In a year fraught with economic uncertainty, the United States stands at a critical juncture where conflicting financial imperatives threaten to destabilize the nation’s economic foundation. The need for lower interest rates to manage a staggering $34.6 trillion national debt clashes with the Federal Reserve’s mandate to curb inflation through higher rates, all unfolding against the backdrop of an impending election year. Brace yourselves—what lies ahead promises to be nothing short of chaotic.

The US Treasury faces a monumental challenge: managing a national debt that surged by $1.6 trillion since September 2023 alone, marking a 47% increase to a daunting $34.6 trillion. This growth trajectory suggests that if left unchecked, federal debt could double to $40 trillion by 2025. Meanwhile, the Federal Reserve grapples with the necessity of raising interest rates to combat inflation, which, if not addressed, threatens economic stability and consumer purchasing power.

The sheer scale of national debt escalation is alarming, with every US taxpayer now burdened with approximately $267,000 in federal debt. Annual interest expenses could soar to $1.6 trillion by year-end if the Fed maintains current rate levels. Equally staggering is the societal impact: a significant majority of Americans now view fast food as a luxury, underscoring the pervasive effect of rising costs on everyday affordability and consumer behavior.

Financial Instability: A continuation of current trends could lead to heightened financial instability, as the government struggles to service ballooning debt obligations amidst rising interest rates.

Economic Inequality: Increasing costs of living, including essential items like fast food, disproportionately affect lower-income households, exacerbating economic inequality.

Policy Gridlock: The urgency of economic policy decisions amidst an election year could lead to gridlock and delayed interventions, further complicating recovery efforts.

Should current economic pressures intensify, there’s a risk of spiraling debt levels and diminishing policy effectiveness. The prospect of a $40 trillion national debt by 2025 looms large, threatening economic resilience and future generations’ fiscal health. Moreover, persistently high interest expenses could divert crucial resources from essential public services, compounding social and economic challenges.

As the United States confronts unprecedented economic crosswinds, a daunting reality emerges: conflicting priorities threaten to plunge the nation into a maelstrom of financial turmoil. With the US Treasury grappling to manage an astronomical $34.6 trillion debt amidst calls for lower interest rates, the Federal Reserve’s imperative to quell inflation through rate hikes poses a dire dilemma. And all this unfolds against the chaotic backdrop of an election year—a perfect storm of economic uncertainty.

Picture this: a national debt ballooning by $11 trillion in just four years, signaling a trajectory towards doubling within a decade. Meanwhile, the potential annual interest expense of $1.6 trillion threatens to drain fiscal resources needed elsewhere. Concurrently, a shocking 78% of Americans now classify fast food as a luxury, upending conventional notions of affordability. This seismic shift reflects not just rising costs but the broader socioeconomic impact of inflationary pressures on everyday expenditures.

This isn’t just an economic dilemma; it’s a crisis of national priorities. As politicians debate fiscal strategies and monetary policies amidst an election year, the consequences resonate far beyond balance sheets. They reverberate through homes where once-affordable luxuries slip beyond reach and through communities where economic disparities widen. The path forward demands not just policy acumen but a moral reckoning—an acknowledgment that economic stability hinges on equitable solutions and sustainable practices.

In navigating these turbulent waters, one thing remains clear: the stakes are high, and the decisions made today will shape the economic landscape for years to come. Whether through prudent fiscal management, equitable economic policies, or responsive governance, the imperative is to steer towards stability amidst uncertainty. For the alternative—a descent into financial chaos—promises consequences too dire to ignore.

US national debt hit a new record of $34.6 trillion in April, up by $1.6 trillion since September 2023.

Total US debt has increased by 47% or $11 TRILLION in just 4 years.

In other words, there is now $267,000 of Federal debt for every US taxpayer.

US debt is on track to… pic.twitter.com/SIl0TCmO9e

— The Kobeissi Letter (@KobeissiLetter) May 24, 2024

👀 👇

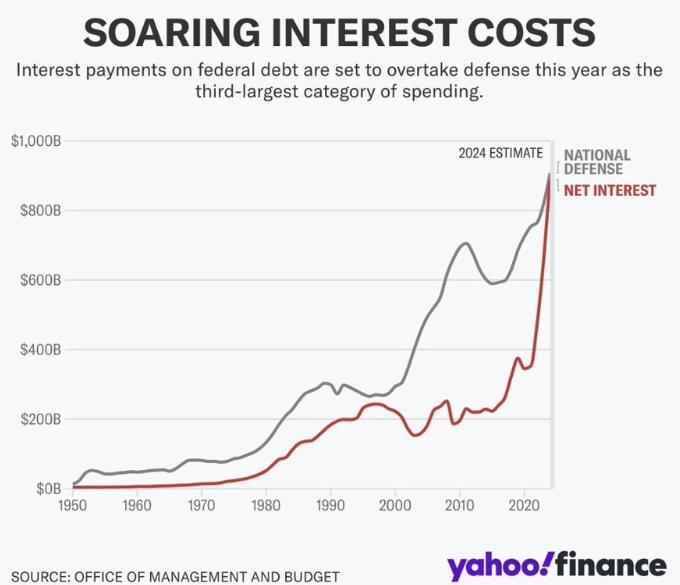

For the first time in the history of the United States, interest payments will likely overtake defense spending in 2024 pic.twitter.com/7OAbQm7yis— Win Smart, CFA (@WinfieldSmart) May 22, 2024

This is concerning:

78% of US consumers view fast food as a luxury due to high prices, according to a LendingTree survey.

75% of Americans eat fast food at least once a week but 62% claim rising prices constrain them to eat it less often.

50% of respondents consider fast food… pic.twitter.com/FzKJv8MXQd

— The Kobeissi Letter (@KobeissiLetter) May 25, 2024