by sterk1984

I see so many articles, comments etc. proclaiming that it’s obvious that we aren’t going into a recession because the economy is doing so well and the unemployment rate is so low. Don’t recessions usually happen at the END of economic cycles when the FED puts the brakes on because the economy is overheating?

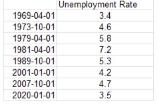

The average unemployment rate since the 60s has a 6% handle on it, and the below table shows the rate at the start of all the US recessions since then:

It is usually BELOW average when a recession begins. This cycle seems to be playing almost exactly to the script, including the unbelievable complacency despite all the usual warning signs flashing red.

Keep dancing while the music is playing but be ready to try and find a chair…