesse Felder (@jessefelder) December 6, 2023

"This is peak open window. This is the last week for corporates to increase exposure, the blackout window begins on Monday, December 11th."

– Goldman Sachs pic.twitter.com/EMcf2prsDC

— Daily Chartbook (@dailychartbook) December 6, 2023

Small businesses are now paying a staggering 10% rate on short-term loans

This is NOT sustainable pic.twitter.com/u7UAZ1Riu2

— Game of Trades (@GameofTrades_) December 6, 2023