The exceptional degree to which the Fed has trapped itself (and all of us) in an economic death spiral is becoming evident everywhere now.

My longtime prediction that the Fed will not be able to kill inflation without destroying the economy is showing itself true in articles about hand-wringing from multiple directions today. The short of it is that the Fed either wins inflation but drives us deep into recession, or it rushes to bail out a collapsing economy but lights inflation fully back on fire again. Either route is bringing the collapse of the Everything Bubble that the Fed and multiple federal administrations created.

Let’s look at the concerns that are emerging from all over the financial realm in today’s news headlines to see what many are sensing and what the most reliable economic indicator is now screaming like a siren.

Most reliable recession timer redlines

Let’s begin with the “creator” of the very accurate “Sahm Rule, which says that, whenever the unemployment level rises 0.5% from its one-year low, we are plunging into recession, regardless of what low level of unemployment we start from. This indicator has never been wrong as a timer, and we are right there! However, we already also dealing with very broken labor indicators. So, maybe we are well past a 0.5% rise or maybe still a touch under. Who can know when even Jerome Powell has said the government’s labor numbers are clearly wrong and when CNBC took the rare step of saying they looked “cooked,” though it’s not clear that Powell knows by how much or in what direction? Just clearly they don’t add up, but that has been my major warning of peril for a couple of years now.

The creator of the rule (or discoverer of it who formalized it) is very worried that the Fed remains focused on fighting inflation for months to come when the rule says we are already plunging into recession:

Economist Claudia Sahm has shown that when the unemployment rate’s three-month average is half a percentage point higher than its 12-month low, the economy is in recession….

The “Sahm Rule” has generated increasing talk on Wall Street that what has been a strong labor market is showing cracks and pointing to potential trouble ahead. That in turn has generated speculation over when the Fed finally will start reducing interest rates….

Sahm, chief economist at New Century Advisors, said the central bank is taking a big risk by not moving now with gradual cuts….

“I do not understand why the Fed is pushing that risk. I’m not sure what they’re waiting for…. The worst possible outcome at this point is for the Fed to cause an unnecessary recession….”

We’re at the highest Sahm reading since the Covid pandemic when we crashed into a sudden recession that was made short by the most massive and enduring rescue packages (bailouts) in the nation’s history. The extremes of that response in Trump’s final year should give you a good idea of how bad it would have been.

The Fed, as I’ve been reporting faithfully all along the way keeps misreading the meaning of its broken labor metrics. It keeps seeing them as proof that the economy is not in immediate peril, unlike Claudia Sahm:

Even with the rising jobless level, Fed officials have expressed little concern about the labor market. Following its meeting last week, the rate-setting Federal Open Market Committee labeled the jobs market as “strong,” and Chair Jerome Powell at his press conference said conditions “have returned to about where they stood on the eve of the pandemic — relatively tight but not overheated.”

In fact, officials sharply lowered their individual forecasts for rate cuts this year, going from three expected reductions at the March meeting to one this time around.

“The bad outcomes here could be pretty bad,” Sahm said. “From a risk management perspective, I have a hard time understanding the Fed’s unwillingness to cut and their just ceaseless tough talk on inflation.”

Sahm said Powell and his colleagues “are playing with fire” and should be paying attention to the rate of change in the labor market as a potential harbinger of danger ahead. Waiting for a “deterioration” in job gains, as Powell spoke of last week, is dangerous, she added.

Based on the Sahm rule, which I’ve written about a few times, we are now falling into recession. My concern whenever I’ve mentioned this indicator has been that, because the Fed is relying on broken labor metrics and thinking they prove the economy remains strong and resilient, it will not see that it is tightening us deeper into recession. However, it is not as if it has much choice, as the choice to stimulate us out of recession is a choice to do the exact opposite of what the Fed’s inflation fight demands, pumping Fed fuel on the fires of inflation all over again.

Wall Street is whining in fear for a Fed change

The recession error Claudia Sahm is concerned about based on her indicator permeates Wall Street for different reasons.

Fear of a Fed Error Is on the Rise as American Consumers Pinch Pennies

Consumers have been saying they’re exhausted by higher prices for some time.

Now they’re actually ratcheting back their spending more materially, as shown in today’s May retail sales data. The question for markets is whether this is a welcome pullback that allows the US economy to cool just enough to tame inflation, or a more pernicious trend that hints at deeper weakness.

Alluding to the flawed labor and CPI metrics I’ve been talking about for months, Gregory Daco of Ernst & Young frets …

“The Fed has to be careful to recalibrate monetary policy and adjust to that environment and not be so backward looking,” Daco said. “Backward looking can be very dangerous in an environment where you have a lot of noise in the data.”

Ian Shepherdson of Pantheon Macroeconomics had a similar take — “Greg and I are going to have an agreement-fest here….”

Fed policymakers are “very backward looking, constantly talking about what the data has been doing,” Shepherdson said. “If you carry on doing that, by definition you’re going to be late when you start cutting rates.”

That is especially true when your data on labor no longer means what it always used to mean. I’ll spare you from repeating my many arguments on that; but its importance is that it will be the linch pin in the Fed’s next big policy error. While it is not that a choice to avoid re-igniting inflation by keeping rates up or even raising them a notch will be any better, we are now at the point where we plunge deeper into recession before the Fed does make that turn because it doesn’t see the problem coming. We are there now! The Fed is trapped between bad choices in a situation it has created.

At issue is a Fed that’s only penciling in one rate cut this year in the face of ongoing economic resilience. The difficulty, as we talked about on Surveillance today, is a complete lack of certainty by analysts and Fed officials alike….

“We are not at a point when everything is falling apart,” he said. “That is not the story here. But we have to get out of the mindset of, it’s just been constant upside surprises for the consumer…. Not anymore.”

I disagree on the part about not falling apart. We are that point, but the misreading on labor is causing everyone to think we can’t be there — other than Sahm who says we are.

“Something feels broken,” Academy Securities’ Peter Tchir suggested today, as cash flows into equities yet stays concentrated in just a handful of big stocks in the S&P 500. Tchir is concerned about passive investors playing an outsized role in market dynamics and the prospect of a “commodity shock” ahead….

“I do think that we’re very susceptible to some sort of a commodity shock over the summer”

An example of a summer commodity shock would be if oil, which took inflation down, takes it back up this summer, making the Fed’s conundrum even more intense and stressing the economy with increased costs in everything.

We’re sliding into recession during the biggest stimulus spending on record!

The Congressional Budget Office (CBO) reported today that Biden’s record deficits, which he claims are responsible for record low unemployment, are coming in far worse than it originally projected. That raises the question of “How do you dig yourself out of a recession when you went into one during the greatest fiscal stimulus spending on record … all financed by debt so no one immediately had to pay for it?” Where do you go from there? Not only that, but how critically bad is the economy if it is even falling into a recession during such massive government stimulus?

This should come as a shock to exactly nobody.

Last week, the Treasury reported that in May, the US government collected $323.6 billion in tax receipts, it spent more than double that, or some $670 billion.…

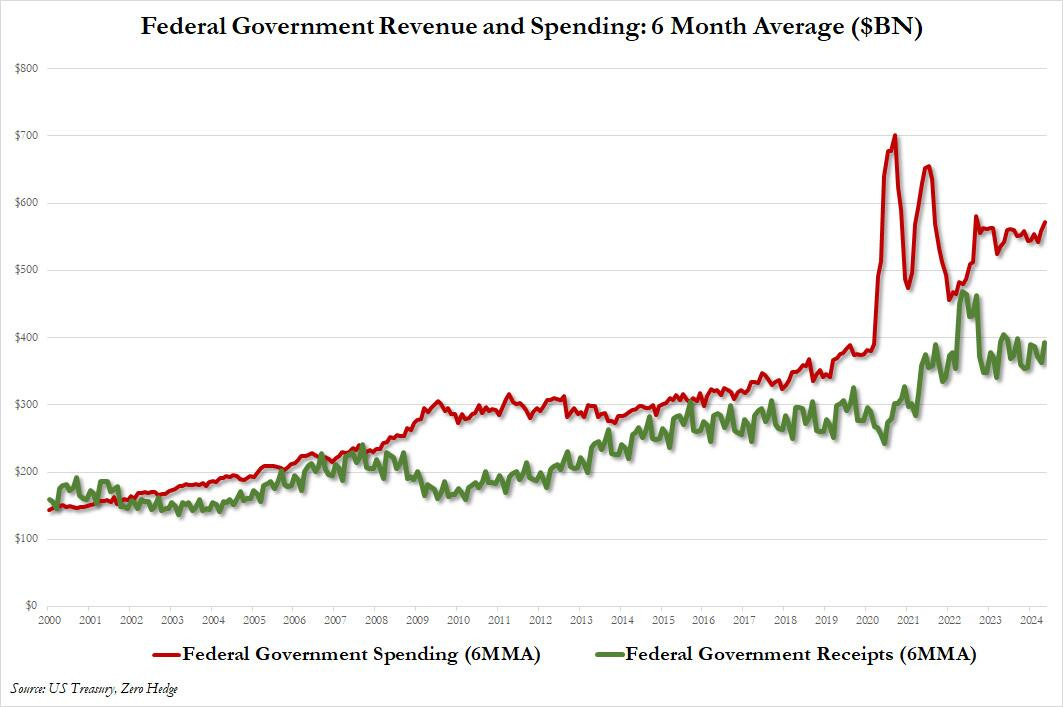

You can see how federal spending keeps gapping far above government revenue, especially during Trump’s final year and now the Biden years:

The May government deficit was about $100-billion more than consensus expectation. Yes, the deficit was wider, if you annualize that, by more than a trillion dollars over the already expected deficit.

As a result of the blowout May deficit, the cumulative fiscal 2024 shortfall once again surpassed the 2023 total, bringing the YTD deficit total to just over $1.2 trillion more than the $1.16 trillion cumulative deficit througth May 2023, and that’s with 4 more months left in the fiscal year.

We’re on the highway to hell in terms of these deficits. Whatever you thought about the horrendous deficits the government created when we were trying to come out of the Great Recession, these are many times worse BECAUSE we are mounting even greater deficits WHILE GOING INTO RECESSION not in an effort to climb out of one! We’re piling in these deficits during what Biden and the Fed have continually claimed is a strong economy. Only it’s not. With all this massive spending, GDP sank last quarter over the previous quarter then got revised even lower, and the Sahm Rule that has never been wrong says we are now going into recession.

The main thing convincing economists that we are not is those faulty labor metrics. You cannot safely fly a plane into a blinding storm with a faulty instrument panel.

Now, at this point, someone who still has a functioning brain at the CBO looked at the two lines and realized that with the final 2023 deficit printing just over $2 trillion, the CBO’s current forecast of “only” $1.5 trillion for 2024 looked idiotic at best, and like total propaganda garbage at worst.

And so, moments ago – and, again, with just 4 months left in fiscal 2024 – the CBO took machete to its 2024 forecast, and in hopes to avoid looking like a consummate fool, hiked its 2024 budget deficit forecast from $1.5 trillion to $1.9 trillion, confirming that there will be effectively no difference in the fiscal picture between 2023 and 2024.

No better picture after all that horrendous deficit stimulus spending. In fact, we’re falling into recession in spite of that massive spending, and this is even with tax revenues that the graph above shows have been rising! How messed up is that? What happens to that deficit when a recession causes revenues to fall and begs for even greater spending to accelerate us back out?

Only it gets worse because that “same” deficit for this year will only prove true if government spending stays the same. However …

In its latest projections published today, the Congressional Budget Office (CBO) predicted that government spending would continue to, drumroll, rise.

Of course, we have a huge increase in military spending and Biden’s big “Build Back Better” campaign that needs to keep steaming along during another election year as his fulfillment of his last campaign promise. His plan is, of course, fascist economics, which is when big government teams up on massive build projects with big business by funding projects that are intended to bring bigger profits to those big businesses. We hire big businesses, using big deficits, to build all the infrastructure. Then we grant other big businesses, using big deficits, money to build all their factories. Then they run the factories and make big money for themselves.

Meanwhile, the cumulative deficit from 2025 to 2034 is projected to reach $22.1 trillion, which is 10% higher than the office previously projected in February, marking a $2.1 trillion increase.

That’s not the total US debt. That’s just the amount we will add to the national debt during the next decade if the CBO’s overly conservative, now confessedly erroneous estimates are correct going forward.

Compared to the past five decades, the budget analysts said deficits over the next 10 years “are about 70 percent larger than their historical average” when measured “in relation to economic output.”

That could sound manageable, except that it accounts for no recessions in the next decade! What if economic output drops as the Sahm Rule says it is going to do right now, taking down government revenue? (And as good sense says it is doing, too.)

The Fed stays its course

There has been no flinching from the Fed in terms of policy, but that also means no move to do what is necessary, after a year of getting nowhere on inflation, to tap inflation back down with another small rate hike because that would clearly be devastating to any possible hope of the government continuing to service the interest on its rapidly soaring debt.

There is plenty of proof, however, that the Fed, indeed, does not see the hot cauldron of water that is simmering all around its feet right now:

Federal Reserve officials, heartened by recent data, are looking for further confirmation that inflation is cooling and for any warning signs from a still-strong labor market as they steer cautiously toward what most expect to be an interest rate cut or two by the end of this year.

Boy are they fulfilling, on a constant basis, the Daily Doom prediction that laid out their biggest blindspot.

Outlining a litany of reasons for optimism that inflation is back on track to the U.S. central bank’s 2% goal after stalling earlier this year, Fed Governor Adriana Kugler said on Tuesday she believes monetary policy is “sufficiently restrictive” to ease price pressures without causing a significant deterioration in the job market….

The latest data, including a government report showing consumer prices did not rise at all from April to May, is “encouraging,” she said.

While more progress is required, Kugler said, “I believe economic conditions are moving in the right direction….”

Chicago Fed President Austan Goolsbee called the latest inflation data “excellent, after a few months of less-excellent numbers, so hopefully we’ll see more like that.”

Last year a surge in the supply of both workers and goods allowed inflation to drop quickly without pushing up on unemployment, a “magic” combination that may still have room to run this year, Goolsbee said….

“We’re in a good position, we’re in a flexible position to watch the data and to be patient,” Dallas Fed President Lorie Logan said at an event in Austin, Texas. While recent data showing inflation is cooling is “welcome news,” there must be “several more months of that data to really have confidence in our outlook that we’re heading to 2%….”

Change in policy is far from coming as soon as markets want to believe, which are still pricing in two rate cuts this year:

St. Louis Fed President Alberto Musalem, in his first speech on monetary policy since taking up the reins at the regional Fed bank, signaled a potentially longer runway ahead.

“I will need to observe a period of favorable inflation, moderating demand and expanding supply before becoming confident that a reduction in the target range for the federal funds rate is appropriate. These conditions could take months, and more likely quarters to play out….”

“I expect interest rates to come down gradually over the next couple of years, reflecting the fact that inflation is coming back to our 2% target and the economy is moving in a very strong sustainable path,” New York Fed President John Williams said in an interview on the Fox Business television channel….

Boston Fed President Susan Collins cautioned against over-reacting to “promising” economic news.

“It is too soon to determine whether inflation is durably on a path back to the 2% target,” Collins told a group in Lawrence, Massachusetts. “The appropriate approach to monetary policy continues to require patience, providing time for a methodical and holistic assessment of the evolving constellation of available data….”

To Richmond Fed President Thomas Barkin, the key will be for price pressures to ease persistently in services as well as in goods…. The choppiness in data since last year means the policy path ahead is not clear.

“We will learn a lot more over the next several months and I think we are well positioned from a policy standpoint to react,” he said.

We’ll be deep into the recession that the practically infallible Sahm’s Rule says is already beginning before all of that plays out. Of course, the Fed will likely cut rates when that recession becomes obvious.

Yet, we will have already carved out the deepest caverns of debt spending our way into this recession that the nation has ever experienced.

For the Fed, “job number 1 is to make sure that we get inflation back to 2%,” Williams said.

I’ve always said, in the face of a vast majority that said otherwise, that the Fed will remain resolutely set on fighting inflation until the economic damage is way past fixing, but what will we fix it with when credit agencies are already downgrading US credit because of the nation’s perpetual massive expansion of debt when suddenly government income plunges in a recession, GDP crashes so spending-to-GDP gets much worse, as does debt-to-GDP and when the amount we are already spending already got us nowhere but down? How do you take out even greater amounts of debt in that kind of spiral to use for economic stimulus without the credit agencies giving you more significant downgrades that raise the cost of your debt even more?

This is the kind of crisis that happens when you always take out debt for economic stimulus during the hard times but never pay it back down during the good times. Worse still, we kept taking out a lot more debt for economic stimulus during the good times! You wind up with soaring inflation and economic collapse at the same time.

Views: 260